October 7, 2021

Health Literacy: Assembly Required

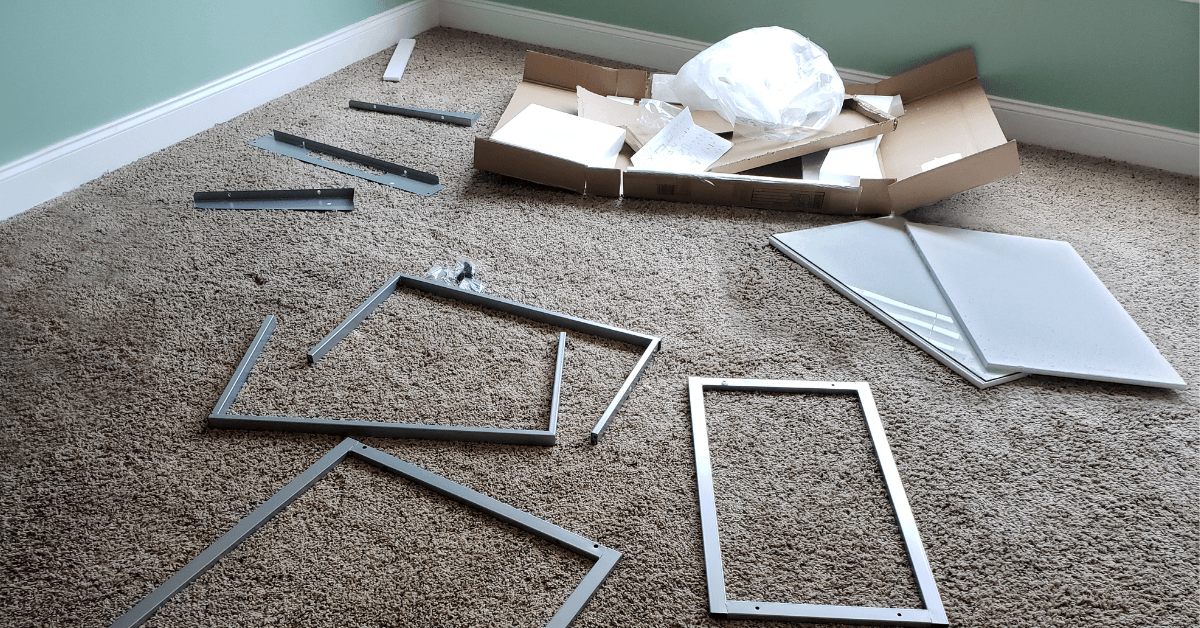

When you buy anything that you have to put together yourself—from an Elfa closet system from The Container Store or a Weber gas grill from Home Depot—the instructions are the same. Unpack all the contents in the box. Familiarize yourself with all the parts. Read all the instructions carefully before starting assembly.

But if you’re like most of us, you take a liberal interpretation of those opening admonitions. You unpack a few things from the box. You look at a few parts. You go right to Step 1 and start assembly before you read to the end. You really don’t have a full understanding of the process until your spouse notices that one shelf in your new IKEA bookshelf is backwards with the rough edge facing out and the finished edge facing the wall.

This, unfortunately, is the same approach that most people take to understanding their health benefits. They probably know their carrier. They generally know how much their paying a month in premiums for their benefits. They kind of know what their benefits cover. But they don’t have a full understanding of their benefits until they need something or something awful happens that’s worse than a backward shelf in a bookcase.

The liberal approach most people take to knowing their health benefits didn’t occur to me until we taped the Sept. 24 episode of our weekly 4sight Friday Roundup podcast, “Are Employer and Employee Health Benefits Falling In Line?” which you can listen to here. With the 2022 open enrollment season upon us, we compared the health benefits that employees say they want next year with the health benefits that employers say they’ll offer next year.

Toward the end of our conversation, our two regular experts on the show, David Johnson, CEO of 4sight Health, and Julie Murchinson, a partner at Transformation Capital, raised two interesting points. If employers offer the benefits that employees want in 2022, would employees even know? And whose responsibility is it to make sure employees understand their benefits, employees or employers?

Not knowing, which we often refer to as health literacy, is a growing problem in the U.S., and it’s costing both employees and employers more money. That’s at least according to three new reports.

Just so we’re all on the same page, the authors or sponsors of the three reports have a financial interest in improving health literacy. They want to convince you things are bad out there and to buy what they’re selling. Two sell consulting services to commercial health insurance companies, and one is a commercial health insurer that would save money if their members knew their own benefits. Still, I think that what they found is noteworthy, and doing what’s right for customers is good business.

Overuse of hospital emergency rooms

Accenture released the first report, “The rising cost of healthcare system complexity,” last month, and you can download the 17-pager here.

Accenture developed a healthcare system literacy index that buckets people into four categories based on their level of knowledge and understanding of health benefits terms such as premiums, deductibles, copays, coinsurance, prior authorization, in-network and out-of-network providers and more. The four categories were: No experience; novice; proficient; and expert.

Accenture then surveyed more than 12,000 consumers on their experiences with health insurers in nine different performance areas and teased their responses out by their health literacy level.

Overall, Accenture said 61 percent of the respondents suffered from low healthcare system literacy (no experience or novices) when it came to their knowledge and understanding of common health benefits terms. That’s up from 52 percent from a similar survey Accenture conducted four years ago in 2017.

Accenture also found significant differences between people with low healthcare system literacy and those with high healthcare system literacy (proficient and expert). Of the consumers with low literacy:

- 15 percent said their insurer “fails to provide the necessary information to find a new doctor or specialist when I need one” compared with 12 percent with high literacy.

- 14 percent with chronic medical conditions said they went to the emergency room in the past year compared with 7 percent of high-literacy consumers with chronic medical conditions.

- 9 percent said they are “not able to use the method I choose (online, mobile, phone call, etc.) to find a doctor” compared with 5 percent with high literacy.

Accenture said that by using ERs instead of less intensive and costly providers for their chronic medical conditions people with low literacy cost the healthcare system an extra $47 billion each year.

Learning health benefits on the streets

Also last month, DirectPath released the results of its health literacy survey of more than 1,000 people with employer-sponsored health insurance. You can download the survey results here.

Like Accenture, DirectPath described the health literacy level of most commercially insured consumers as low, since less than half of the respondents said they don’t understand terms like coinsurance or allowed amount. But what’s interesting about the DirectPath survey is where the respondents said they got their health benefits information.

Like those of us who were deathly afraid to ask their parents about the birds and the bees or who had parents who were just as afraid to tell their kids about the birds and the bees, many of these consumers said got their health benefits education on the “street.” For example:

- 34 percent said they educated themselves online.

- 14 percent said they talked to a friend, acquaintance or coworker.

- 5 percent said no one, and they didn’t even try.

- 5 percent said a teacher.

Only 37 percent said they consulted a member of their employer’s human resources department to get health benefits information.

Further, most employees said they didn’t take advantage of the benefits resources and education that were available to them through their employers. For example:

- 41 percent of the respondents said their employers sent them health benefits information by email, but only 28 percent said they read them.

- 39 percent said their employers offered a health benefits presentation or group session with HR, but only 27 percent said they went.

- 28 percent said their employers offered one-on-one health benefits sessions with HR, but only 19 percent said they met individually with HR.

Staying out of the hospital

Finally, earlier this month, UnitedHealthcare released a two-page report on health literacy that you can download here.

Crunching data from a variety of sources, including CMS, the Robert Wood Johnson Foundation and the Census Bureau, United calculated a health literacy level for every county in the U.S. Then it compared the counties with the highest health literacy levels with the counties with the lowest health literacy levels on six different outcomes for Medicare beneficiaries. Beneficiaries in the counties with the highest health literacy levels had:

- 31 percent more flu shots.

- 26 percent fewer avoidable hospitalizations.

- 18 percent fewer ER visits.

- 13 percent lower costs per beneficiary.

- 9 percent fewer hospital readmissions.

All told, improving the health literacy of Medicare beneficiaries could save the Medicare program more than $25 billion a year, United said.

Collectively, the three reports draw a direct line between low health literacy and overuse and misuse of the healthcare system that’s costing everyone a lot of money. Each report also outlined solutions to the problem. Accenture, for example, recommended simplifying health insurance products. DirectPath said employers should invest more in benefits educators and advocacy services. United suggested the use of videos and other visuals to support consumer understanding of their health benefits.

None of the recommended solutions, though, guarantee that members will know their health benefits and use them wisely, just like there’s no guarantee that people will read the owner’s manual before they start their new lawn mower.

I think people should be required to pass a health literacy test before an employer activates their health benefits. Nothing that would stump an actuary but something simple like knowing what’s covered and what’s not covered, what copays are for different services, who’s in network and who’s out of network.

If we expect people to become good healthcare consumers, it’s our responsibility to teach them how to use the healthcare system effectively.

Thanks for reading.