January 30, 2020

Death by a Thousand Mergers

When the Centene Corp. completed its $17.3 billion acquisition of WellCare Health Plans late last week, it created a health insurer that now operates in all 50 states with a total of more than 24 million members across the country. It also signaled the start of what promises to be yet another year of unbridled healthcare merger and acquisition activity.

Everyone likes to quote the late great healthcare economist Uwe Reinhardt’s observation that “it’s the prices, stupid,” when trying to explain why healthcare costs are so high in the U.S. compared with other countries around the world. Who am I to disagree?

But I’d like to add a caveat to Uwe’s observation that says “it’s the mergers, stupid.”

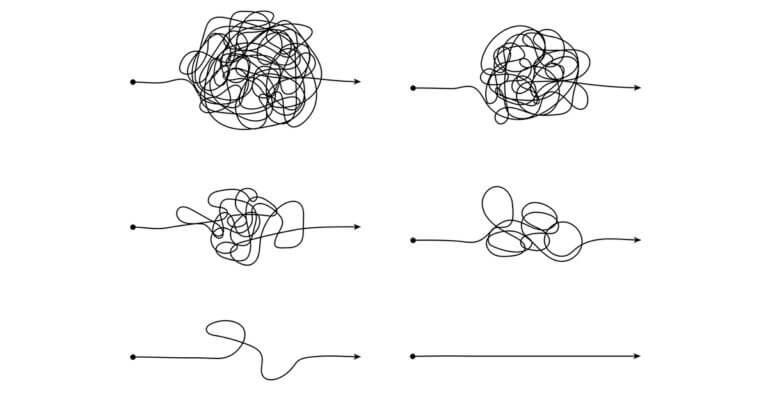

Merger after merger, acquisition after acquisition, consolidation after consolidation, from megamerger to small practice acquisition, competition goes down and prices go up. Most transactions are too small to get noticed by federal or state regulators, who rarely do anything about the headline-grabbing deals anyway. Collectively, deal by deal, the industry contracts, giving more market power to fewer players. It’s death by a thousand mergers.

Here are last year’s tallies from four different sources:

- The health services sector of the economy featured 1,221 deals in 2019, according to a report from PwC. The company defines deals as “mergers, acquisitions, shareholder spin-offs, capital infusions, consolidations, and restructurings” announced during the calendar year. PwC’s total is down 1.5 percent from 2018, but the report noted that it was the fourth consecutive year that the health services sector deal total topped 1,000. The long-term care subsector saw the most deals with 437 last year followed by physician and medical groups with 219 deals, according to PwC.

- The number of healthcare mergers and acquisitions hit 1,774 last year, according to preliminary data from Irving Levin Associates. It’s the second highest total recorded by the firm following 2018’s record of 1,908 healthcare mergers and acquisitions, the company said.

- The number of hospital and health system mergers and acquisitions crept up to 92 last year from 90 in 2018, according to a report from Kaufman, Hall & Associates. The average size of the seller last year was $278 million in annual revenue compared with $409 million in 2018, the company said.

- The number of announced hospital and health system “change of control” transactions dropped to 85 last year from 116 in 2018, according to a report from Ponder & Co. Twenty-one percent of the acquirers were for-profit hospitals or chains in 2019 compared with 18 percent the previous year.

No matter how you cut it, wheeling and dealing has and will continue to be a hallmark of the healthcare system in the U.S. That’s because healthcare is a business just like any other business in any other sector of the economy. Businesses merge and acquire to be more successfully financially, and healthcare is no different.

If you want prices to come down, let competition go up. That starts with somehow putting the brakes on industry consolidation. Let the market work for consumers just like we do in any other industry.

Thanks for reading.