August 22, 2018

Against the Wind: Hospitals Challenge CMS’s Pro-Market Payment Reforms

Over the past month, the Centers for Medicare and Medicaid Services (CMS) announced several pro-market policies that will enhance pricing transparency, stimulate competition (and fair prices) for routine procedures and eliminate burdensome reporting requirements.

Hospitals welcome the regulatory relief but generally oppose measures that improve pricing parity and transparency. They are on the wrong side of history.

Left alone, incumbents tend to hold onto wasteful and self-serving business practices, despite the need for change. Fortunately, CMS is nudging the industry toward greater accountability, consumerism and value creation.

NEW RULES

As part of a new outpatient payment rule released on July 25, 2018, the agency announced it is expanding its “site-neutral” payment policy to clinic visits. “Clinic visit” is the most common service billed under the outpatient rule. CMS anticipates the new rule will save Medicare $610 million per year and save patients $150 million per year through lower copayments.

As part of its finalized “inpatient prospective payment system rule” published on August 2, 2018, the agency will require hospitals to publish their standard procedure charges in an online, machine-readable format beginning January 1, 2019.

Beginning January 1, 2019, the new rule also establishes a 90-day reporting period for individual electronic health records (EHRs). It further requires that all EHRs incorporate 2015-edition Certified EHR Technology (CEHRT) standards promulgated by the Office of the National Coordinator for Health Information Technology. Finally, the new rule promotes interoperability through streamlined performance scoring.

These initiatives are consistent with HHS Secretary Alex Azar’s admirable goal of achieving “value-based transformation of the entire healthcare system.” In a speech (1) delivered on March 8, 2018 Secretary Azar identified the following four “areas of emphasis” to guide CMS’s reform efforts:

- Giving consumers greater control over health information through interoperable and accessible health information technology;

- Encouraging transparency from payers and providers;

- Using experimental models in Medicare and Medicaid to drive value and quality throughout the entire system; and

- Removing government burdens that impede this transformation.

NEW FOCUS

Secretary Azar is using multiple tools to advance these four objectives. While not radical, his “areas of emphasis” confront a healthcare ecosystem that is opaque, activity based (as opposed to outcomes based), fragmented, overpriced and in need of disruption.

For example, site neutrality essentially requires Medicare to pay the same price for identical services irrespective of delivery site. When hospitals acquire physician practices, they usually apply hospital-based prices for services provided in physician offices. Overnight, the cost for the same procedure by the same doctor in the same office skyrockets, often doubling or tripling. This is a good deal for providers, but a terrible deal for consumers and payers.

The lack of EHR interoperability is equally maddening. It strains credulity that in 2018 providers cannot share digitized patient information effectively with one another and patients.

It’s also maddening that patients have little to no understanding of how much their care costs and their share of that cost. Out-of-network providers working at in-network hospitals have too much power to charge outrageous prices for routine services.

In 2017, the Price Transparency & Physician Quality Report Card (2) gave failing grades for transparency to 43 states and for quality to 42 states. Meanwhile, healthcare costs continue to rise, and healthcare companies remain largely unaccountable for performance.

The root cause of these practices is that the American healthcare system runs on artificial economics that sever buyer-seller relationships. Industry incumbents maximize revenues and profits by optimizing reimbursement claims, not by delivering quality care outcomes at the lowest costs with the best service.

Though they applaud the regulatory streamlining, hospital representatives have largely decried the advent of site-neutral payment. The following statement by Tom Nickels, an executive vice president at the American Hospital Association, offers a typical reaction:

“CMS has resurrected a proposal, which it had previously deemed unwise, that would penalize hospital outpatient departments that expand the types of critical services they offer to their communities—preventing them from caring for the changing needs of their patients.”

Nothing in CMS’s site-neutrality rules prevents hospitals from offering critical services. They just cannot charge higher prices for them. Mr. Nickels similarly framed the new chargemaster transparency requirements with the following statement,

“We do not want patients to forgo needed care, especially if the quoted price is for the total cost of the service and not what the patient will be expected to pay out-of-pocket.”

Nothing in the CMS transparency rules prevents hospitals from providing additional, clarifying information for patients. After all, 43 states received failing transparency grades in 2017. There’s significant room for improvement.

NEW GAME

Traditional healthcare business models and practices perpetuate fragmentation, distort service provision and deliver suboptimal outcomes. Hospitals clinging to that status quo are on the wrong side of history. Like the boy who cried wolf, they risk being ignored by policymakers and consumers.

Secretary Azar made this point eloquently in his March speech,

“But I want to emphasize that this change will not be easy or painless. Putting healthcare consumers in charge, letting them determine value, is a radical reorientation from the way that American healthcare has worked for the past century.

…the status quo is far from a competitive free market in the economic sense of the term, and healthcare is such a complex system, that facilitating a competitive, value-based marketplace is going to be disruptive to existing actors.”

Simply put, our current system may be working for many. But it’s not working for patients, and it’s not working for the taxpayer.

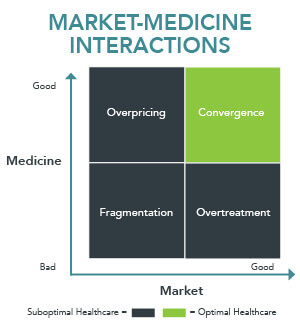

There are good and bad medical practices just as there are good and bad market behaviors. Clarifying the characteristics and implications of market-medicine interactions is essential for understanding U.S. healthcare’s structural flaws and how proper market function corrects them.

Good medical practices advance market-driven reform by rewarding innovative organizations that deliver better outcomes, lower costs and/or superior customer service. This is optimal healthcare.

Bad market behaviors strengthen incumbents through regulatory manipulation, market concentration and/or lack of transparency, perpetuating the status quo system. This is suboptimal healthcare and constitutes the majority of U.S. healthcare delivery.

Fundamentally, good market behaviors support good medical practices and align interests between high-performance organizations and discerning consumers. This approach is pro-market and pro-consumer. Bad market behaviors enable bad medical practices. A healthcare system that incentivizes such practices is anti-competitive and favors status quo business interests over consumer interests.

The distinction between pro-market and pro-business behaviors is not well understood. Too many believe “pro-business” is always “pro-market.” That is simply not true.

Business activities can be either pro-market or anti-market. At their worst, pro-business policies degenerate into crony capitalism. They support monopolistic practices, distort market function and steal from consumers.

At their worst, suboptimal healthcare practices encapsulate the lethal combination of bad medical practices and bad market behaviors. The chart below highlights the good and bad interactions between markets and medicine.

Bad medical practices and bad market behaviors results in fragmented, overpriced care delivery (lower-left quadrant) that ignores customer needs. These pernicious habits riddle American healthcare, robbing the American people of vital care while wasting vital societal resources.

Good medicine that’s overpriced (upper-left quadrant) isn’t much better. A $5,000 MRI may be necessary, but it’s wildly expensive. Overtreatment only strains the system. An unnecessary MRI is wasteful, even if it only costs $500.

Fragmentation, Overtreatment and Overpricing are the three faces of suboptimal healthcare. They thrive in opaque and unaccountable operating environments. The American people deserve better. They deserve great healthcare at fair prices.

The harmonic convergence of holistic care delivery with efficient, transparent markets produces optimal healthcare (upper-right quadrant). There are pockets of optimal healthcare practiced in America, but they are the exception, not the rule.

By definition, optimal healthcare is pro-market. It supports level-field competition, transparency and accountability. It sustains efficient markets and delivers value to consumers.

Pro-market health companies deliver the right care at the right time in the right place at the right price by focusing on what patients/customers need, want and desire.

REGULATORY BALANCE

Competition is hard but makes companies better. Free markets depend upon balanced regulation and effective enforcement to ensure “level-field” competition.

Preserving competitive markets is a delicate exercise that requires constant vigilance and tinkering. Too much regulation and overly vigorous enforcement burden productive companies, stifle innovation and exert a negative drag on the economy.

Too little regulation and feeble enforcement encourage negligent corporate behavior, create moral hazard and increase societal harm. This also retards innovation and economic growth.

The constant challenge for the American government is to find a “Goldilocks” balance where regulation and enforcement protect societal interests, encourage innovation and stimulate economic growth.

American consumers need appropriate governmental oversight and regulation with effective enforcement powers to sustain market-driven healthcare reform. Pro-market companies will win by delivering better, more convenient healthcare services at lower costs. In a robust healthcare marketplace, outcomes matter, customers count and value rules.

STORM WARNINGS

Given its high cost, pervasive fragmentation and imbedded inefficiencies, U.S. healthcare must become more pro-market (value enhancing) and less pro-business (status quo preserving). Optimal healthcare practices must displace suboptimal practices.

Given its high cost, pervasive fragmentation and imbedded inefficiencies, U.S. healthcare must become more pro-market (value enhancing) and less pro-business (status quo preserving). Optimal healthcare practices must displace suboptimal practices.

For hospital executives, the message should be clear. Bob Dylan’s Subterranean Homesick Blues contains the following couplet that captures the direction pro-market reforms are taking the U.S. healthcare system:

You don’t need a weather man

To know which way the wind blows

The government is speaking. The American people are speaking. Healthcare’s disruptive “consumerism” hurricane is forming just over the horizon and it’s headed toward value.