January 29, 2019

After the Breakups: Big Payers Find Vertical Love in New Faces

In rapid succession at the end of 2018, CVS closed its $70 billion acquisition of Aetna and Cigna closed its $67 billion acquisition of Express Scripts. The consolidated companies are massive. CVS-Aetna and Cigna-Express Scripts have projected annual revenues of $221 billion and $142 billion respectively.

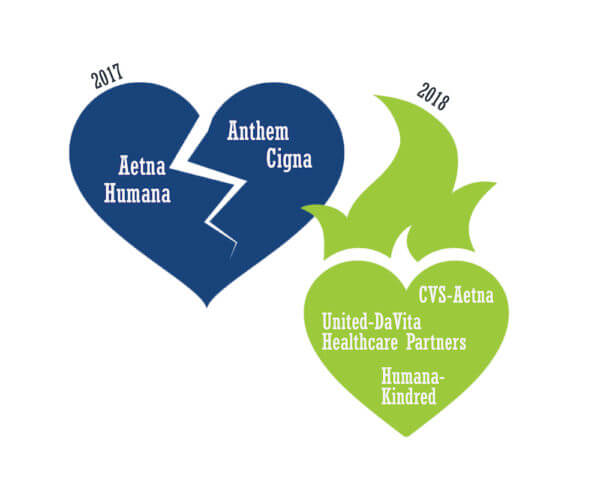

What a difference a year makes. 2017 was the year of big “horizontal” breakups. The Justice Department challenged both the Aetna-Humana and Anthem-Cigna mergers on anti-trust grounds. Federal judges in different jurisdictions blocked the transactions from going forward. Rather than appeal, Aetna and Humana ended their merger efforts in March 2017. Anthem and Cigna followed suit in May.

Divorce can be messy and expensive. Humana received a $1 billion breakup fee from Aetna after their merger collapsed. Cigna is suing Anthem for over $13 billion in damages and a $1.85 billion breakup fee. Anthem refuses to pay the fee and is contesting the damages.

By contrast, 2018 was the year of “vertical” marriages. In December 2017, CVS shocked the healthcare universe with its agreement to acquire Aetna. That same week, UnitedHealthcare and Humana announced their respective acquisitions of Davita HealthCare Partners and Kindred’s Homecare/Hospice operations.

Not to be outdone, Cigna announced its intention to acquire Express Scripts in March 2018. Around the same time, rumors began to swirl that Walmart was negotiating to acquire Humana. If that comes to fruition, Walmart-Humana would share many of the same attributes of the CVS Aetna merger.

It’s revealing to follow the logic of these well-positioned big payers as they’ve shifted from horizontal to vertical growth strategies. That shift will have a profound impact on healthcare service delivery throughout the country.

THE BROKEN PAYER BUSINESS MODEL

Underlying the strategic repositioning of Aetna, Cigna, Humana and United is the hard truth that the traditional big payer business model is broken. Administrative-services-only (ASO) contracts are under attack and disruptive new market entrants develop business models that link payment to care outcomes.

Aetna, Anthem, Cigna, United, and to a lesser-extent Humana (the “Big 5”), contract directly with self-insured employers to design and administer employee healthcare benefits through ASO arrangements. Under ASO contracts, employers bear the financial risk for covering their employees’ healthcare expenditures.

Conventional wisdom suggests that all healthcare is local. The business of healthcare is also local. Insurers, physicians and hospitals compete to pay and provide for healthcare services within confined geographic regions with established referral patterns. This enables entrenched payers and providers to exercise monopsony and monopoly pricing power within local markets.

For example, big payers with market leverage can exert pricing and care management pressure on providers, positioning themselves to capture greater profits from individual transactions. Life is good for well-placed intermediaries with limited financial risk.

ASO contracting historically has been lucrative for commercial insurers and still is in markets where payers exert pricing control. They receive as much as 15% of premium dollars to administer healthcare benefit programs. If possible, they boost profits with add-on services, such as care management. Overall compensation is a function of total claims administered. More treatment activity translates into higher revenues.

Life has not been so good for self-insured employers nor for their employees. Each has experienced consistently increasing health insurance coverage costs. The financial burden can be particularly heavy for individuals enrolled in high deductible health plans when accessing healthcare services. All commercially- insured individuals and families experience mind-numbing administrative complexity in managing their healthcare claims.

Customer adversity has created opportunities for disruptive competitors. They are attacking non-competitive local markets with a wave of strategies designed to deliver more value to customers. Virtual care, bundled services, retail care and out-of-market acute care offer lower costs with great outcomes and a better, often more convenient, customer experience.

Surveying their strategic horizons, the big payers realized the status quo would not hold. They sought protection in scale and diversification.

STRIVING FOR BIGNESS: THE HORIZONTAL BEHEMOTH STRATEGY

The logic for mega-payer mergers is straightforward. It is easier and safer to withstand a disruptive gale in an aircraft carrier than a battleship. Given current market dynamics, it has become impossible for large publicly-traded payers to meet Wall Street expectations for organic growth, particularly as their core products and services commoditize.

Horizontal mergers offered greater scale, product diversification, back-office synergies and expanded geographic coverage. As markets commoditize, it is essential for companies to drive marginal costs lower and reach more customers.

While consolidation achieves greater operating efficiencies, it does not address the strategic reality that weakening core businesses cannot sustain long-term growth. For this reason, companies operating in disruptive markets also explore alternative business models that have growth potential.

Even as the big payers pushed to consolidate, there were glimmers of new business model exploration. These included Cigna’s move into Medicare Advantage through HealthSpring and Humana’s move into home-based care through Humana@Home.

Had the mergers gone through, the big 5 payers would have become the even bigger 3. Between them, they would have controlled 90% of the nation’s commercial insurance coverage. Such market concentration raises the specter of monopsony with the worry that big payers could dictate lower prices to individual providers, force higher prices on consumers and garner disproportionate profits for themselves.

This concentration concerned large employers, the principal purchasers of commercial insurance policies. In multiple surveys, the vast majority of large employers viewed reduced payer competition negatively. Moreover, healthcare consolidation has an image problem. Across all healthcare sectors, post-merger prices/premiums increase. Promised synergies and savings fail to materialize.

Failing to convince key constituents and confronting an energized Department of Justice, the parties acknowledged defeat and regrouped. It was now clear that they couldn’t cut their way to prosperity with anemic organic growth. It became time to “think different.”

The big payers had abundant cash to undertake acquisitions. With horizontal consolidation no longer possible, the companies began contemplating alternative strategies. Underlying this strategic repositioning was the growing realization that healthcare’s economics are untenable and that health insurance products had to offer greater value.

THE BIG PAYER CHALLENGE AND OPPORTUNITY: DEMAND MANAGEMENT

In April 2012, Donald Berwick and Andrew Hackbarth published a seminal article titled “Eliminated Waste in U.S. Health Care.”1 In a detailed, bottom-up analysis of 2011 healthcare spending, the authors estimated that “waste” accounted for between 21% and 47% of all U.S. healthcare spending.

In 2011, U.S. healthcare expenditure totaled $2.289 trillion and accounted for 17.3% of the overall economy.2 Applying the authors’ waste estimates range between $558 billion and $1.263 trillion. These are astronomical numbers. The authors identified the following 6 waste categories:

- Failures of Care Delivery: $102-154 billion

- Failures of Care Coordination: $25-45 billion

- Overtreatment: $158-226 billion

- Administrative Complexity: $107-389 billion

- Pricing Failures: $84-178 billion

- Fraud and Abuse: $82-272 billion

Since 2011, healthcare expenditure has grown $3.337 trillion and now constitutes 17.9% of the U.S. economy (2016 figures). Despite the escalating expenditure growth, there has been no material change in practice patterns and their associated waste.

As healthcare reform unfolds and risk-based contracting expands, managing demand in traditional FFS markets is emerging as a major strategic opportunity for big payers. Within markets, payers and providers often frustrate one another as they seek to maintain market advantage. Zero-sum thinking predominates, derailing collaboration toward improved outcomes.

Tolerance for healthcare’s profligacy, however, is waning. Corporations are exploring strategies (direct contracting, bundled payments, on-site clinics, etc.) to shift care to lower cost settings, avoid unnecessary care, practice better chronic disease management and promote employee health.

More importantly, risk-based payment models are increasing their market penetration. Most notably, a third of Medicare beneficiaries now enroll in Medicare Advantage (MA) plans through commercial health insurance companies. MA’s growth in absolute and percentage terms will accelerate as baby boomers are now aging into Medicare in record numbers.

While MA contains significant administrative complexity, it does shift care management responsibility and its related financial risk to third parties. Payers that manage the care of their enrollees more effectively and efficiently generate higher margins. Of the Big 5, United and Humana have been the most aggressive in targeting care management business, most notably MA, with capitated (e.g. per member per month) contracts.

Care management also carries significant financial risk. Payers lose money if they cannot provide care services cost-effectively. This is particularly challenging in markets that continue to contract for care services using fee-for-service (FFS) payment formularies. These payment models trigger the “waste” described by Berwick and Hackbarth.

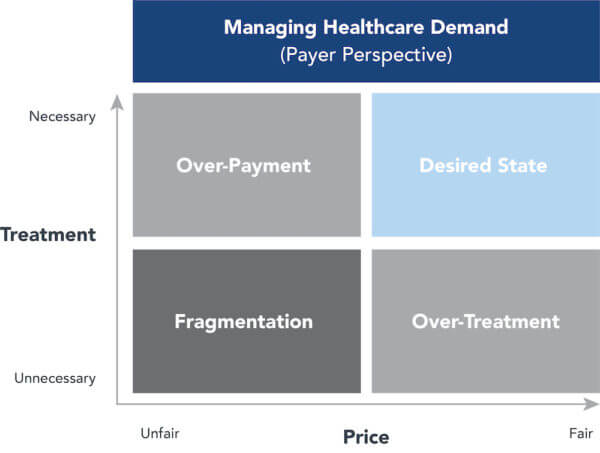

The following chart captures the dynamics of effective demand management from the payer’s perspective. Payers that reduce overtreatment (too many units of care) and overpayment (overpriced units of care) position themselves to succeed in markets as payment models shift toward full-risk contracting.

Often better-positioned and enlightened payers and providers are more willing to initiate risk-based contracting arrangements with their counterparts. They recognize healthcare offers a mature product mix within immature, inefficient and high-cost service delivery infrastructures. They understand this structural deficiency creates significant potential for operating improvement through supplier alignment.

THE UNITED/OPTUM EXISTENTIAL THREAT

Lurking in the background as the Aetna-Humana and Anthem- Cigna mergers moved forward was industry-leader UnitedHealthcare. United made an early attempt to acquire Aetna at a bargain-basement price. Aetna declined to engage.

More than the other big payers, United has developed vertically- integrated provider capabilities within its Optum subsidiary. This positions the company well to generate non-regulated revenues and undertake risk-based contracting

Once United’s acquisition of Davita HealthPartners closes, Optum will employ 50,000 physicians, making it the nation’s largest owner of physician practices. In January of 2017, United acquired Surgical Care Affiliates, one of the nation’s premier ambulatory surgery companies, to expand its care delivery capabilities.

Optum’s goal is to operate in 75 markets nationwide, up from 30 today. As an asset-light provider with multispecialty practices and high-volume ambulatory surgical capacity, Optum can steal volume from higher-cost, less-efficient, asset-heavy hospital-based providers. As such, Optum’s business model has the potential to redefine medical supply-demand relationships.

Optum’s strategy reflects a deep understanding of disruption theory. As the marketplace disintermediates traditional health insurance products (e.g. ASO contracting), they want to get closer to their customers as both members and patients. They strive to guide their individual health journeys. The hallmarks of new health insurance business models are consumer-centricity, which requires greater customer connection, enhanced convenience and pricing transparency.

Aetna, Cigna and Humana view Optum’s vertical delivery strategies with envy. They are sprinting to catch up.

VERTICAL INTEGRATION’S LURE

Although the Big 5 payers are national companies, they operate in markets with unique configurations of hospitals, physicians, payers, employers, regulatory guidelines and consumer preferences. Consequently, healthcare payment and delivery are locally-driven enterprises. It’s almost impossible to implement top-down strategies. It’s much easier to develop strategies that work in local markets and scale them for larger populations.

Competitive dynamics for big payers have become more hostile since the passage of the Affordable Care Act. National coverage models have atrophied. Excluding high-cost enrollees from risk pools is no longer allowable. New competitors (e.g. Oscar) are emerging. Employers are bidding ASO contracts and exploring new contracting arrangements (e.g. ABJ) to reduce their health insurance costs.

Competitive dynamics for big payers have become more hostile since the passage of the Affordable Care Act. National coverage models have atrophied. Excluding high-cost enrollees from risk pools is no longer allowable. New competitors (e.g. Oscar) are emerging. Employers are bidding ASO contracts and exploring new contracting arrangements (e.g. ABJ) to reduce their health insurance costs.

It is becoming clear that markets with higher percentages of Medicare Advantage (MA) contracting (Minnesota; Orange County, CA; Portland, OR) are experiencing higher levels of vertical integration to align payment with care outcomes.

The Big 5 understand that full-risk contracting challenges their traditional business models. Consequently, they are reconfiguring their service platforms to offer higher levels of care management services in select markets. They develop these capabilities nationally and apply them locally where appropriate. Humana’s “Bold Gold” commitment to improve health by 20% in targeted communities reflects this new strategic orientation.

“Platforming” service delivery works when principals focus on capabilities, outcomes and cost, not ownership and control. For big payers, “unbundling” delivery components and combining them with insurance and pharmacy services enables creation of vertically-integrated service offerings that deliver higher value to customers.

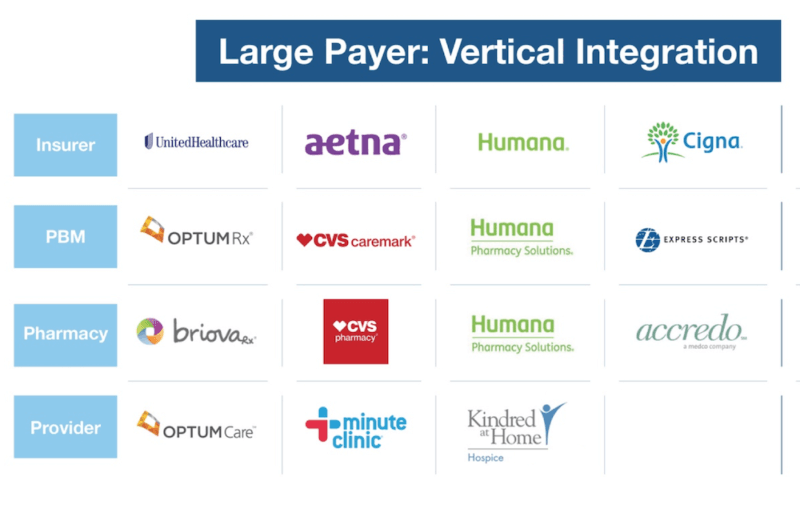

The following chart depicts how United, CVS/Aetna, Humana/ Walmart and Cigna/Express Scripts have reconfigured to offer vertically-integrated services.

It’s interesting to note that none of these platforms contain high-cost hospital-based providers. Decentralized, asset-light provider services offer convenient, lower-cost alternatives for healthcare’s increasingly commoditized product mix.

With vertically-integrated platforms, companies can develop product offerings that are more helpful to customers and more meaningful to the marketplace. Design flexibility will enable companies to customize and specialize product offerings for targeted market segments. They will support new products/ services with user-friendly technologies and seamless customer interfaces. Enhanced steerage, customer experience and cost profiles will result.

Examples of vertically-integrated product offerings could include the following.

- Fixed-priced joint replacement surgeries and rehabilitation with money-back guarantees.

- More accurate assessments of whether acute or

pharmacological interventions offer better, more cost-effective outcomes. - Better coordinated chronic disease management through

primary care practices and convenient in-store clinics. - Greater use of technology, including telemedicine, for remote/in-home care.

- Much lower cost and more convenient diagnostic procedures (e.g. MRIs, colonoscopies).

- Greater application of advanced directives to give patients and their families more control of end-of-life care decision making.

The list goes on. What these examples have in common is the bundling of care-delivery services with payment, pharmacy, health records and customer preference data to create integrated product offerings with transparent prices. This what Amazon does – optimizing supply-chain components to deliver value to customers.

Ultimate success for the Big 5 rests on shifting to business models that deliver outcomes, not outputs. That means big payers must embrace demand management as their means to sustain market relevance. It is no small task for entrenched incumbents to shift business models. Execution will differentiate winners from losers.

THE TRIUMPH OF SECOND MARRIAGES

The legendary English commentator Samuel Johnson once quipped that “Second marriages are the triumph of hope over experience.” After their attempts to “marry” one another failed, Aetna, Cigna and Humana had to start “dating” again. For them, hard-learned lessons from failed courtships and aggressive competitors are reshaping their individual approaches to maintaining relevance in the post-reform marketplace.

The Big 5 understand that their traditional products lose luster in markets that adopt more expansive healthcare risk contracting. They won’t give up profitable ASO contracting arrangements until necessary, but they are complementing them with new business solutions that integrate insurance, pharmacy and provider services for customers that demand holistic care services.

Each of the Big 5 is “bundling” and “unbundling” existing services on emerging vertical platforms to give its customers value-based healthcare solutions. They are testing them in select markets and investing in their growth. Expect successes, failures and bumpy transitions.

The marketplace will determine the fitness of these new service delivery networks. Those that differentiate on outcomes, cost, quality, convenience and customer experience will increase market share and gain market relevance.

In the process, American consumers will receive more value for the hard-earned dollars they spend on healthcare. This is the American way.

SOURCES

- https://jamanetwork.com/journals/jama/article-abstract/1148376

- https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html

Co-AUTHOR

John N. Poulin is Partner and healthcare practice leader at Innosight. He works with clients to design new strategies for long-term growth, architect resource allocation, build innovation capabilities, define new operating models, and manage enterprise wide transformation. John brings significant M&A advisory experience, from initial identification, to transaction support, to post-merger integration.

John N. Poulin is Partner and healthcare practice leader at Innosight. He works with clients to design new strategies for long-term growth, architect resource allocation, build innovation capabilities, define new operating models, and manage enterprise wide transformation. John brings significant M&A advisory experience, from initial identification, to transaction support, to post-merger integration.

John has served executive teams of leading institutions across the value chain, including payors, providers, medical device, pharma / biotech, suppliers, and health information technology. Recently, his work focuses on how payors and providers can better collaborate to catalyze new care delivery models, new economic models, and better consumer experiences – both physical and digital. Prior to joining Innosight, John was with the Health and Life Sciences practice of Oliver Wyman, where he developed product and portfolio strategies for bio-pharma clients and worked with leading health insurance companies to catalyze business model transformation, from fee-for-service to fee-for-value constructs. Before Oliver Wyman, John advised a senior executive group at Genzyme and developed healthcare delivery integration strategies at ICF International.