February 5, 2019

An Unbearable Burden: Paying for Commercial Health Insurance

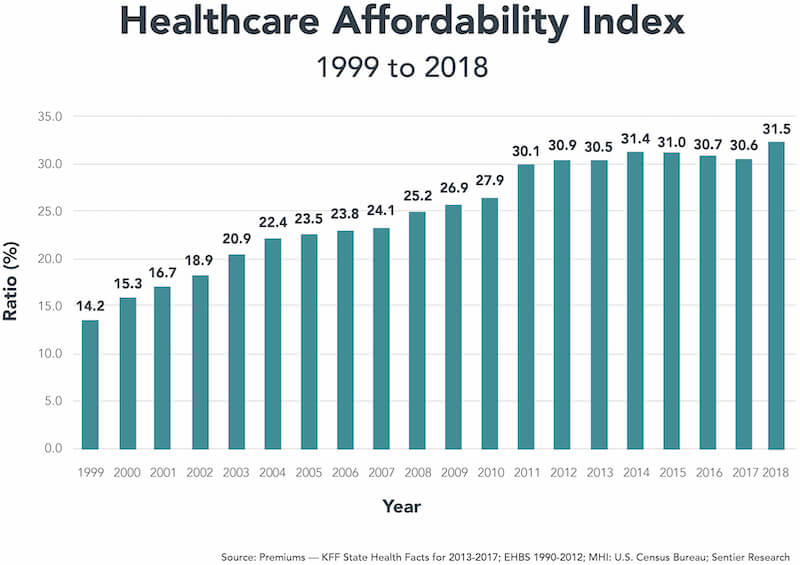

The Healthcare Affordability Index (the Index) is a simple and powerful metric for assessing the impact of rising healthcare cost on American living standards. The Index measures the relationship between the total cost (employer and employee portions) of a commercial family health insurance policy relative to Median Household Income (MHI).

Importantly, the Index reveals this obvious but hidden truth: the very high cost of private health insurance contributes significantly to middle-class wage stagnation. More than half of Americans depend on employer-sponsored health insurance for their healthcare.

The Index hit a record level of 31.5% in 2018. This confirms that commercial health insurance rates are once again growing faster than wages. This is a profoundly disturbing trend.

As health care costs rise, health insurance premiums also rise. This requires both employers and employees to pay more for healthcare coverage. The undeniable conclusion is that the cost of commercial health insurance has become an increasingly unbearable burden for American workers.

The Healthcare Affordability Index

In November 2017, Zeke Emanuel, Aaron Glickman and I published an article in the Journal of the American Medical Association (JAMA) that introduced the Healthcare Affordability Index. JAMA included editorial critiques from respected economists Ewe Reinhardt from Princeton and Joseph Antos from the American Enterprise Institute. Our article was widely read and heavily commented upon.

Our intention was to create a comprehensible measure of health insurance affordability using readily available and highly trusted data elements. The Kaiser Family Foundation’s (KFF) annual Employer Health Benefits Survey documents employer and employee contribution levels for commercial health insurance. The U.S. Census Bureau annually publishes U.S. Median Household Income, the most widely used measure of middle-class family income. We selected these credible sources.

Our findings were stark. The Index more than doubled between 1999 and 2016 from 14.2% to over 30%. Our belief is that increasing health insurance costs have contributed to stagnant income growth for workers employer-paid health insurance premiums have become a greater percentage of employees’ total compensation.

The academic reaction to the Index largely focused on defining affordability and income. Some suggested our formula was misleading because it did not include employer health insurance contributions as a component of family income. Adding employer-paid health insurance premiums to income lowers the Index but does not change its upward trajectory during the 1999-2016 measurement period.

While these criticisms have validity, they obscure the more important relationship between health insurance costs and middle-class incomes. Debating definitions of affordability and income creates a smokescreen. It distracts from the unassailable conclusion that health insurance consumes an ever greater percentage of family resources.

The 2018 Healthcare Affordability Index

Since 1999, the Kaiser Family Foundation has published an annual survey of employer health benefits. Employer-sponsored health insurance covers approximately 157 million Americans (1), largely through private commercial health insurance plans. The cost of a family health insurance policy in 2018 was $19,616.

The Census Bureau has tracked nominal and real median household incomes since 1984. It is a widely used measure of middle-class incomes. On an inflation-adjusted basis, median U.S. household incomes peaked in 1999 and have stagnated since. Median U.S. household income in 2017, the latest year reported, was $61,372.

A Sentier Research report (2) found U.S. median household income to be a record $62,175 in June 2018. We are using this figure to calculate the 2018 Affordability Index until the Census Bureau releases its 2018 median household income figure in September 2019.

Measuring the numerical relationship between these credible, widely available metrics creates a framework for assessing the financial burden imposed by health insurance on middle-income families. The chart below measures healthcare affordability between 1999 and 2018 through the Healthcare Affordability Index.

Here are several salient observations regarding the Healthcare Affordability Index.

- The 2018 Index is 31.5%, which represents the percentage relationship between employer and employee contributions for a family health insurance policy ($19,616) and Median Household Income ($62,175).

- The 2018 Index score of 31.5% is a record high, based on a modest 1.3% increase in median household income over 2017. By contrast, family health insurance premiums rose 4.5% 2017 to 2018.

- The ratio of health insurance premiums to median household income has more than doubled from 14.2 % to 31.5 % in less than 20 years.

- Increasing health insurance costs exert a substantial and depressing influence on wage growth. Health insurance premiums increased 5 times faster (239%) than workers’ earnings (48%) between 1999 and 2018.

- All other things being equal, a constant 14.2% Affordability Index would translate into a 2018 median household income of $72,943, which would be a meaningful $10,768 (17.32 %) increase over the current level of $62,175.

- Adding deductibles and co-pays increases the cost of actual healthcare for Americans beyond the Index, making paying for coverage and actually getting care more taxing. This is particularly true for the increasing numbers of Americans with high deductible health plans.

- The Index fluctuated around 30% between 2011 and 2017. This appeared to indicate a natural barrier against further increases. However the 2018 Index of 31.5% is an alarming break in this pattern that signals a return to healthcare consuming a greater percentage of workers’ total compensation.

Healthcare’s Increasing Burden on Working Americans

The U.S. boasts the world’s most productive workforce. High worker productivity creates wealth and sustains high living standards. The U.S. outspends all countries on healthcare services. Logic suggests that generous health spending enhances national productivity, competitiveness and wealth creation. The opposite is true.

America’s health status is lower than that in other developed economies. While all Americans bear the burden of increasing health insurance premiums, that burden falls disproportionately on lower-income communities and families who suffer stagnant wages and increasing health disparity.

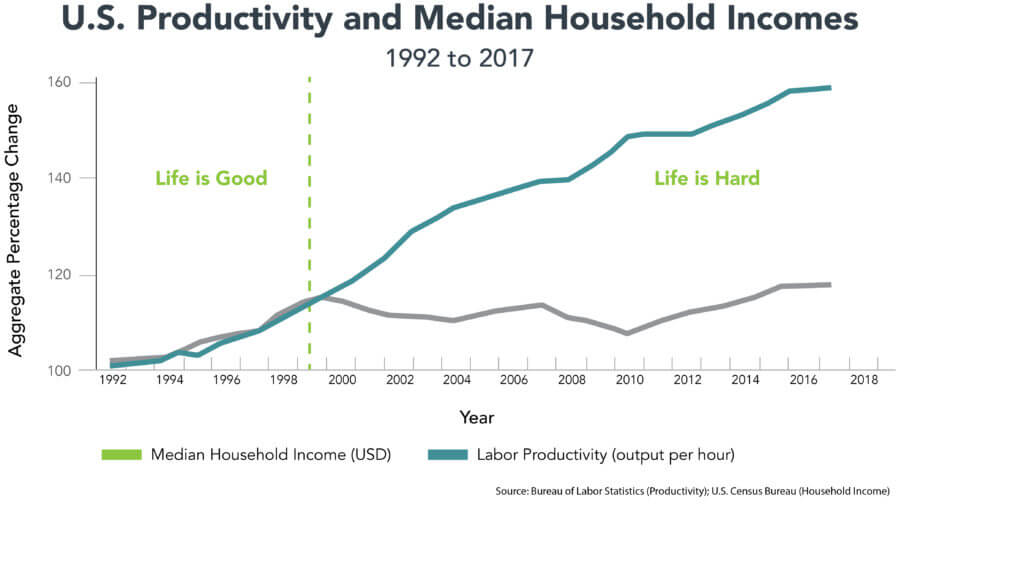

Historically, there has been a tight correlation between improving productivity and growing median household income. This is wealth creation in action. The benefits of higher productivity flowed directly to American workers in the form of higher wages. This historic pattern changed for the worse as America entered the new millennium.

Historically, there has been a tight correlation between improving productivity and growing median household income. This is wealth creation in action. The benefits of higher productivity flowed directly to American workers in the form of higher wages. This historic pattern changed for the worse as America entered the new millennium.

Despite increasing productivity, wages for American workers have stagnated since 2000 on an inflation adjusted basis (see chart). There are multiple reasons for this depressing reality. These include two major recessions and increasing competition from a lower-cost, globalizing workforce. Healthcare’s rising costs, however, are an underappreciated component of the wage stagnation afflicting U.S. workers. Increasing health insurance premiums reduce monies available for wage increases.

Rising health insurance premiums act as tax on worker incomes. Unfortunately, the healthcare system has become more dependent on this “tax” to fund its profligacy.

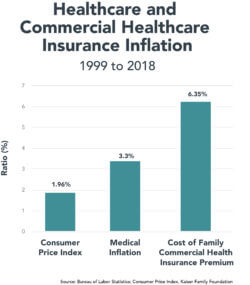

Employer-sponsored health insurance subsidizes America’s inefficient and exceptionally high-cost healthcare delivery system. As the chart to the left illustrates, commercial health insurance premiums have risen more than three times the rate of inflation (as measured by the Consumer Price Index) and almost double the rate of medical inflation.

High-cost healthcare could not exist in America without very high-cost private health insurance. Importantly, the U.S. healthcare system has become increasingly dependent upon high-cost commercial premiums to fund increasing healthcare expenditures. My biggest disappointment with U.S. healthcare is that employers haven’t demanded more value for their healthcare purchases.

Educating Americans on the direct connection between healthcare expenditures and the all-in costs of health insurance is a national priority. The Healthcare Affordability Index is an effective tool for making this connection understandable.

Consumers Disconnected from Rising Healthcare Costs

Americans understand that healthcare is expensive, but generally do not recognize the direct connection between health insurance premiums, healthcare costs and incomes. The following factors contribute to this perception failure, and these factors blunt optimal consumer purchasing behavior.

- Employers and governments cover the lion’s share of health insurance costs. This benefit insulates consumers from actual healthcare expenditures. Americans worry more about access to healthcare services than their cost.

- Consumers experience the healthcare marketplace through the purchase and use of health insurance products. Their relevant measures are not healthcare costs, but rather the costs of insuring against adverse health expenditure (employee health insurance premiums, deductibles and co-pays).

- Healthcare principals negotiate prices without customers. Patients see doctors, who prescribe treatments, for which a third party (e.g., a health insurance company) pays a predetermined price. This transaction process severs the buyer-seller relationship that governs transactions between consenting parties in efficient markets.

- Employees focus on income, while employers focus on total compensation. Consequently, workers underappreciate the negative impact rising healthcare and health insurance costs exert on their take-home pay.

Public Policy Implications

Increasing healthcare and related employer-sponsored health insurance costs exert a double whammy on wages. Workers pay more for health insurance, which decreases their out-of-pocket spending. Meanwhile, escalating health insurance costs limit employers’ ability to increase wages. The net result: workers pay more for health insurance and receive lower pay.

Healthcare costs are strangling middle-class incomes. “We the People” fund America’s bloated healthcare system and its costs fall disproportionately on low- and middle-income Americans through wage stagnation and declining health status. This negative cost shift deprives American workers of vitally needed income.

Funding America’s highly expensive, inefficient and often ineffective healthcare delivery system through high-cost private health insurance plans has consequences. It weakens the American economy. It reduces the global competitiveness of U.S. companies. It robs workers of higher wages and lowers living standards. It also siphons investment from more productive industries.

The Healthcare Affordability Index connects the high cost of private health insurance with household incomes through a clear, easy-to-understand metric. Properly appreciated, the ever-rising Index scores since 1999 should anger the American people. Properly informed, government officials could use their “bully pulpits” to advocate for lower Index scores.

Regular publication of the Index could stimulate industry-wide efforts to improve healthcare productivity and reduce costs. Concurrently, it would make individual providers, payers and suppliers more accountable as regions compete to offer more affordable healthcare services.

At a macro level, delivering the same or better healthcare for less money will free up enormous resources to pay workers higher incomes and invest in more productive industries. The human and financial costs of U.S. healthcare’s fragmentation, dysfunction and unfairly distributed burden are massive. Fixing the system is this generation’s primary public policy challenge.

Continued…

Part 2 of “Unbearable Burden” will examine the widely varying, state-specific impact of purchasing health insurance on family resources.

Sources

- Kaiser Family Foundation

- Green, Gordon, and John Coder. Household Income Trends June 2018 Report. July 2018. http://sentierresearch.com/reports/Sentier_Household_Income_Trends_Report_June_2018_07_24_18.pdf