January 28, 2025

Better Health Insurance Starts With a People-Focused Standard — and Yes, Profitability Still Matters

Ask anyone: Health insurance sucks. It’s complicated to understand, there’s no price transparency, it’s extremely expensive and it seems to get more expensive every year. Most people agree that health insurance is due for an overhaul.

But what should the overhaul entail? And where would we start to create change?

One suggestion, based on our latest research at the Christensen Institute, is a new industry standard of “The best care at the best cost, every time.” It’s a win for almost everyone: patients, providers, sponsors and insurance innovators. Incumbent insurers may stand to lose, but they don’t have to.

I’m a skeptical person, so if I were reading this, I would think, “That sounds nice, but is that possible? And where would we even start?” Below, I’ll outline the answers to these questions.

The Root Cause of the Healthcare Cost Inflation Problem

To effectively solve a problem, you have to uncover its root cause. And when it comes to health insurance, that’s where a lot of us seem to disagree. Our research reveals that the true cause of high and rising healthcare cost inflation is the system that creates it.

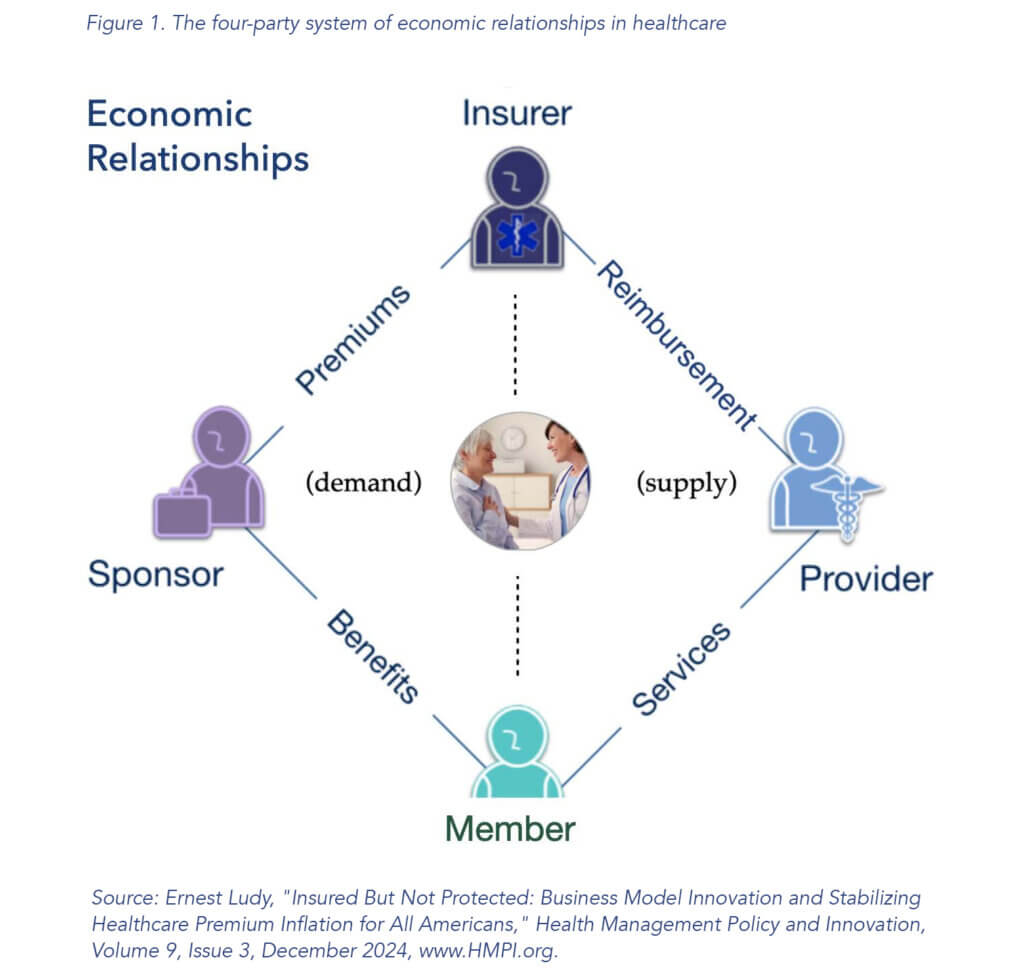

There is a complex four-party economic system underpinning the industry. The result of this economic system is that the health insurance market doesn’t follow traditional rules of supply and demand. Instead of having typical buyer-seller dynamics where, as demand increases, price increases, and so does supply, the four dominant players in the industry (i.e., sponsors, insurers, providers and consumers) neutralize this dynamic. See Figure 1 for more detail.

The four-party system is the root cause of runaway inflation, and it creates three consequences that innovators must address to reduce inflation: 1) the insurer’s cost-plus business model, 2) weak market forces, and 3) no supply chain visibility. For more detail on each of these consequences, see the linked article.

In brief, insurers spend more to earn more, largely due to the Medical Loss Ratio. Weak market forces don’t drive innovation. When there is limited competition, existing players are disincentivized to innovate. Of critical importance, the lack of supply chain visibility means that insurance purchasers (i.e., sponsors or individuals buying a plan) have no way to know if they’re buying a high-value plan. That’s partially due to supply chain disintermediation between the four parties in the system.

So, when it comes to transforming the industry, changing the four-party system isn’t a feasible first step for innovators. However, they must address its consequences if they wish to reduce systemic inflation. That’s because systemic issues require systemic solutions.

What Hasn’t Worked in the Past: Pure Play Disruption

Many innovators want to “disrupt healthcare” or “disrupt health insurance” to create a better system. And the market is ripe for it. Sponsors buying insurance for beneficiaries (i.e., consumers or members) and the beneficiaries themselves are overserved, meaning they’re charged too much for the value they get from health insurance.

Why has no one been able to disrupt the market?

To be clear, disruptive innovations make products and services more affordable and accessible to more people. They aren’t breakthrough technologies that make good products better. Importantly, disruption is a process that often unfolds over decades. But still, despite many attempts, no one has unseated incumbents at scale.

Let’s uncover why by looking at insurtechs. One reason they failed was that they went after incumbent organizations’ best customers (i.e., Medicare Advantage consumers that produce high margins). When startups go after incumbents’ best customers, they usually enter a sustaining innovation fight where incumbents are poised to fight back and win.

Second, innovators also need scale from the beginning if they want to succeed in health insurance. Insurtechs and other innovators struggle to enter the market with scale.

Third, due to the ACA’s regulation around essential benefits, entering at the low end of the market (as disruptors often do) is extremely challenging in health insurance. That’s because offering a solution that could be seen as “good enough” isn’t actually legal.

One innovation that shows promise for industry transformation is Medstat, the earliest initiative to empower employer sponsors and governments to buy truly high-value care. Through an optimal care paradigm to address healthcare inflation by helping customers stabilize health benefit expenses and insurance premiums, founder Ernest Ludy demonstrated a new way to reduce inflation. Much can be learned from this model.

For more detail on Medstat, additional past attempts at disruption, and why they didn’t succeed, see our full report: “Zero-Inflation Healthcare.”

What Can Work in the Future: Business Model Innovation Paired With a New Value Network

All hope is not lost if pure disruption is unlikely in health insurance. Transformation is still possible through business model innovation paired with a new value network.

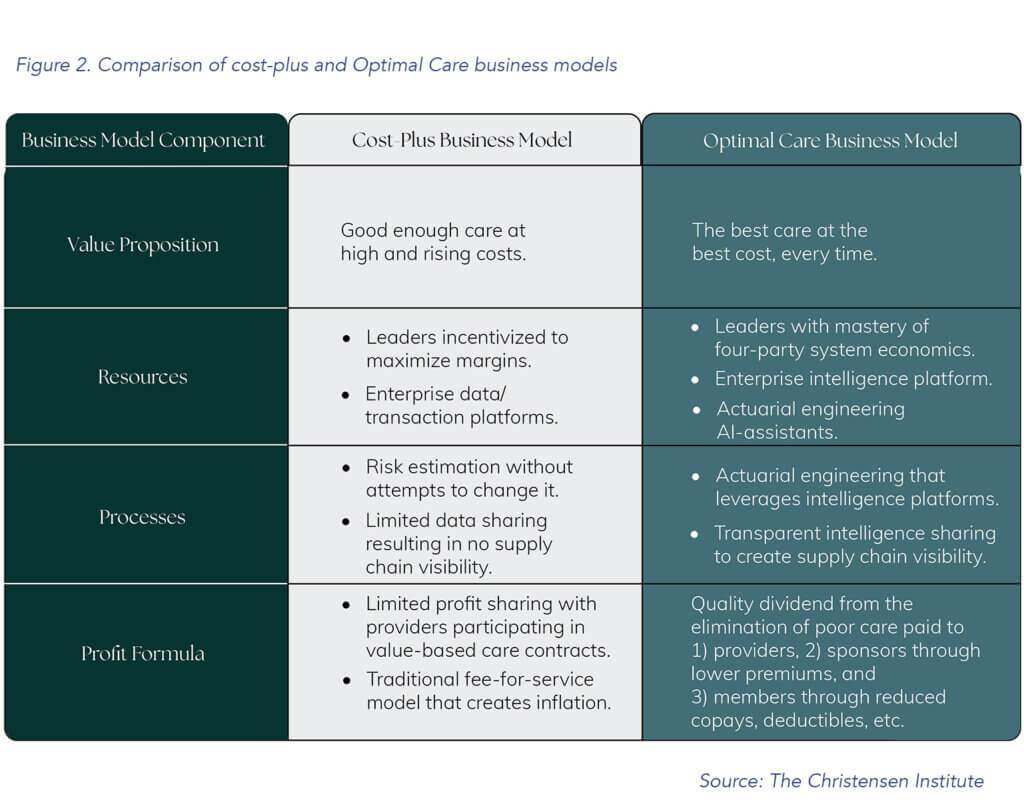

Business model innovation can come in various forms, but the one showing the most promise based on Medstat’s experience is the optimal care business model. In short, it’s a health insurance solution powered by a health intelligence platform. It’s designed to drive the best care at the best cost for each member it serves. Our report provides a full outline of this model, but a summary is found in Figure 2.

Business model innovation can seed transformation. But innovative business models need a new value network to scale. Without scale, the industry can’t transform.

Business models don’t exist in an ether. For business model change to create transformation, the value network has to be an enabling force. Business models determine an organization’s capabilities and its priorities, but a value network — the ecosystem of suppliers, partners, distributors, customers, other institutions, and regulations a company interfaces with to establish and maintain its model — determines the resources an organization has access to, the rules it must follow, and the permissions it needs to operate. It also includes external entities with varying degrees of power to shape the organization’s priorities through resource dependence, regulation and governance.

For a simple healthcare example, let’s look at the value network for a local hospital. It would include other healthcare entities in the hospital’s locality like primary care practices; employers (i.e., health plan sponsors); patients; ambulance services; local, state and federal government; medical schools; the American Hospital Association; insurance companies; medical suppliers; pharmacies; and more.

Bringing the Vision to Life: Potential Go-to-Market Strategies

Once innovators have established a new optimal care business model concept, they need a go-to-market strategy for testing, iterating and scaling it. As a result, innovation may be most effective if it starts within or in partnership with the government. This could occur with CMS or a state government. Undoubtedly, lobbyists and entrenched interests will push back on such an effort. However, as noted in Clay Christensen’s “Innovator’s Prescription,” as the largest payer, the U.S. government has the power to create a new value network and support the scale required to transform the industry.

But that doesn’t make the government the only possible starting point.

Innovation could also begin with the private sector. Private market solutions, such as large employers or investor-backed entrepreneurs, are possible. Yet, given the scale needed for enduring success, tremendous financing and strategic patience for growth would be required.

Where to Go From Here: Overcoming the Fear of the First Step

At the risk of stating the obvious, industry transformation is a decades-long undertaking that requires commitment and dedication from every corner of the industry — as well as some innovators outside of it. So how can we get started? As innovation experts Tom and David Kelley outline, innovators must overcome four key fears to find their creative confidence and innovate effectively. Specifically, innovators often falter or fail to launch due to the fear of the first step.

However, to achieve a goal, one eventually just has to start.

To do so, leaders need to articulate what a new standard for “better” looks like and map out a path to achieve it. What I’ve outlined here is just one idea, its potential target, and its associated pathway: The best care at the best cost, every time, achieved through business model innovation and a new value network.

Leaders coming together, choosing and vowing to focus on what’s best for people — not solely what’s best for profits — is a critical first step in achieving any kind of positive change. If you’re reading this, you’re likely a healthcare leader yourself.

If healthcare is going to get better — for our communities, our elders, our friends, our children, and even ourselves — we must start the transformation now. No one likes the status quo, so what are we waiting for?

More specifically, what are you waiting for?