June 24, 2020

Collecting & Saving Pennies: Turbocharging Health System Revenue Management & Productivity

In our recent article we identified the following five margin pressures that are coalescing to drive more value into the delivery of healthcare services:

Their collective impact poses an existential threat to many health systems. Consequently, “business-as-usual” is no longer a viable long-term strategy. Strategic partnerships, reconfiguring routine care, increasing productivity and effective revenue management are value-based strategies that enhance competitiveness and enable long-term market relevance.

Health systems must become much more proficient both at optimizing revenues under value-based and FFS payment models, and at delivering appropriate care services at competitive prices.

This article will examine strategies for improving revenue management and organizational productivity. Benjamin Franklin observed, “A penny saved is a penny earned.” Franklin’s simple but compelling logic applies to healthcare during this period of industry transformation in the following two ways:

Capturing all appropriate revenues through astute revenue management is a prerequisite for optimizing health systems’ financial performance. In that sense, a penny captured that otherwise wouldn’t be is also a penny earned.

Improved health system productivity is translating into higher margins as payers incorporate bundled pricing, shared savings and other risk-transferring tactics into payment models. Consequently, that penny saved is truly a penny earned.

During this transition period to value-based care and payment, health systems confront the dual challenge of optimizing topline revenues and improving productivity (not just cutting costs) to maintain their near-term competitiveness and longer-term sustainability.

Effective Revenue Management

Payment reform that shifts financial risk to providers is the principal vehicle through which value-based care delivery is emerging.

Full-risk contracting, where providers accept the financial risk for the care services they deliver, is one of the most powerful methods for incentivizing value-based care delivery. Full-risk contracting comes in two basic forms: full-risk bundles for episodic care and up-front capitated payments to care for specific individuals, usually within larger populations (e.g., a Medicare Advantage plan, some Medicaid managed care programs).

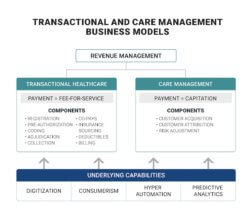

As value-based payment models proliferate, transactional healthcare will decrease, and care management will increase. Transactional healthcare and FFS payment will not disappear, but they will commoditize.

Bundled payments are a subset of the fee-for-service (FFS) payment formularies that constitute the vast majority of health system revenues. FFS healthcare is transactional by design – providers receive payments for the care they provide in accordance with pre-determined formularies and negotiated arrangements with payers. Because of the numerous negotiated arrangements with payers and highly regulated government payment programs, health systems have complex revenue cycle programs to collect FFS revenue.

Capitated payments and the care management programs they incentivize are the opposite of transactional healthcare. Once payers and providers agree on the capitated payment, providers must manage the care costs of individual members within their overall budgets to avoid operating losses.

Care management programs become profitable by promoting health and well-being, thereby limiting the need for acute interventions. There are no additional payments for unnecessary treatments, medical errors or overpriced services. There can be bonuses for achieving better health outcomes.

As value-based payment models proliferate, transactional healthcare will decrease, and care management will increase. Transactional healthcare and FFS payment will not disappear, but they will commoditize.

Transactional and care management business models operate with different incentives, organizational structures and metrics. Both are essential to high-functioning healthcare delivery. They can coexist, but health systems should not comingle their functioning nor the revenue management of FFS and capitated payments.

Source: Christensen Institute, “How Disruptive Innovation Can Finally Revolutionize Healthcare,” Spring 2017.

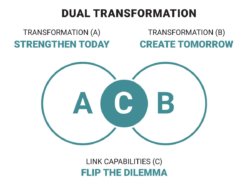

This revenue management model applies the dual transformation’s[1] business theory for accommodating disruptive change. Transactional healthcare and FFS payment represent the current business model (Transformation A). Care management and capitation (Transformation B) are disruptive to traditional practices because they align payment with desired outcomes: appropriate holistic healthcare and health promotion.

As value-based payment models proliferate, transactional healthcare will decrease, and care management will increase. Transactional healthcare and FFS payment will not disappear, but they will commoditize. The prices for care services will coalesce at transparent market-based levels. Health systems will no longer be able to charge premium prices for routine care.

Dual Transformation enables company to manage the current business (A) while developing the future business (B). Effectively allocating capabilities (C) is essential to organizational success.

The managerial challenge in dual transformation is operating the existing business (transactional healthcare) effectively, even as it shrinks, while nurturing and growing the new business (care management). There is no overlap. However, senior management must ensure that capabilities flow to both “A” and “B” in sufficient measure to optimize organizational success.

Consequently, revenue management for transactional healthcare and care management must operate independently from one another. At the same time, each must receive the resources necessary to have revenues effectively flow efficiently into the traditional and new businesses.

These resources include people, capital, time and technology. Intentional allocation of resources to revenue management for FFS and capitated payments is essential for effective revenue management in dual transformation. Examples include:

PEOPLE Billing, coding, charge capture, collections personnel are important roles for high-performing FFS revenue operations while care managers, resource nurses, care coordinators and financial risk managers are key for success managing capitated payments

TECHNOLOGY Intelligent automation improves quality and efficiency in the highly transactional FFS environment and predictive analytics improves quality and efficiency for managing capitated payments

Operational and outcome metrics for transactional healthcare and care management are key for senior leaders to manage the ongoing allocation of resources and performance.

Increased Productivity

As challenging as it is, optimizing revenue under both transactional healthcare and care management business models is only half the battle. Health systems must embrace productivity improvement to achieve the same or better outcomes at lower costs. This is particularly true for routine care services.

As shown in other industries, understanding costs, enhancing resource allocation, optimizing staffing, centralizing services, eliminating waste and managing supplies are essential to being competitive. This “better, faster, cheaper” mentality is now coming to healthcare.

In transactional healthcare, prices for care services will commoditize at lower, transparent price points. In response, health systems will need to reconfigure their operations to deliver high-quality and profitable care services at these lower price points.

During this transition period to value-based care and payment, health systems confront the dual challenge of optimizing top-line revenues and improving productivity (not just cutting costs) to maintain their near-term competitiveness and longer-term sustainability.

The same will be true in care management. As prices for capitated health provision commoditize at transparent rates, profitable health systems will deliver the preventive, diagnostic and therapeutic services that optimize their members’ health within a global care delivery budget.

Under both business models, developing a deep understanding of organizational costs is essential to making rational resource allocation decisions. Effective cost accounting makes this possible. Market pressures for value-based care delivery make it necessary.

Fortunately, advances in data collection and analytics make the application of cost accounting methodologies easier and more cost-effective to implement in healthcare. These advances include activity monitors to measure labor costs, better capture of treatment activities within electronic health records and standardized metrics for measuring performance outcomes.

Breakthrough performance in healthcare is becoming a function of managerial mindset. Value-driven organizations prioritize outcomes, costs and customer experience in a relentless drive to improve their performance.

The bottom line is that health systems must become much more proficient both at optimizing revenues under value-based and FFS payment models, and at delivering appropriate care services at competitive prices. Revolutionary healthcare, where outcomes matter, customers count and value rules, is coming.

Is your health system ready?

Sources:

Co-author

Jeff Jones is the former Chief Commercial and Strategy Officer for Conifer Health Solutions. He defined the strategic direction for businesses including the enterprise strategy and strategic partnerships, led commercial activities, headed client service and delivery, owned brand, marketing and go-to-market strategy, and directed new solution innovation. Jeff’s 30+ years of experience in both the healthcare and technology industries, coupled with his demonstrated track record partnering with health systems, academic medical centers, specialized providers, medical groups and health technology companies allowed him to bring unparalleled insights into Conifer’s overall business.

Jeff Jones is the former Chief Commercial and Strategy Officer for Conifer Health Solutions. He defined the strategic direction for businesses including the enterprise strategy and strategic partnerships, led commercial activities, headed client service and delivery, owned brand, marketing and go-to-market strategy, and directed new solution innovation. Jeff’s 30+ years of experience in both the healthcare and technology industries, coupled with his demonstrated track record partnering with health systems, academic medical centers, specialized providers, medical groups and health technology companies allowed him to bring unparalleled insights into Conifer’s overall business.