July 9, 2020

Don’t bail out. Bail in to value-based care.

Key Takeaways:

- Hopes for a V-shaped recovery in healthcare spending are fading fast as COVID-19 caseloads, hospitalizations and ICU bed use surge in half the U.S.

- Hospital and physician practices should expect further deterioration in their income and balance sheets as lockdowns and economic activity restrictions spread.

- The initial federal provider bailout will likely prove inadequate under these conditions. More federal assistance will be necessary before the November election.

- To win bipartisan backing for another provider bailout, healthcare leaders should support inclusion of provisions that expedite their movement toward value-based care.

- They also should back additional funds to participate in COVID-19 testing and tracing activities; support at-home, telehealth and other alternative care models; and address care gaps revealed by the pandemic.

The COVID-19 pandemic’s renewed resurgence dashes any hope the healthcare economy will quickly recover from its sharp downturn. More than half the states are reporting an increasing caseload. Senior executives and finance officers at hospitals and physician practices should start planning now for a prolonged downturn in routine and elective healthcare services.

For a brief moment, it appeared that a rapid rebound, what some call a V-shaped recovery, was possible. After the lockdowns of March and April triggered dramatic declines in elective surgeries and office visits, things began to reverse in May.

But now some of the largest states in the union are reimposing lockdowns and social distancing orders due to the premature reopening of their economies. Their COVID-19 caseloads rose steadily during June. Hospital ICU beds in some cities in Florida, Texas, Missouri and Arizona are nearing capacity. Conservative Republican governors in those states have had to reverse course and ignore the Trump administration’s pleas to keep their economies open.

This tightening puts most plans for rapidly returning to normal operations at hospitals and physician offices on hold. The economic downturn that knocked out an estimated 10% to 20% of healthcare revenue in the second quarter will continue well into the third quarter and likely beyond. The federal government’s willful failure to mount a national response to the pandemic all but guarantees it.

Uncertain Times

The current moment is unprecedented. During every previous economic downturn, the healthcare economy kept chugging along as if nothing happened. During the Great Recession of 2008-10, for instance, healthcare added over a half million jobs while the rest of the economy lost 9 million jobs. During those years, healthcare’s overall share of the economy surged from just under 14% to over 17%. Healthcare didn’t grow faster than normal. Rather, the rest of the economy shrank rapidly while providers suffered little harm from the downturn.

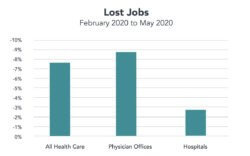

That’s a far cry from what’s happening now. Healthcare is shrinking faster than the rest of the economy for the first time in post-Depression history. During April, healthcare accounted for just 15.8% of all economic activity, well below the nearly 18% average of recent years, according to estimates from the Altarum Institute.[1] Although it bounced back to 17.3% in May, that’s still below its pre-pandemic level. Though 312,000 healthcare employees returned to work in May, there were still 1.3 million fewer jobs in the sector than there were in February.

A sea of federal CARES Act funding is keeping hospitals afloat. The bill earmarked about $175 billion for providers. Hospitals’ median operating margin rose to 4% with federal help, according to a new Kaufman Hall survey. Without it, the median margin would have been -8%. In April, those margins stood at -12.5% with the aid and -35% without it.[2]

The healthcare sector has built-in stabilizers that usually allow it to weather downturns better than the rest of the economy. The Medicare and Medicaid programs continue paying the bills for seniors, the disabled and the poor, all heavy users of services. During recessions, laid-off workers and their families swell the rolls of both programs. If you include the Veterans Administration, the military and the 9 million federal workers and dependents covered through the Federal Employee Health Benefits plan, recession-resistant federal funding pays well over half the annual healthcare tab.

But all that becomes inoperative during a pandemic. The unemployed may shift onto Medicaid or a subsidized ACA plan, but no one can schedule elective surgeries or office visits during a shutdown. Even in states that can reopen because their numbers appear under control, seniors, who spend the most on healthcare, remain extremely reluctant to resume normal care patterns since they are at greatest risk of the severest complication from COVID-19.

A new Commonwealth Fund study showed 80% of seniors support social distancing and shelter-in-place orders. The latest New York Times public opinion poll among likely voters found seniors in battleground states backed prioritizing pandemic control over reopening the economy by a 26-point margin.

Return to Normal?

The best-case scenario for restoring near normalcy in healthcare consumption patterns will depend on the nation’s leaders summoning up the will and discipline to impose shelter-in-place and social distancing orders for as long as it takes to get the pandemic under control. The likelihood of that happening before 2021 is highly unlikely. A bitterly contested presidential election will dominate the public conversation over the next four months. Unless he reverses course, President Trump will continue vacillating between half-hearted endorsement of such orders or actively encouraging resistance.

Hospital officials also shouldn’t count on a rebirth of consumer-led demand except in a few areas like cancer care. The Centers for Disease Control and Prevention reports that emergency room visits, a major engine for hospital admissions, fell a staggering 42% during April compared to the previous year. While ER visits improved in May, they remained 26% below the 2019 level for the comparable period.[3]

It’s unlikely these “lost” ER visits represent pent-up demand that will magically reappear at a later date. The CDC report noted much of the decline involved childhood injuries and asthma attacks, musculoskeletal injuries, non-coronavirus viral infections, and digestive and abdominal disorders. Most are passing maladies that either resolve on their own or get treated at alternative venues like urgent care facilities.

There was also a notable decline in presentations for nonspecific chest pain, heart attacks and strokes. In most cases the first won’t require follow-up care. And the most likely outcome for the others will be a regrettable increase in mortality.

Even in states where successful public health measures allow reopening safely, local healthcare facilities may encounter a very different attitude among consumers. Over the past decade, the number of people in high deductible insurance plans soared to more than 30% of the population. The shutdown has allowed them to pocket substantial savings by reducing their out-of-pocket expenses. That pattern is likely to continue as long as unemployment and fear of unemployment remain high.

The pandemic also exposed many consumers to alternative methods of accessing care like telehealth, which generates less revenue for providers. Many also learned there’s no harm in living without services they paid for in the past – like an MRI for low-back pain. Experts estimate a quarter of all healthcare services are unnecessary or very low-value care.[4]

Revenue, Expenses Misaligned

The American Hospital Association estimates hospitals lost over $200 billion during the second quarter of 2020, and project another $120 billion in losses by year-end, for a total of $320 billion.[5] That exceeds the amount of money earmarked for hospitals in the CARES Act.

If Congress fails to authorize another bailout, industry executives will confront the need for additional measures to bring expenses more in line with revenue. Livonia, Mich.-based Trinity, the nation’s seventh-largest hospital system, announced on June 29 it will keep thousands of employees on furlough and lay off an unspecified number. The system projected revenue for the fiscal year that started July 1, 2020, will fall 10% from 2019’s $19.3 billion level.[6]

During April, hospitals managed to reduce expenditures by nearly 8%, according to the Kaufman Hall survey. That came largely through nonessential-employee furloughs and sharp cuts in spending on drugs and other supplies. It wasn’t enough to bring spending in line with revenue, which fell at a 16% rate – more than twice as fast.

Physician practices are suffering dramatically larger declines in revenue. A new study in Health Affairs estimates the average primary care physician will see income decline by nearly $68,000 this year, a total loss of more than $15 billion for the sector.

Given the latest trends in COVID-19 cases, the healthcare industry could face a major financial crisis before Labor Day. The industry is already putting pressure on Congress to act. However to be successful, industry leaders need to get behind a bailout plan that can win bipartisan support on Capitol Hill. It must not only deal with providers’ immediate financial needs but advance the movement toward value-based care.

Change Should Start Now

Six former heads of the Centers for Medicare and Medicaid Services recently offered the broad outlines of such a plan. In a letter to Congressional leaders, the six, who’ve served various administrations since George H.W. Bush, called for:

- An immediate provider-aid program of $30 billion to $50 billion conditioned on participation in COVID-19 testing and tracing activities; supporting at-home care models; and taking steps to address care gaps caused by the pandemic.

- Requiring providers to expand their use of alternative payment models so that when the pandemic ends, they will continue making broader use of telehealth, flexibility in service sites and similar reforms.

- Encouraging commercial insurers and states to expand their use of alternative payment models.

That’s a bare minimum. Policymakers should consider even bolder steps that would put every provider on a path toward ending their reliance on fee-for-service medicine. The time to start the wholesale movement into value-based care is now.[7]

There are two promising models for making that shift. The first is capitated payments where providers assume downside risk for covered lives under their care. The second is putting provider organizations on guaranteed budgets, which can be adjusted annually based on a group’s individual role in a region’s healthcare economy and the need to control overall healthcare spending.

These models clearly work. CMS already uses capitated payment in its Medicare Advantage program, which now covers one in three beneficiaries. Unfortunately, most private insurer plans still make fee-for-service payments to providers. A bailout bill could mandate change.

Over 70% of Medicaid beneficiaries have their healthcare benefits managed by managed care organizations operating under capitated payment arrangements. While much of that is also still fee-for-service, about 40% of states allow their MCO contractors under section 1115 waivers to pay for services that address the social determinants of health.[8]

Maryland is the only state experimenting with global budgeting for its hospitals. It reportedly is holding up well under pandemic conditions.[9][10]

Let’s face reality. A bailout, in the end, is nothing more than a guaranteed budget that flows regardless of what services the budgeted entity provides.

While it’s unrealistic to expect providers to make wholesale change in the midst of the pandemic, the sector’s dire financial circumstances gives policymakers a unique opportunity. A new bailout bill should send a clear signal that the fee-for-service medicine era is drawing to a close.

The trick is to make it palatable to even the most reluctant providers. “Carrots rather than sticks are probably the preferred approach during a crisis,” Dr. Anand Parekh, the chief medical officer for the Bipartisan Policy Center, wrote in an email.

“Receiving bailout dollars to compensate for wasteful, overused services necessary to match an inflated cost structure should not be what public policy supports,” Parekh continued. “Some sort of requirement about how the infusion of funds supports value-driven healthcare transformation would be helpful.”

Sources:

- Paul Hughes-Cromwick, et al, “Perspective: Health Sector Spending Partially Rebounds in May but Outlook Remains Deeply Uncertain,” Altarum Institute, June 26, 2020 (https://altarum.org/news/health-sector-spending-partially-rebounds-may-outlook-remains-deeply-uncertain, accessed June 26, 2020).

- Kaufman Hall, “National Hospital Flash Report,” June 2020 (https://flashreportmember.kaufmanhall.com/executive-summary-june-2020, accessed June 26, 2020).

- Kathleen P. Hartnett, et al, “Impact of the COVID-19 Pandemic on Emergency Department Visits – United States, January 1, 2019 – May 30, 2020,” Morbidity and Mortality Weekly Report, The Centers for Disease Control and Prevention, June 12, 2020 (https://www.cdc.gov/mmwr/volumes/69/wr/mm6923e1.htm, accessed June 26, 2020).

- William H. Shrank, et al, “Waste in the US Health Care System: Estimated Costs and Potential for Savings,” JAMA Special Communication, October 7, 2019 (https://jamanetwork.com/journals/jama/fullarticle/2752664, accessed June 26, 2020).

- Brady, M. “Hospitals will take $320B hit this year, AHA says.” Modern Healthcare, June 30, 2020. (https://www.modernhealthcare.com/finance/hospitals-will-take-320b-hit-covid-19-this-year-aha-says?utm_source=modern-healthcare-daily-finance-tuesday, accessed July 1, 2020).

- Tara Bannow, “Trinity Health projects $2 billion less revenue, will lay off more staff,” Modern Healthcare, June 29, 2020 (https://www.modernhealthcare.com/providers/trinity-health-projects-2-billion-less-revenue-will-lay-more-staff, accessed June 30, 2020).

- Merrill Goozner, “End Fee-For-Service Medicine,” Modern Healthcare, June 29, 2020 (https://www.modernhealthcare.com/opinion-editorial/end-fee-service-medicine, accessed June 30).

- Karen DeSalvo and Michael Leavitt, “For an Option to Address the Social Determinants of Health, Look to Medicaid,” Health Affairs blog, July 8, 2019 (https://www.healthaffairs.org/do/10.1377/hblog20190701.764626/full/, accessed June 29, 2020).

- Mark Japinga and Mark McClellan, “Uniquely Similar: New Results from Maryland’s All-Payer Model and Paths Forward for Value-Based Care,” Milbank Quarterly Issue Brief, June 2020 (https://www.milbank.org/publications/uniquely-similar-new-results-from-marylands-all-payer-model-and-paths-forward-for-value-based-care/, accessed June 29, 2020).

- William Padula and Erin Trish, “Global budgets offer financial cushion amid the coronavirus pandemic,” Modern Healthcare, May 18, 2020 (https://www.modernhealthcare.com/opinion-editorial/global-budgets-offer-financial-cushion-amid-coronavirus-pandemic, accessed June 30, 2020).