May 21, 2019

Getting Urgent about Urgent Care: Health Systems Go Big on Retail

Historically, health systems have delivered acute care services in hospitals and ambulatory facilities. Their business models centralize care delivery in expensive settings to optimize their operations and revenue. In avoiding lower-cost, community-based services, they’ve shown little consideration for consumer access, convenience and service. That dynamic is changing.

Starting in the mid-1970s, urgent care clinics emerged and positioned themselves as a “retail” alternative for routine care delivery. Typically owned and operated by independent physicians, urgent care clinics provide walk-in, on-demand access in convenient locations at convenient hours with clear pricing. Today, urgent care both competes against and complements primary care and hospital-based emergency care by appealing to time-constrained, price-sensitive consumers.

Investors recognize the growing market need for retail care. They’re funding the growth of proven urgent care companies with strong brands, operational know-how and customer-focused business models.

These businesses require savvy operators. Barriers to entry are low but barriers to success are high. Consumers respond strongly to superior quality, convenience and value. Scale and brand create market traction quickly.

Urgent care is also becoming a critical component of health systems’ care delivery networks. Increasingly, health systems recognize their own need to reduce patient leakage and enhance value by providing more convenient care to retail-oriented consumers.

While many health systems operate owned facilities, a growing number are partnering with expert urgent care operators through joint ventures. This facilitates network expansion with limited capital investment. It also leverages the expertise of private operators in delivering efficient, consumer-friendly retail health services.

In this article, we’ll look at the forces driving this trend and the characteristics of successful partnerships.

Healthcare Grows Up

As industries mature, they naturally migrate away from highly-centralized production centers to lower-cost, more convenient locations that are closer to customers. Consider how banking shifted from imposing buildings on Main Street to small retail branches, ATMs in gas stations and total digital access. When products and services become commodities, companies learn to differentiate their offerings through brand strength, lower prices, greater convenience and enhanced customer experience.

U.S. healthcare’s “third-party” payment system disconnects health systems from those consuming their services. Consequently, health systems have not received the powerful buy-sell signals from consumers that pressure commoditizing industries to move away from highly-centralized production centers toward retail service delivery and pricing. As a result, they often deliver basic, replicable procedures in higher-cost settings with high price tags.

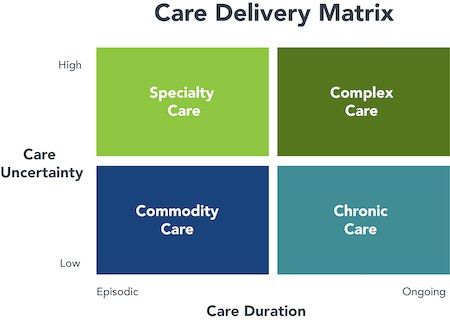

In spite of this historic tendency, the U.S. healthcare marketplace is under great pressure to change. Care services are rapidly segmenting into four distinct areas (see chart) based on care duration and care outcome uncertainty. Each segment requires a different business model to compete effectively.

Today, the majority of medical treatments are routine and subject to commoditization. Primary and non-specialty care exemplifies this evolution. With outcome certainty, consumers judge value less on quality and more on speed, convenience and service.

Commodity care is a high-volume, low-margin business. In a competitive environment, operators cannot survive by offering such services in high-cost, low-volume settings like hospitals. Consumers today are responsible for a growing portion of their healthcare spending. They demand lower-cost, more convenient treatment alternatives.

Urgent care is already a commoditized, retail business. As consumers use clinics more expansively to meet their health and healthcare needs, health systems must develop retail service offerings to remain competitive.

Health Systems’ Historic Struggle with Retail Medicine

Health systems with urgent care centers typically accumulated their facilities haphazardly through idiosyncratic investments and/or acquisitions. They often haven’t known how many facilities they owned, much less incorporated their centers into integrated networks. The market pressure is now on to develop urgent care capabilities as part of broader retail and branding strategic initiatives.

Operating urgent care networks, however, is not for the faint of heart. Most health systems lack the business sophistication to compete successfully on price, brand and customer experience in retail environments. Success requires the following attributes, which don’t come naturally to health system executives:

- Optimal locations

- Efficient operations

- Lean staffing

- Brand consistency

- Retail services

- Coordinated care delivery

- User-friendly consumer engagement

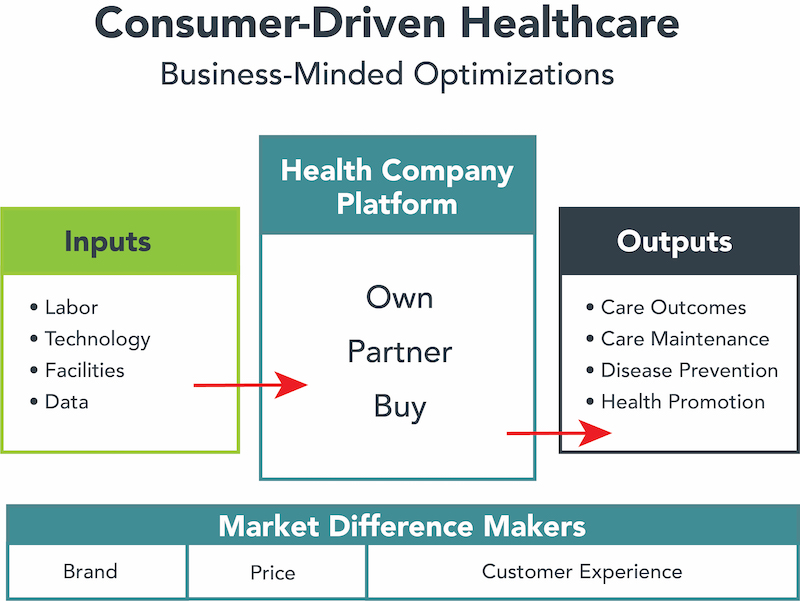

The right way for health systems to view urgent care services is as an integral piece of an overall platform (see chart) focused on outcomes, value, brand strength and customer experience.

Health systems are often best positioned by partnering with experienced retail urgent care operators. When structured properly, these strategic relationships are mutually beneficial.

The Urgent Care Advantage for Health Systems

To create win-win partnerships, health systems and urgent care operators must leverage their brand awareness in local markets; enhance operational efficiency; integrate clinically; and achieve scale.

Health systems have traditionally relied on ERs as access points for primary and non-acute services. This impedes service and quality by clogging up capacity, driving up costs, and frustrating consumers.

Sixty percent of ER visits are actually for urgent or semi-urgent conditions that are treatable in less-costly settings. Consumers are increasingly using urgent care centers for their care needs. These clinics provide convenient and timely access to care services that consumers need and want.

Today, there are nearly 9,000 urgent care clinics in the U.S. They offer the following attributes to price- and service-conscious consumers:

- Accessible, retail locations

- Convenient hours

- Walk-in or “reserve your spot” availability

- Shorter wait times

- High-value care

Health systems are playing catch-up. The following four case studies illustrate urgent care’s potential to advance retail medicine through strategic partnerships. Together, the partners can build market presence and withstand competition from well-funded rivals.

System Led: The Trinity Approach

Trinity Health is a not-for-profit Catholic health system based in Livonia, Michigan that operates 94 hospitals in over 20 distinct markets. To deliver population-based care tailored to individual consumer needs, Trinity has divided into three distinct service lines:

- Transactions

- Population health

- Community well-being

This reorganization is part of their thoughtful plan to coordinate care delivery and manage financial risk by delivering the right care to consumers at the right time, place and price. Trinity wants to be proactive in promoting health and diagnosing and treating illnesses, particularly chronic diseases.

In line with this strategy, Trinity conducted a facility inventory to better categorize its urgent care assets. This analysis revealed that Trinity operated 63 urgent care clinics of two distinct types.

- “Box within a box” facilities that operate inside primary care offices.

- Stand-alone urgent care centers.

Distribution of such centers was indiscriminate, so Trinity developed a proprietary, data-driven methodology for identifying ideal center locations. Going forward, the system plans to make substantial urgent care investments in all its markets either by internally developing new centers or by partnering with independent urgent care companies.

Trinity also has identified a half dozen unique patient profiles that are critical to understanding the specific retail needs of consumers. It is using these profiles to inform the design, service offerings and operations of its retail facilities. As Mike Englehart, SVP of medical groups and ambulatory strategy, notes, “Our customers are not numbers. Trinity wants to conduct population health at the person level.”

For example, “Willful Endurers” (WEs), representing 10 to 25% of Trinity’s consumers, are the most prevalent users of urgent care. WEs tend to wait until the last minute to receive care. They value convenience and are open to new models of care delivery. Serving WEs successfully is vital to Trinity’s growth and long-term sustainability.

A Family of Brands: Urgent Team

Urgent Team is a leading provider of urgent and family care in the Mid-south with 51 locations in Arkansas, Mississippi and Tennessee, Alabama and north Georgia, all within a day’s drive from their Nashville home offices.

Through earlier acquisitions, new centers in distinct markets, and a joint venture partnership, Urgent Team operates four distinct brands: Urgent Team, Physicians Care, Sherwood Urgent Care, and Baptist Health Urgent Care. The company is in the process of operating 65 centers by year-end. Management employs algorithms to identify suitable markets. Sites are up and running within six months.

The company’s executive leadership team has significant experience scaling and operating health care companies. Urgent Team is continuing to pursue joint-venture strategic partnerships with leading regional health systems to locate and operate efficient, high-volume centers in underserved rural and ex-urban markets. The company operates lean, with a mid-level staffing model in which physicians supervise mid-level providers, including physician assistants and nurse practitioners.

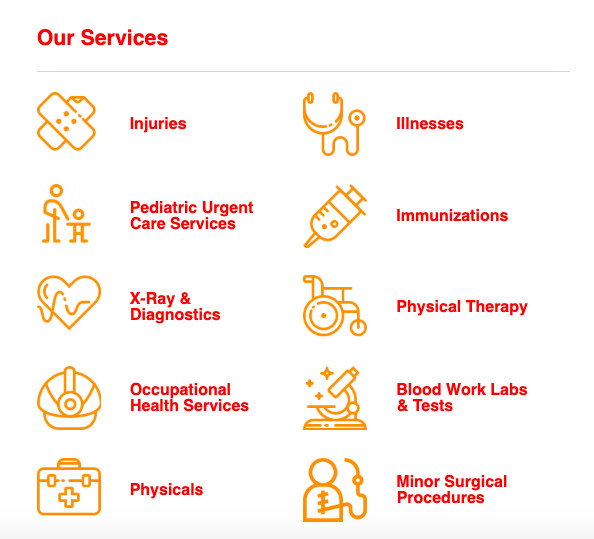

Urgent Team centers offer a continuum of services including urgent care, primary care, and occupational health. Consumers access services on a walk-in basis or through an online scheduling tool, Hold My Spot™. The company’s marketing campaigns target women ages 24-55, who are the primary healthcare decision makers for their families.

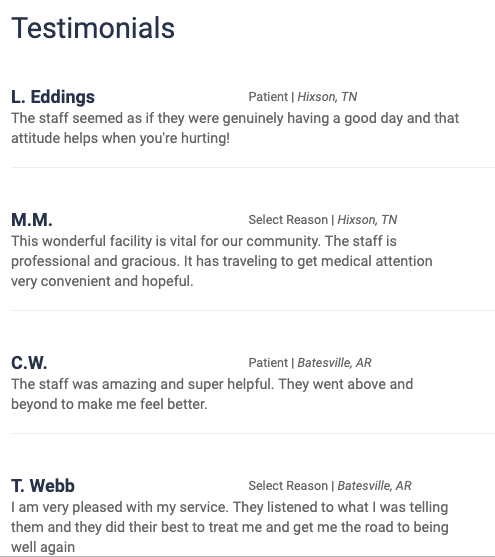

Consistent high quality, customer experiences are essential to the company’s ongoing success. As Chairman and CEO Tom Dent observes, “People want the same experiences from healthcare they get from other retail shopping experiences – convenience, easy access, and reliability. We’re turning the patient experience into a customer experience.”

Urgent Team relentlessly uses net promoter scores (NPS) to evaluate customer satisfaction at each retail location. Team members receive daily NPS updates and strive to achieve monthly scores in the mid-to-high 70s. Recognizing how today’s consumers learn about and evaluate businesses, leadership also pays close attention to online ratings, such as Google star ratings.

Strong Growth: Physicians Immediate Care

Physicians Immediate Care (“PIC”) is among the nation’s largest urgent care companies and the largest in metropolitan Chicago. Founded in 1987, PIC operates 43 clinics focused on urgent care and occupational health services. The leadership team brings deep retail management expertise from their experience at Walgreens.

PIC is an analytics-driven organization. It uses data to make its staffing, site location and marketing decisions. It also uses analytics to measure outcomes and continuously improve processes.

Like Urgent Team, PIC uses highly-targeted customer profiles. This enables them to understand the needs and behaviors of urgent care consumers and the unique conditions of local markets. It targets its marketing accordingly.

PIC’s management emphasizes patient experience and believes wait times drive patient satisfaction. To reduce wait times, PIC runs a user friendly website that facilitates online appointment booking. Clinics offer a comfortable and inviting environment.

Four years ago, PIC transitioned from operating independent centers to partnering with health systems on retail care delivery. This change in strategic direction has fueled the organization’s rapid growth. Today, PIC has six health system partners.

PIC is expert at helping health systems develop, reposition and/or operate urgent care clinics. Aligning interests and maintaining operating control are essential to their health system partnerships. PIC is the managing partner for each JV and owns a controlling partnership interest. This structure enables PIC to deliver superior performance in their partners’ strategically important but often underserved service segments.

As CEO Stan Blaylock notes, “We want our health system partners to make us part of their family. We embrace each other’s offerings and coordinate care collaboratively to reduce excess costs and take care of patients seamlessly. We keep patients within their system by giving them a good experience through convenient locations, great service and centralized coordination of any necessary additional care. I like to say, we’re the tail wagging the dog, but every dog needs a tail.”

Going for Gold: GoHealth Urgent Care

GoHealth was launched in 2014 with five independent locations in Portland, Oregon. From the beginning, it was built to partner in deeply-integrated joint ventures focused on revolutionizing how consumers access and experience healthcare.

GoHealth launched its urgent care partnership model with Northwell Health in Long Island with the intention to build more than 50 New York locations in 3-4 years. Today, just 4+ years later, GoHealth has achieved the fastest growth in the industry by opening more than 125 urgent care centers (including 50+ in New York) in large-scale joint ventures with prominent and progressive health systems. It is the largest partnership-based urgent care company in the U.S.

GoHealth’s partnership model leverages the benefits of a true 50-50 JV arrangement, including prominent co-branding with its health system partners. All of GoHealth’s centers are seamlessly integrated with its partners’ clinical operations and electronic medical record systems.

For patients, this integration increases the quality of care, reduces confusion, speeds care delivery by improving access and enables frictionless same-day and next-day referrals to specialists that cuts weeks off wait times.

CEO Todd Latz observes, “Urgent care is at the intersection between healthcare and retail. We have the opportunity to demonstrate how a partnership-focused retail business with healthcare services as its product can continually raise the bar for consumer experiences.”

GoHealth’s award-winning center design enhances workflow and patient experience. Its use of online check-in and preregistration puts the power back in consumers’ hands while also helping to streamline and optimize staffing. GoHealth’s digital technology and in-center innovation allows practitioners to operate at the top of their license, focusing on listening and shared understanding with patients to improve engagement.

“Experience is the new currency in healthcare,” says Latz. He recognizes that there are no “switching costs” in urgent care and consumers have many retail care choices. “We need to earn their loyalty with every encounter by exceeding their expectations.” GoHealth has proven that they can do just that, with outstanding net promoter scores across the country that consistently hit the mid 80s to low 90s.

While most urgent care models focus on episodic care delivery, GoHealth sees significant opportunities in moving into population health. It is positioning itself to become the “front door” for its health system partners as they move from volume- to value-based care and establish a compelling value proposition for the new wave of educated healthcare consumers.

Conclusion: Urgent Care Delivers for Consumers

Leading health companies understand their strengths (why customers “hire” them) and the risks they should own. They relinquish control to strategic partners who add value and generate better outcomes. An unrelenting drive to achieve competitive advantage is the mechanism through which successful companies evaluate and make effective resource-allocation decisions.

As consumerism advances in healthcare, the movement toward platform service models will accelerate. Health organizations will reorganize to deliver better, more convenient healthcare services at lower costs. Fulfilling customer priorities will fuel innovation and value creation.

Urgent care clinics are an essential component of retail healthcare and holistic, high-functioning delivery platforms. With consumerism rising, health systems must develop retail muscle to remain competitive. Urgently pursuing urgent care delivery with seasoned partners is a proven strategy for leveraging brand strength and winning consumer loyalty.

Wyatt and Dave discuss this topic in an episode of the Cain Brothers House Calls podcast. Find all episodes of House Calls here.

Co-Author

Wyatt Ritchie, Managing Director, Cain Brothers, is a senior banker focusing on Post-Acute Care and Outsourced Services. Mr. Ritchie joined Cain Brothers in 2010 with 23 years’ experience advising public and private companies in merger and acquisition, capital raising, and strategic advisory transactions. His recent transactions include the refinancing of senior and subordinated debt for American Surgical Professionals, the sale of Centerre Healthcare to Kindred Healthcare.

Prior to joining Cain Brothers, Mr. Ritchie was at Jefferies & Company, responsible for that firm’s healthcare services practice. Prior to joining Jefferies, Mr. Ritchie was at CIBC Oppenheimer for eight years where he was responsible for that firm’s West Coast healthcare services investment banking practice, and at Bank of America, where he was responsible for Bank of America’s healthcare leverage finance business. Mr. Ritchie earned BA in Economics from St. Olaf College and an MBA in Finance from the University of Chicago.