August 3, 2016

Back with Vengeance: Vertical Integration’s Demons Wreak Havoc

With pride and promise just two short years ago, Catholic Health Initiatives (CHI) introduced Prominence Health, a wholly-owned subsidiary, that would “significantly advance CHI’s ability to excel in a pay-for-value environment.” Leadership declared that Prominence Health would “oversee a growing portfolio of commercial and Medicare Advantage health-insurance plans, networks of care and related products and services in markets across the nation.”

Leadership further declared that Prominence would “be a key element of CHI’s system-wide emphasis on innovative products that help support an essential transition to value-based care delivery and reimbursement. The spectrum of service offerings represents a customer-centered “bridge” to population health, connecting communities to a wide range of programs and solutions that help improve overall health and well-being.”

After massive operating losses at renamed QualChoice Health, CHI has decided to divest its health plan subsidiary.[1] That so much could go wrong so fast highlights the difficulties and dangers of healthcare providers moving into the health insurance business.

This story has a familiar ring. Under reform pressure in the 1990s, many health systems began offering health insurance plans. The complexity of pursuing full-risk contract caused significant operating losses and led most systems to abandon their integrated delivery initiatives.

Across all industries, vertical-growth strategies (doing different things in the same market) are more complex and challenging to execute than horizontal-growth strategies (doing the same thing in different markets). That’s why horizontal growth swamps vertical growth.

Since the 2010 passage of the Affordable Care Act, many health systems have initiated and/or expanded health insurance operations to position for value-based payment systems.[2] Owning a health plan creates opportunities for growth and better medical management, but it also increases organizational complexity and conflicts.

As CHI’s cautionary tale illustrates, owning a health plan can be catastrophic for providers. Vertical integration’s demons wreak havoc on the best-intentioned strategies. It’s best for health system leaders to understand these demons before embarking into the health insurance business. A company’s best strategic decisions are often those initiatives it chooses not to pursue.

Performance and the Inverted “U” Curve

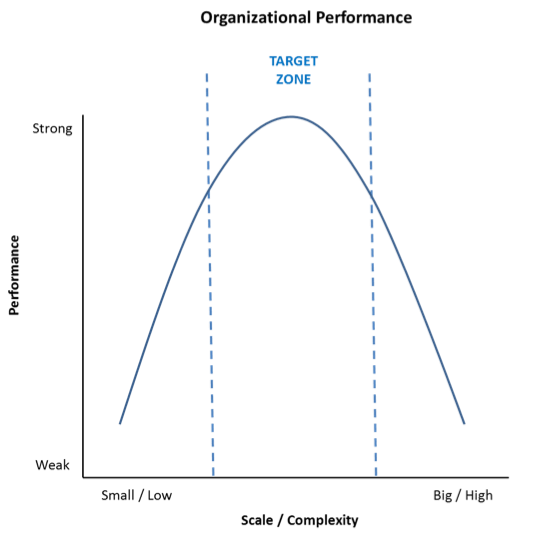

In David and Goliath, Malcolm Gladwell discusses the “inverted U curve” phenomenon where performance improves, levels and declines as a measurable index increases.[3] This relationship applies to parenting and wealth (too little wealth makes parenting difficult but so does too much); wine consumption (a little wine is healthy, too much isn’t) and school classroom size (performance suffers when classes are too small and too large). The chart below displays an inverted performance U curve relative to a company’s scale and complexity:

As companies grow, their performance improves with increasing economies of scale. This continues until they reach a “target zone” where diseconomies of complexity offset further economic benefits. As scale and complexity push beyond equilibrium, performance declines.

Mergers fail when complexity and its associated costs exceed accretive value. Most acquired hospitals underperform for this reason[4]. Performance curves related to scale and complexity vary by industry and company. Managing the inherent tension between scale and complexity is a key determinant of organizational success.

Complexity’s Challenge to Integrated Health Delivery

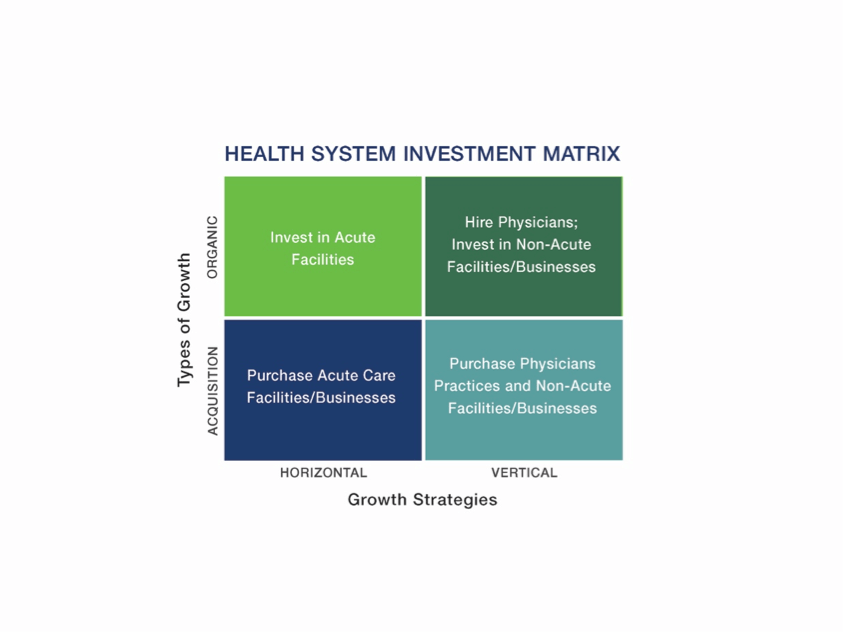

As with all companies, health systems grow organically and through acquisition by pursuing horizontal and/or vertical strategies. All growth strategies fall within this four-corner matrix:

Historically, health systems have largely pursued horizontal growth by building or acquiring acute care facilities. As reform marches forward, many health systems are growing vertically by expanding their care continuum to become integrated delivery systems (IDSs), capable of managing care for distinct populations.

Growth creates economies of scale by spreading fixed costs over larger operating platforms, eliminating duplicative functions and increasing negotiating leverage. Growth also increases organizational complexity by blending cultures, introducing new business and/or regulatory risks and requiring more expansive oversight.

As companies grow, diseconomies of complexity offset and sometimes overwhelm beneficial economies of scale. Vertical growth is more complex than horizontal growth. It’s clear that IDSs have more operating complexity than hospital management companies. Accordingly, it’s probable that health systems developing IDSs will experience greater diseconomies of complexity.

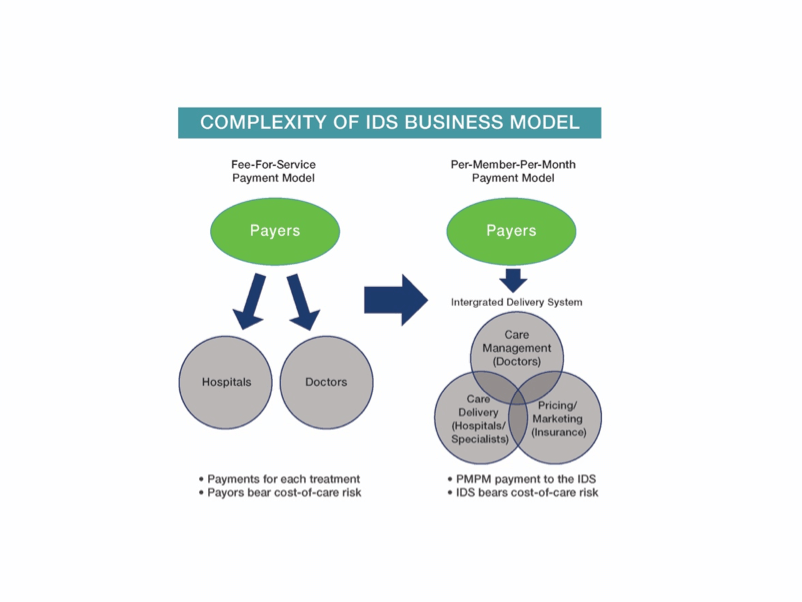

IDSs represent a major business-model shift for treatment-focused health systems accustomed to fee-for-service payments. The following chart displays the shift in risk that accompanies the IDS business model:

Given its inherent complexity, vertical integration creates several potential sources of conflict and energy drain. These organizational “demons” include the following:

- Culture clashes: Operators and suppliers see the world differently. They aren’t inclined to solve one another’s problems;

- Embedded problems don’t disappear: Vertical integration cannot create demand for faltering businesses. Customers gravitate to lower-cost, higher-value products and services;

- Former partners become competitors: Companies alienate historic channel partners and supply-chain relationships as they move into new business lines. Opportunities for “win-win” arrangements diminish;

- Mushy transfer pricing: Absent real market competition, internal service pricing and cost allocations become political exercises;

- Favoritism for internal suppliers: Operators cannot seek higher-value external alternatives;

- Too much refereeing: Disputes between operating divisions expand and intensify. Senior managers expend too much energy resolving disputes. Solutions are often sub-optimal; and

- Lost focus: Companies lose competitive advantage. Diseconomies of complexity overwhelm the benefits of vertically-integrated operations.

CHI Revisited

CHI has not revealed its logic for exiting the health insurance business. Leadership made its decision after a comprehensive strategic review necessitated by substantial operating losses. Through three quarters of FY 2016, thee system lost $556 million on $12.6 billion in revenue. All three rating agencies (Fitch, Moody’s and S&P) have downgraded the company’s long-term debt ratings.[5]

Undoubtedly, complexity’s diseconomies unleashed vertical integration demons that crushed CHI’s attempts to build a sustainable health insurance business. For example, Nebraska’s largest insurer (Blue Cross and Blue Shield of Nebraska) cancelled its CHI provider contract in September 2014 citing the high costs of CHI’s Alegent Creighton Health in Omaha. This action triggered sever operating losses and substantial layoffs at CHI’s Nebraska hospitals.

Blue Cross reinstated CHI into its Nebraska provider network in July 2015. The new agreement contains differential payment rates for CHI’s higher-cost Omaha hospitals and its other hospitals in the state.[6]

Popular business wisdom holds that “culture eats strategy for breakfast.” Within most health systems, strong operating cultures pursuing fee-for-service reimbursement resist shifting toward value-based care delivery (better outcomes; lower costs; greater customer convenience) because they lose money – at least in the short term.

After its QualChoice divestiture, CHI will need new strategies to navigate successfully in the post-reform marketplace. It could find inspiration with its own organization. CHI and Adventist Health jointly own Centura Health, a large regional health system serving the Metro-Denver marketplace. Centura will offer a co-branded health insurance product next year with Minneapolis-based start-up Bright Health.

A “Bright” Lining [7]

Healthcare delivery and health insurance are not the same. Health systems cannot realistically enter the health insurance business until they have confidence their delivery system can provide consistent, high-quality and cost-effective care.

In the interim, many health systems are partnering with health insurance companies to sell co-branded insurance products. McKinsey indicates the number of co-branded health insurance offerings almost doubled from 36 to 71 from 2014 to 2015.[8] The Centura-Bright arrangement is part of this broader trend.

Former UnitedHealthcare CEO, Bob Sheehy, former Definity Health and Redbrick Health co-founder and CEO, Kyle Rolfing, and former Carrol and Luminat co-founder, Dr. Tom Valdivia launched Bright Health in 2015. They’ve received over $80 million in Series A venture backing before enrolling a single member.

Bright sees market advantage in providing competitively-prices health plans that foster closer, more collaborative relationships between patients and their care providers. Bright eases administrative burdens, aligns incentives, and leverages an expansive technology platform to advance quality delivery and engage members in their care. Here’s how Sheehy describes their model,

What we’ve seen, particularly in the individual market, is that the old insurance model doesn’t work. A better model is one that really aligns the care provider, the physicians and the hospitals, financially, with the insurance company.

Bright’s vision is to partner with efficient, high quality systems, like Centura, in each of its geographic markets. Bright will bring new customers/patients into its partners’ ecosystems. Bright and its health system partners will share financial risk; mine health system, health plan and consumer data to understand the patient’s needs; and collaborate to enhance their combined care management capabilities.

Just as UnitedHealthcare and Humana exit the Colorado Exchange, Centura and Bright Health are teaming up to sell narrow network plans on and off the public exchanges in 2017. Bright will pilot its model in Colorado with the goal of adding 3-5 new markets in the next five years.

In Colorado, members enrolling in Bright Health’s insurance plans will choose a Centura primary care physician to manage their care. Bright and Centura will collaborate in developing and implementing programs to manage chronic disease, promote health and lower acute care treatment costs.

Creative Destruction

The experiences and activities of CHI, Bright Health and Centura are component parts of the larger disruption roiling the healthcare industry. Individual companies respond to marketplace realities, adapt and reposition.

CHI exits the health insurance business after a two-year failed experiment. Centura and Bright launch a new co-branded initiative into a market void created when UnitedHealthcare and Humana exited the Colorado Exchange.

Austrian economist Joseph Schumpeter describes this evolutionary, bottom-up, market-driven repositioning as “the gale of creative destruction…[a] process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.”[9]

Markets are agnostic with regard to organizational structure and mission. They run on results. This relentless, ongoing market pressure and evolution is pushing healthcare toward value. Winning companies will understand and manage complexity while delivering superior products and services at competitive prices.

The winds of change are howling, but the storm is just beginning. Batten down the hatches!

[1] http://www.modernhealthcare.com/article/20160630/NEWS/160639998

[2] http://healthcare.mckinsey.com/provider-led-health-plans-market-evolution

[3] David and Goliath by Malcolm Gladwell See Chapter Two: “Teresa DeBrito”, sections 4 and 5 for a complete discussion of inverted U curve dynamics

[4] See my June 2013 article “Scale Matters: Bigger and Better Health Systems”. It references studies by Deloitte and Booz & Co. that support this conclusion.

[5] http://emma.msrb.org/ER980352-ER767264-ER1168685.pdf

[6] http://journalstar.com/news/state-and-regional/nebraska/chi-health-blue-cross-blue-shield-reach-agreement/article_213d0552-6270-51d2-beb4-5b23b3061028.html

[7] http://www.bloomberg.com/news/articles/2016-05-26/health-startup-led-by-ex-united-manager-goes-where-rivals-quit

[8] http://www.denverpost.com/2016/05/26/bright-health-moves-into-colorado/

[9] Schumpeter, Joseph A. (1994) [1942]. Capitalism, Socialism and Democracy. London: Routledge. pp. 82–83.