November 15, 2022

Health Systems’ ESG Imperative: Making Cost-Effective Investments To Advance Well-Being

Health systems confront many big challenges. Environmental, Social and Governance (ESG) criteria is a major one that doesn’t get enough attention. Its time has come.

If U.S. healthcare were a nation, it would rank 13th in the world for greenhouse gas emissions. [1] Healthcare accounts for approximately 10% of the nation’s greenhouse gases which, in turn, contribute to 98,000 annual deaths. [2] For health systems, this inconvenient truth compromises their ability to advance population health, community well-being and health equity. Healthcare without health is a recipe for societal decline. ESG investments put more health into healthcare.

ESG’s three components interconnect with one another as a set of standards and practices that shape an organization’s environmental and societal impact. The bad news is that health systems’ deficiencies in meeting these criteria comes with significant financial and societal costs. The good news is that strategic remedies for these deficiencies generate high returns, optimize efficiencies, promote population health and enhance brand strength.

Across industries as diverse as transportation, hospitality, apparel and technology, companies are incorporating ESG practices not only to become better corporate citizens but also because it’s good business. Health systems are just beginning to grasp ESG’s potential.

In October 2022, CREF, (Global Corporate Real Estate and Facilities), convened a first-of-its-kind assembly of thought leaders, CEOs, environmental experts and stakeholders to discuss ESG’s significance to the healthcare industry. Participants included senior representatives from large health systems, government agencies, banking, private equity, venture capital, real estate development, construction, consultancies, green-tech companies and entrepreneurial startups.

These leaders share an urgent commitment to addressing healthcare’s ESG challenges along with the belief that progress begins by implementing practical solutions. Executed properly, ESG investments can cost-effectively improve environmental sustainability while redesigning operations to promote value-based care delivery and better community health.

The participants also recognize that the healthcare industry is changing fast. New regulations, evolving business priorities and expanded funding sources make this an opportune time to make ESG investments. By doing so, health systems can control their ESG destiny. This won’t be true forever.

If Not Now…

As with other technological and organizational advances, the healthcare industry has lagged other industries in embracing ESG criteria. Continuing to do so is a strategic mistake.

Regulatory changes are coming. Just as health-equity and social-determinant scoring influence Medicare payment rates today, ESG performance scoring is likely to become a factor in future Medicare payment. ESG scores and reputation also will influence health-system brand strength and relationships with communities, suppliers and business partners.

Health systems that adopt ESG strategies will differentiate and outperform their competitors. Those that don’t will appear hypocritical by continuing to pollute the environment while promoting community-wide health and well-being.

At the CREF Summit, former U.S. Representative and the current Managing Director of Citizen’s Energy Joseph Kennedy III emphasized the compelling need for health systems to align their operations with their corporate missions through enlightened ESG practices.

Patients don’t think about environmental standards when they visit a hospital. And, from a business perspective, administrators might be concerned first and foremost with how they keep costs down and turn to the cheapest forms of procurement. But if your mission is health, then as a healthcare institution, whether a hospital or a health insurance company or a health center or whatever else, then your interactions with the greater community have a health impact as well.

Here are the practical questions health system leaders have to ask of their organizations as they square their operations with their missions: Do we turn to a diesel generator or a micro-grid to lower the cost of the electric bill? Do we use more efficient filtration systems to capture carbon rather than emit it? Can we use laundry services that are just as hygienic but use less hot water? How do we dispose of toxic waste in a safe, environmentally responsible manner? Most importantly, can we look at all these approaches as part of a competitive advantage and lead with them because they are effective and because they are right?

Kennedy is right. With the right framework, partners and strategies, health systems can initiate proactive ESG initiatives that generate immediate financial savings. Even better, these solutions can create significant incremental improvements on other strategic priorities, including care-delivery optimization, population health and health equity.

At the CREF Summit, David Shore, Senior Scientist at the Environmental Health and Engineering Agency, summarized the ESG healthcare opportunity succinctly: “Welcome to the great reset.”

Healthcare has a new imperative. It’s time for health systems to embrace ESG criteria, make ESG investments and improve their social impact.

ESG’s Interwoven Complexities

The ESG movement has its origins in hard-headed finance. During the early 2000s, the principles underlying ESG emerged as progressive investors developed criteria to allocate funding to prospective portfolio companies. They believed that investment dollars could reward businesses that do well (financially) by doing good (socially and environmentally).

The ESG movement has its origins in hard-headed finance. During the early 2000s, the principles underlying ESG emerged as progressive investors developed criteria to allocate funding to prospective portfolio companies. They believed that investment dollars could reward businesses that do well (financially) by doing good (socially and environmentally).

At its core, ESG solves network problems. Businesses, governments and community-based organizations need one another to achieve social impact at scale. Health systems are well positioned to collaborate with like-minded partners and lead community-wide efforts to promote environmental sustainability, equity and well-being.

Not everyone embraces ESG. Companies that struggle to meet ESG criteria often criticize the movement as “stakeholder capitalism.” Florida, Texas and other states have banned the use of ESG criteria by state pension fund managers. [3] Attorneys general in 19 states recently signed a letter accusing BlackRock, the largest ESG-promoting fund with $8.5 trillion in assets under management, of violating its fiduciary duties by pursuing a social/political agenda at the expense of financial returns. [4]

At heart, these attacks are political, not economic. The embrace of ESG practices has been widespread and notable. 96% of the world’s 250 largest companies publish ESG reports. ESG investment funds have achieved popularity and financial success, outperforming standard fund averages. [5]

Within most publicly traded companies, ESG frameworks are becoming meaningful and durable. Companies with high ESG scores have lower capital costs by as much as 10%. [6] [7] McKinsey has found that corporate ESG investment stimulates top-line growth, cost reduction, financial and regulatory risk reduction, improved productivity and asset optimization. [8]

Relative to other industries, healthcare has more to gain from ESG investments because its incumbents are under pressure to transform inefficient and ineffective business practices that harm patients and burden caregivers. For example, the vaunted Quintuple Aim strives to improve population health, enhance patient experience, reduce costs, address clinician burnout and promote health equity.

ESG solutions advance each of these essential aims. Healthy environments reduce harm, promote diversity, create holistic working environments, stimulate innovation and reward efficiency. Simply put, an effective ESG strategy helps health systems fulfill their societal missions while also improving their margins.

Start With E

Without addressing their massive carbon footprints, health systems cannot be credible advocates for health equity and population health. Joe McCannon, Senior Advisor on Climate Health & Equity, Department of Health & Human Services, made this point powerfully at the CREF Summit. McCannon referenced findings contained in a 2021 New England Journal of Medicine editorial to emphasize ESG’s contribution to improving health equity. [9] [10]

Climate change is broadly viewed as the largest threat to global public health. And the populations that are suffering most as a result of climate change and its impacts are the most vulnerable communities.

ESG’s “Environmental” criteria incorporates facility improvement, new technologies, process optimization and enhanced logistics. Hospitals are major sources of greenhouse gas emissions, toxic waste and other pollutants. Most operate with aging facilities badly in need of improvements to save energy and reduce greenhouse gas emissions. Reducing environmental harm through innovative ESG frameworks creates a healthier and more efficient workplace that operates at lower costs.

Given the scope of energy-related challenges hospitals confront and the proven solutions for addressing them, it makes sense to launch ESG programming at hospitals by first attacking the “E” in ESG to gain early, visible wins. This requires a comprehensive approach to energy management and reductions in all three categories of harmful emissions.

Scope 1 emissions are those produced by the health system, particularly through facility operations, on-site electricity use, heating, technology and some medical gases. Scope 2 emissions come from the generation and delivery of energy procured by the health system for electricity. Scope 3 emissions include those produced in transportation (by employees, patients, and suppliers), and emissions from the production and distribution of pharmaceuticals, medical equipment, food, etc.

No organization has direct control over all three scopes. Yet publicly traded companies are increasingly accountable for reporting their carbon footprints. The SEC’s proposed rules on ESG disclosures will reinforce that trend. [11] This reality shapes an array of business decisions related to sourcing, partnerships, vendors and service delivery.

Dr. Lindsey Butler, Director of Climate and Health Resilience for Blue Cross Blue Shield of Massachusetts, acknowledged her organization’s responsibility for contracting with progressive ESG partners.

As a payer, our environmental footprint is actually quite small in the grand scheme of the healthcare sector. But we’re thinking about what the payer’s role is in pushing the rest of the healthcare system to start addressing their emissions?

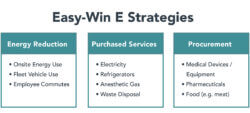

Health systems have numerous ways to improve their environmental sustainability across energy sourcing, facility optimization, construction, transportation and care delivery. For health systems, initial E strategies with the highest likelihood of success focus on controllable operating functions that are easy to track. As the following chart details, these “easy-win” E strategies focus on energy reduction, purchased services and procurement.

These “E” strategies are well-understood and proven. Health systems can incorporate these investments within well-defined operational units, including facility management, procurement and finance.

As a leader in ESG building management for healthcare companies, CREF has developed and managed energy-optimization programs in multiple U.S. markets. Examples of successful CREF programs for large hospitals and health systems include equipment replacement (projected 15-year savings totaling $16.4 million); HVAC efficiency enhancement (annual energy savings of $2.8 million per year); and LED enhancements (annual energy savings of $2.7 million per year).

In each of these examples, energy savings more than cover upfront capital costs while improving environmental sustainability. That’s a major win-win investment scenario.

E investments, however, are not the end of the story. E’s successes set the stage for subsequent investments that improve Social and Governance criteria. Ruben King-Shaw, EVP and Chief Strategy Officer at Steward Health Care, explains how the interplay among Steward’s ESG investments creates value for its communities.

Our strategy is really focused on community-based care and community hospitals. Disproportionately, these are moderate income hospitals and moderate-income neighborhoods that are largely populated by black and brown people. And our workforce reflects the communities that we serve. So we literally are black and brown people serving black and brown people to deliver high quality, culturally competent, accessible care at a sustainable cost.

When asking how to make the business case for ESG investments, the answer is easy. There is no possible way that we can deliver on our mission without ESG. We can’t be sustainable, we can’t be culturally competent, we can’t be connected to the communities that we serve without it.

Conclusion: It Takes An Ecosystem

As with other major change initiatives, healthcare leaders face a choice regarding ESG investments: go forward now or wait. The clock is ticking. Regulatory, market and reputational forces are pushing U.S. corporations to become more socially responsible. A proliferation of new consulting firms and technology applications have emerged to identify, monitor and report ESG performance at America’s largest companies.

As with other major change initiatives, healthcare leaders face a choice regarding ESG investments: go forward now or wait. The clock is ticking. Regulatory, market and reputational forces are pushing U.S. corporations to become more socially responsible. A proliferation of new consulting firms and technology applications have emerged to identify, monitor and report ESG performance at America’s largest companies.

Healthcare will not be able to duck its ESG responsibilities forever. The industry comprises 20% of the U.S. economy and produces 10% of its greenhouse gases. Its facilities are old and inefficient. Fortunately, health systems have a once-in-a-generation opportunity to shore up their finances, optimize their operations and improve community well-being through enlightened ESG investments. Rarely have mission and margin been so intertwined.

It’s time to move on ESG strategy. Governments and private foundations increasingly fund environmental improvements through grants and/or tax credits. The Inflation Reduction Act of 2022 allocates $370 billion for clean-tech investment. Innovative green vendors are ready to help. These type of E investments offer early wins and positive returns. Both are important to building and sustaining ESG programs. Senior HHS Advisor McCannon reinforces this point.

The opportunities are there for healthcare facilities to make investments in efficiency and resilience. There are tax deductions, tax credits, grant money, technical assistance programs and pools of funding available at the state and regional level that allow for significant upfront investment in infrastructure and energy efficiency projects. And we’re also excited that there are incentives in place to actually focus on the most vulnerable populations.

The only remaining question is how best to start. Health systems typically own their facilities and control their operations. This explains, in part, why the healthcare industry has lagged in its adoption of innovative technologies and business practices. In today’s dynamic marketplace, health systems require strategic partners to achieve competitive advantage. Dr. Lindsey Butler emphasizes that health systems need to find external partners to progress on ESG priorities.

System problems require ecosystem solutions. You cannot have these conversations with just the payer and the provider in the room. You have to break down the silos by also talking to the facilities team and the real estate developer and the custodians and the financers, and so on.

Health systems cannot achieve ESG transformation on their own. Systemic solutions for energy procurement, infrastructure maintenance and green facility construction require trusted partners with capital, expertise and experience. America needs its health systems to expand their role and leadership in advancing ESG priorities. Health systems need strategic partners to make that happen.

Sources

- https://www.reuters.com/article/us-health-hospitals-pollution/hidden-harm-us-healthcare-emits-more-greenhouse-gas-than-entire-uk-idUSKCN0Z82FR

- https://www.healthcarefinancenews.com/news/healthcare-gas-emissions-responsible-10-national-emissions-98000-deaths-annually

- https://www.wsj.com/articles/esg-backlash-at-odds-with-shift-by-companies-and-investors-11661825320

- https://www.wsj.com/articles/esg-cant-square-with-fiduciary-duty-blackrock-vanguard-state-stree-the-big-three-violations-china-conflict-of-interest-investors-11662496552

- https://www.spglobal.com/marketintelligence/en/news-insights/blog/global-ma-by-the-numbers-q3-2022

- https://www.forbes.com/sites/rrapier/2021/08/25/the-cost-of-ignoring-esg/

- https://www.safetystratus.com/blog/gri-the-blueprint-for-sustainability-reporting/

- https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx

- https://www.nejm.org/doi/full/10.1056/NEJMe2113200

- https://www.npr.org/2021/09/07/1034670549/climate-change-is-the-greatest-threat-to-public-health-top-medical-journals-warn#:~:text=The%20rapidly% 20warming%20climate%20is,will%20be%20impossible%20to%20reverse.%22

- https://news.bloomberglaw.com/securities-law/recent-sec-enforcement-hints-at-looming-crackdown-on-esg-claims