December 10, 2019

Commercializing Breakthrough Drugs In a Value-Based Market

Key Takeaways:

- Society demands both innovation and fair pricing from drug companies that develop treatments for all diseases. Proving meaningful efficacy and value is essential for successful drug commercialization.

- The market opportunity for commercialization services is broad, covering a wide-ranging suite of services focused on the effective launch and ongoing commercial success of a drug or medical device.

- The best growth strategies for consolidating CCOs rely on differentiation.

- CCOs play a crucial role in establishing value-based payment arrangements that provide value to buyers and sustain innovation.

Around 2,000 people in the US suffer from a hereditary disease called Leber’s congenital amaurosis, which causes blindness. Spark Therapeutics, a startup focused on gene therapies, developed a one-time treatment that significantly improves the condition. Their drug, Luxturna, costs $425,000 per eye.[1]

Spinal muscular atrophy is a fatal genetic condition that afflicts approximately 1 in 10,000 children worldwide. Novartis developed a drug called Zolgensma which potentially cures the disease with a single dose. At $2.1M per patient, the drug is the most expensive drug in history.[2][3]

Drugs like Luxturna and Zolgensma target, alleviate and sometimes cure rare diseases. While such therapies give hope to the afflicted, they come with exceptionally high prices. Pharma companies justify these high prices because the market for drugs that treat these “orphan” diseases (diseases afflicting fewer than 200,000 patients in the U.S.) is small and development costs can be enormous. In addition, they also compare the price to the ongoing societal costs of treating a patient’s symptoms over a lifetime.

American society is grappling with the wrenching cost-benefit tradeoffs created by costly pharmaceutical therapies. Stimulating innovation without allowing profiteering is at the center of this public debate. Hoping to avoid regulatory remedies, some drug manufacturers are pushing for outcomes-based payment models.

Novartis CEO Vas Narasimhan and AstraZeneca CEO Pascal Soriot are among industry leaders calling for value-based payment mechanisms for high-cost drugs.[4] For example, Novartis will not charge leukemia patients the $475,000 cost of its drug Kymriah if they do not respond favorably to the treatment within one month.[5]

Cynics may view this embrace of value as an industry ploy in which Big Pharma always wins; yet outcomes-based pricing models bring transparency to the murky orphan-drug market, incentivize drug development and help deliver lifesaving medicines to patients who desperately need them.

From an industry perspective, the trend toward costlier therapies with demonstrable value intensifies the need for real-world evidence and public education. Manufacturers must prove and communicate the comparative efficacy and potential monetary benefits of new therapies to multiple stakeholders, including payers, PBMs, patients, providers and government regulators.

Today, Medical Affairs departments within pharma companies as well as external Contract Commercialization Organizations (CCOs) and specialized consultancies seek to satisfy market demands for real-world evidence of drug effectiveness. Their collective efforts help drug companies develop and implement more sophisticated commercialization strategies.

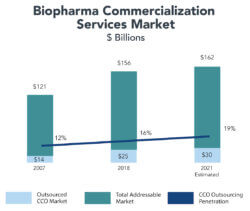

In 2018, Syneos, a multinational Contract Research Organization (CRO), estimated the market for CCO services to be $156 billion.[6] As the need for outcomes-based payment mechanisms expands, CCOs and commercialization consultancies are becoming pivotal players in commercializing new drugs and attractive acquisition targets in a consolidating market.

Value Comes to Drug Development

For patients in desperate need, new therapies cannot arrive quickly enough. Rather than wait for exhaustive clinical trials to prove a drug’s efficacy, manufacturers, regulators, doctors and patients often prefer to test promising but unproven drugs on afflicted patients.

Today, the FDA routinely fast-tracks approval for new drugs for serious and fatal conditions lacking viable treatment therapies. This is especially true for cancer drugs. Last year, 43 new drugs, representing 73% of total new drugs, gained some form of fast-track approval based on promising early research.[7]

Many of the fast-tracked products are novel, first-in-class treatments that are difficult to price due to the lack of existing comparative therapies and limited clinical trial data. To overcome that hurdle, drug developers and payers must agree on a pricing framework that rewards drug innovation relative to quality of outcomes and the ongoing societal costs of treating symptoms. As Novartis CEO Vas Narasimhan has said, “We need new economic models to determine exactly how much value [a cure] represents.”[8]

Value-based payment models compensate drug manufacturers for positive health outcomes, not the number of dosages administered. Examples of drugs where manufacturers accept value-based payment include: Merck’s diabetes drugs Januvia and Janumet, Novartis’ treatment for heart failure Entresto, and Amgen’s cholesterol drug Repatha.

When rare conditions lack effective therapies, the marketplace welcomes new breakthrough drugs. This is not true, however, for new drugs that treat common, chronic conditions for which there are existing treatments.

For example, Novartis’ drug Ilaris showed promise in clinical trials for preventing heart attacks. However, its $60,000 dosage price is four times higher than other cholesterol-reducing drugs. As a result, Ilaris failed to gain traction in the market.[9]

As these examples indicate, society demands both innovation and fair pricing from drug companies that develop treatments for all diseases. Proving meaningful efficacy and value is essential for successful drug commercialization.

Demonstrating a drug’s efficacy and value is the responsibility of Medical Affairs groups that operate within pharma companies. In essence, Medical Affairs provides evidenced-based sales support through Health Economics and Outcomes Research (HEOR) and Real-World Evidence (RWE). As the need for HEOR and RWE expertise grows, drug companies are increasingly outsourcing this function to external service providers.

The Growing Importance and Challenge of Drug Commercialization

Medical Affairs is the lynchpin between drug discovery and commercialization. Medical Affairs groups employ a broad range of professionals (economists, statisticians, researchers, physicians, lawyers, etc.) to fulfill the following two basic functions:

- the collection and interpretation of scientific data and real-world evidence in support of drug discovery; and

- the effective commercialization of new drug therapies, including regulatory and compliance approvals.

To establish real-world evidence, Medical Affairs generates and interprets data to make a case for a drug’s value and support its market price. Medical Affairs experts incorporate a drug’s safety, efficacy, and cost-benefit ratio relative to existing drugs. In support of the commercialization process, Medical Affairs also provides compliance, regulatory approval and marketing expertise.

Once a drug enters the market, Medical Affairs educates buyers, providers and consumers regarding that drug’s benefits and value. In this sense, Medical Affairs, along with the marketing and sales functions, is the drug manufacturer’s public voice for the scientific efficacy of the product. It also marshals R&D and marketing to support expanded research and clinical trials. This can include retaining independent scientists to evaluate the drug’s effectiveness.

Increasingly, Contract Commercialization Organizations (CCOs) provide Medical Affairs expertise and other commercialization services to large pharmaceutical manufacturers and small startups. The market opportunity for commercialization services is broad, covering a wide-ranging suite of services focused on the effective launch and ongoing commercial success of a drug or medical device.

Dynamic Marketplace for Commercialization Services

The prevailing trend in FDA approvals is toward tailored medicines and advanced therapies for targeted patient populations. At the same time, stakeholders now increasingly demand demonstrated value for these therapies that incorporates outcomes, medical need and costs.

New therapies are increasingly expensive, tailored, and complex. For their drugs to succeed in the market, biopharma companies must gather, incorporate and effectively communicate real-world evidence.

Since 2008, the number of companies with active drug pipelines has doubled to approximately 4,000. Many of the new entrants are small or virtual companies that outsource their drug development and commercialization services.

Consequently, the market for Contract Commercialization Organizations (CCOs) services is robust. CCOs are expanding their contractual relationships with both large pharma companies and startups by providing extensive guidance regarding optimal commercialization strategies.

In 2007, Syneos estimated a total CCO market size of $121 billion, with only $14 billion (12%) outsourced. By 2018, Syneos estimates that CCO outsourcing had increased to $25 billion, or 16% of the addressable market.

Outsourcing trends for Contract Research Organizations (CROs) provide a positive corollary for CCO outsourcing. Outsourcing rates for CROs have increased steadily over the last decade. Current estimates place CRO outsourcing penetration at approximately 55%, up from approximately 37% in 2009.[10]

As pharma and biotech streamline their operating costs and value-based contracting becomes more prevalent, the rate of outsourcing for commercialization services is expected to grow.

In 2018, 32%[11] of FDA approvals were for novel, first-in-class therapies and 58%[12] for orphan diseases.[13] On average, orphan drugs annually cost $150,854 per patient, compared to $33,654 per patient per year for non-orphan drugs.[14] While drugs for rare and orphan diseases target small patient populations, that does not mean the overall market is small. According to The National Organization for Rare Disorders (NORD), there are as many as 7,000 rare diseases affecting up to 30 million Americans.[15]

Moreover, the percentage of societal spend on specialty pharmaceutical drugs is increasing dramatically. Specialty drugs carry high price tags, require more complex injectable or intravenous application as well as more stringent storage and distribution requirements.

According to Express Scripts, approximately 32%[16] of drug spend in 2014 was for specialty pharmaceuticals. By 2018 that percentage had grown to approximately 45%.[17] Several researchers expect the percentage of specialty drugs to increase to more than 50%[18] by 2020 or 2021. This reflects a robust FDA approval pipeline for specialty drugs.

CCOs are well positioned to assist pharmaceutical companies in articulating the value proposition of these higher-priced, complex medicines to payers and PBMs. CCOs also educate patients and physicians about the efficacy and administration of specialty therapies. Their insights assist in developing optimal distribution strategies.

The CCO marketplace is fragmented. The industry’s biggest players, Syneos’ CCO division and UDG’s Ashfield division, account for $2.1 billion19 of the approximately $25 billion[20] in outsourced commercialization services. Consequently, the opportunities for growth through acquisition or consolidation are robust.

The best growth strategies for consolidating CCOs rely on differentiation. High-value CCOs are experts in big data analysis, interpretation and feedback. They offer valuable risk mitigation and market access and pricing insights using real-world evidence. They are also digitally savvy and efficient, using technology and data to make compelling arguments to all stakeholders.

Beyond technology, high-performing CCOs recruit and retain the best employees. Their highly skilled professionals assess, summarize, and package complex clinical data and real-world evidence. They make the case that carries the day.

Examples of Successful Outsourced Commercialization Platforms

The following companies represent innovative leaders in the field.

Eversana

Founded in 2018, Eversana operates a fully integrated commercialization services platform. Eversana, backed by PE-firms Water Street Healthcare Partners and JLL Partners, was formed through several acquisitions, including Alliance Life Sciences, Dohmen Life Science Services, Health Strategies Group, The Access Group, Triplefin, Patient Experience Project, and Seeker Health.

The combined company provides services across the entire life sciences industry and its subsectors. It has over 500 clients that range from startups to large pharmaceutical companies.

Eversana assists clients by making drugs ready for launch. It works with patient communities to develop understanding of the market need and develops global pricing, market access and distribution strategies.

As drugs launch, Eversana helps its clients scale distribution, track safety and efficacy, and consolidate data that illustrate HEOR and RWE measures. It also helps patients manage the affordability of costly drugs and work with payers more effectively.

Once drugs are in the market, Eversana consolidates data to prove value and works to engage patients in support programs that drive adherence and better outcomes. It also monitors supply chains to optimize efficiency and revenues.

Decision Resources Group (DRG)

Founded in 1990, Burlington, MA-headquartered Decision Resources Group (DRG) provides data and guidance to support the commercialization of therapies. A global company, DRG works with 48 of the top 50 life sciences companies, 8 of the top 10 payer/providers, and 15 of the top 20 PBMs.

Since 2012, DRG has pursued a consolidation strategy, making eight acquisitions that diversify its data assets and services.

In data and analytics, DRG helps customers understand markets and physician behaviors. It seeks to optimize drug access while tracking real-world data on more than 300 million longitudinal US patient lives.

As a strategic advisor, DRG assists clients in new product planning, commercial strategy and pricing and market access.

For drug commercialization, DRG generates insights through market research, real-world data and disease analysis, providing insights on reimbursement and regulatory dynamics.

Envision Pharma Group

Backed by GHO Capital and founded in 2001, Envision Pharma Group is a global technology and scientific communications company serving pharmaceutical, biotechnology and medical

device companies. Its clients include 18 of the top 20 pharmaceutical companies.

Envision provides evidence-based communications and medical affairs services to support access to market strategies for new biopharma compounds. Envision’s medical affairs platform supports compliance, planning and decision making across evidence-generation, communication and grants programs.

In the area of evidence generation, Envision goes beyond clinical trial data to include investigator-supported trials, internal studies, expanded access programs and preclinical/academic collaborations. It also communicates that evidence through key channels to stakeholders.

Conclusion: Enabling Both Value and Innovation

FDA drug approvals reached a record high in 2018 despite intensifying market hurdles. Bringing a new molecular therapy to market can cost $2.5 – $3.0 billion.[21] Failure to demonstrate efficacy in late-stage clinical trials can be financially catastrophic for drug manufacturers. CCOs aid biopharma companies in reducing the risks associated with drug commercialization.

As competition, societal resources, stakeholder scrutiny and market access challenges intensify, demonstrating value and efficacy of clinical outcomes, relative to existing therapies, is paramount for commercial success. Such data and insights shape drug development programs and drive efficiencies within clinical trials.

Like its Medical Affairs counterparts, CCOs are becoming an indispensable component within the pharmaceutical industry in bringing breakthrough therapies to market. CCOs play a crucial role in establishing value-based payment arrangements that provide value to buyers and sustain innovation.

Outcomes Matter. Customers Count. Value Rules.

John and Dave discuss this topic in an episode of the Cain Brothers House Calls podcast. Find all episodes of House Calls here.

Sources:

- https://www.cnn.com/2018/01/03/health/luxturna-price-blindness-drug-bn/index.html

- https://www.nbcnews.com/health/health-news/2-1-million-drug-treat-rare-genetic-disease-approved-fda-n1009956

- https://www.nytimes.com/2019/05/24/health/zolgensma-gene-therapy-drug.html

- https://fortune.com/2018/03/12/novartis-ceo-vas-narasimhan-drug-discovery/

- https://www.nytimes.com/2019/05/24/health/zolgensma-gene-therapy-drug.html

- Syneos Health, Company Presentation – January 8, 2019

- https://www.pharmacist.com/article/fast-track-drug-approval-designed-emergencies-now-routine

- https://www.fiercepharma.com/pharma/novartis-ceo-narasimhan-preps-zolgensma-launch-call-for-new-drug-payment-model

- https://www.forbes.com/sites/matthewherper/2017/08/27/a-new-way-to-prevent-heart-attacks-and-maybe-cancer-too/#44c5d6725cc8

- Barclays Equity Research

- FDA Center for Drug Evaluation and Research: Advancing Health Through Innovation, 2018 New Drug Therapy Approvals

- FDA Center for Drug Evaluation and Research: Advancing Health Through Innovation, 2018 New Drug Therapy Approvals

- EvaluatePharma® Orphan Drug Report 2019

- EvaluatePharma® Orphan Drug Report 2019

- EvaluatePharma® Orphan Drug Report 2019

- Express Scripts 2014 Drug Trend Report

- Express Scripts 2014 Drug Trend Report

- Express Scripts 2014 Drug Trend Report

- CapitalIQ and Company Filings

- Syneos Health, Company Presentation – January 8, 2019

- The Tufts University Center for the Study of Drug Development

Co-Author:

John Kerins is a Director in Cain Brother’s Corporate M&A Advisory practice. Mr. Kerins joined Cain Brothers in 2015 with 10+ years of experience in a variety of merger and acquisition, capital raising, and strategic advisory transactions. Mr. Kerins’ notable transactions since joining Cain Brothers include the minority recapitalization of RedCard by Parthenon Capital Partners, the sale of iCardiac Technologies to ERT, the recapitalization of Steward Health Care System with Medical Properties Trust, the sale of Onlife to Guidewell, Morgan Stanley Capital Partners’ acquisition of Clarity, advising Premier Healthcare Exchange and Pay-Plus Solutions on their merger with Stratose, and BioScrip’s PIPE offering to Coliseum Capital Management.

John Kerins is a Director in Cain Brother’s Corporate M&A Advisory practice. Mr. Kerins joined Cain Brothers in 2015 with 10+ years of experience in a variety of merger and acquisition, capital raising, and strategic advisory transactions. Mr. Kerins’ notable transactions since joining Cain Brothers include the minority recapitalization of RedCard by Parthenon Capital Partners, the sale of iCardiac Technologies to ERT, the recapitalization of Steward Health Care System with Medical Properties Trust, the sale of Onlife to Guidewell, Morgan Stanley Capital Partners’ acquisition of Clarity, advising Premier Healthcare Exchange and Pay-Plus Solutions on their merger with Stratose, and BioScrip’s PIPE offering to Coliseum Capital Management.

Prior to joining Cain Brothers, Mr. Kerins was a Vice President at Deloitte Corporate Finance LLC, where he focused on mergers, acquisitions, and fairness opinions across a variety of sectors. Mr. Kerins’ prior experience also includes working for McMaster-Carr Supply Company, a privately held distributor, in a variety of management capacities, including operations and sales management. Mr. Kerins earned a BA in Political Science from Kenyon College and an MBA from Fordham University.