November 29, 2017

Honey vs. Vinegar: Value-Based Pricing Wins Customers and Market-Share

Common wisdom holds that “it’s easier to catch flies with honey than vinegar.” That aphorism also applies to payers seeking lower prices for routine healthcare procedures. It “tastes” better when providers attract new customers with “bottom-up” high-value services than when payers hammer providers through “top-down” payment reform.

In competitive markets, consumers reward companies that offer high-value products and services, but that doesn’t often happen in healthcare. Instead, healthcare consumers tolerate high pricing variation for routine services, even when “transparency tools” would save them money.

Consequently, some commercial and governmental payers achieve lower prices through top-down payment reform. Like flies fleeing vinegar, this approach repels providers and does little to attract customers. Success is often short-term as providers maneuver to offset losses through revenue optimization strategies.

Enlightened providers, however, can attract new customers through lower prices and great customer service. This approach delights payers and patients alike. Honey wins. Market-based competition reconfigures supply-demand relationships, shifts market share, and allocates resources more effectively.

Consumers with a taste for healthcare honey will become value-seeking machines who reward companies that deliver what they want when they need it.

Hayek Speaks and Markets Move

The “honey vs. vinegar” pricing debate is not new. Post World War II, policy makers debated whether centrally-managed or free-market economies offered the better alternative for wealth creation and societal advancement.

Europe was still in ruins and memories of the Great Depression were fresh. Fascism and communism offered logical responses to unbridled capitalism. Many scholars believed a planned economy, often termed market socialism, could allocate societal resources more equitably and efficiently.

Friedrich Hayek, winner of the 1977 Nobel Memorial Prize in Economic Sciences, explained the pitfalls of top-down planning in his seminal paper, “The Use of Knowledge in Society.”[1]

Born in Vienna in 1899, Hayek was a leading mid-century economist who championed liberal democracy and free-market capitalism, taught at the University of Chicago and debated socialist theorists on markets, social planning and government’s role in the economy.

Hayek maintained that markets and competition were the best mechanisms for calculating and coordinating economic choice. He believed that prices contain sufficient information to guide and adjust economic decisions. To Hayek, the decentralized decisions that individuals and companies make around pricing leads to more efficient resource allocation and wealth generation.

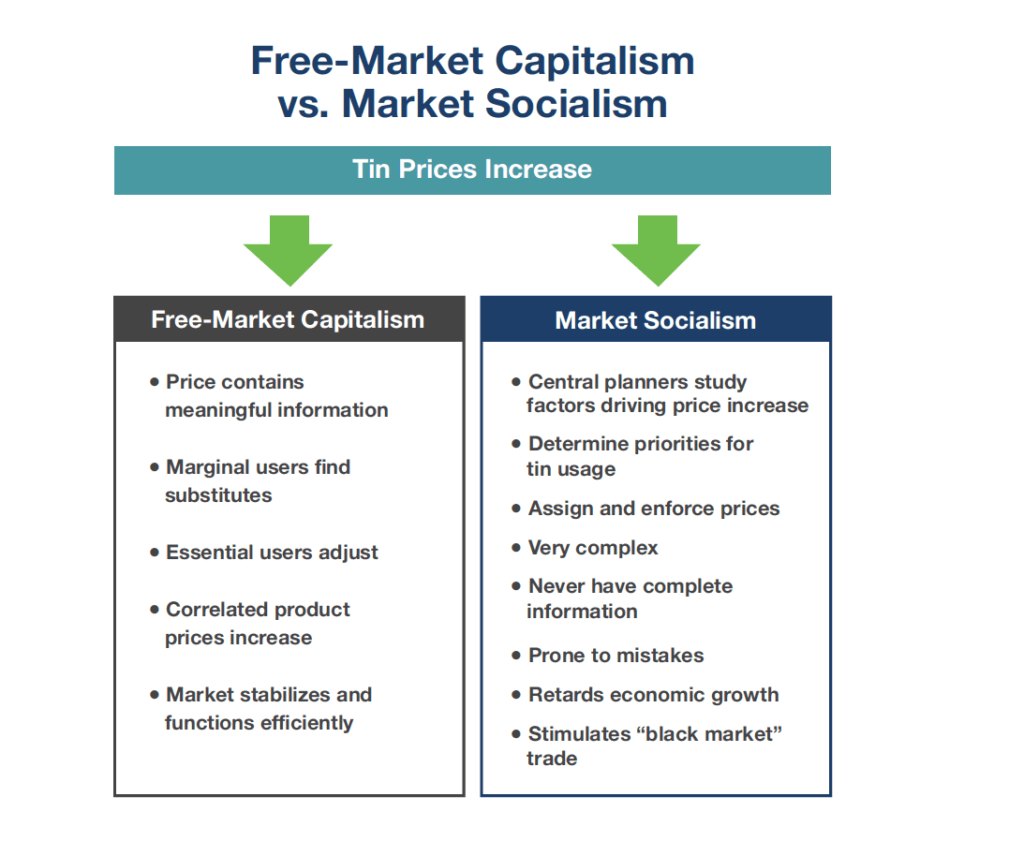

To illustrate, Hayek contrasted how free-market enterprise and market socialism respond to increasing tin prices (see chart below).

In a free-market characterized by decentralized planning, primary and marginal users of tin listen to prices and adjust consumption accordingly. In response, manufacturers substitute materials, improve production mechanics and/or adjust prices. The cycle repeats until the market stabilizes.

In contrast, centralized planning requires complex protocols to determine why the price of tin increased, establish priorities for its use, assign prices and enforce market acceptance. Before long, complexity overwhelms managerial capabilities and it becomes easy to make mistakes and create imbalances in supply and demand. The marketplace ends up with too many tin cups and not enough tin cans.

Despite global success with free-market capitalism, the U.S. government relies largely on centralized planning through the Center for Medicare and Medicaid Services (CMS) to design, administer and police healthcare services. This has created enormous distortions across healthcare’s vast array of supply/demand relationships.

Notably, Hayek—one of the “godfathers” of free market principles—had no philosophical problem with universal coverage. As he wrote, “… the case for the state helping to organize a comprehensive system of social insurance is very strong.” Rather, it was the means of making planning decisions that concerned him.

Market-driven reforms that deliver better outcomes, lower costs and better customer service demonstrate how capitalism can generate greater value for consumers in healthcare. Companies innovate and improve services to attract more customers and beat competitors.

Honey vs. Vinegar in The Commercial Market: Honey Wins

Commercial payers alternatively employ top-down payment policies and bottom-up payment incentives to shift patient volume to lower-cost, higher-value treatment centers.

In a textbook “vinegar” move, Anthem announced in late August that it will no longer pay for MRIs and CT scans performed in hospitals (unless medically necessary) on an outpatient basis.[2] This will require physicians to direct patients to lower-cost, free-standing imaging centers for MRIs and CT scans. Time will tell if other payers adopt equivalent policies.

Anthem’s reimbursement shift attacks high hospital imaging costs in a blunt, top-down manner. Hospital organizations were quick to respond, claiming that Anthem’s new imaging payment policy will harm physician-patient relations, fragment delivery and increase bureaucracy.

Brian Tabor, the president of the Indiana Hospital Association, noted that Anthem’s new policy will increase appeals for denied imaging services. Emphasizing this point, Tabor lamented that “a physician’s time is being taken away from patient care and refocused on claims adjudication, and that’s not good for our healthcare system.”[3]

Vinegar tastes bitter. The Anthem policy change pits health insurers against hospitals in a divisive payment battle. While hospitals can and will fight to maintain off-market prices for imaging services, the widespread availability and convenience of free-standing centers is shifting the market toward lower, more consistent price points for routine MRIs and CT scans.

In contrast, Smart Choice MRI uses honey.[4] The Chicago-based service provider offers every MRI for $600 or less at convenient, high-touch centers. The $600 price includes a second read from the Cleveland Clinic.

The average MRI price nationwide is $2600.[5] Smart Choice has no hidden fees, tells customers their costs up-front and works with health insurers to ease the paperwork burden.

Smart Choice MRI is an example of how innovative business models are reshaping healthcare’s supply-demand relationships. Hospitals with high treatment prices and inferior customer service run the risk of losing profitable patient volume. Honey wins.

Here’s more honey. A recent Kaiser Health News article[6] highlights how payers can exploit divergent hospital prices to shift demand to higher-value providers. Self-insured Santa Barbara County in California encouraged Leslie Robinson-Stone, a former deputy Sheriff, to undergo knee replacement surgery at a Scripps hospital in La Jolla (250 miles away) rather than have the procedure at a higher-priced local hospital.

Working with San Francisco-based Carrum Health, the County saved over $30,000. “Bringing common sense to healthcare,” Carrum arranged a bundled payment that covered Robinson-Stone’s surgery costs, travel costs and out-of-pocket costs as well as giving her more than a thousand dollars in spending money.

Carrum Health’s approach earns the confidence of self-insured employers and their covered employees. Robinson-Stone chose her surgeon, had a personal concierge who oversaw every aspect of her treatment and received physical therapy at her hotel, the Estancia La Jolla Hotel and Spa. She loved the experience. As Carrum Health promises on its website, this was “no tradeoffs” healthcare.

CMS “Vinegar” Also Tastes Bitter

The Centers for Medicare and Medicaid Services (CMS) also employs top-down vinegar and bottom-up honey approaches to rein in healthcare spending. Their payment policies shape market behavior in powerful ways. Not surprisingly, CMS’s “vinegar” policies have been less effective in stimulating care delivery innovation than the “honey-sweet” Medicare Advantage program.

A centerpiece of the Affordable Care Act (ACA) was the creation of the Center for Medicare and Medicaid Innovation (CMMI). Since 2010 CMMI has instituted an alphabet soup of centrally-planned accountable care models that reduce costs and improve quality.

So far, results are mixed. While these value-based payment models are slowly improving quality, they come with high administrative and startup costs and have generated anemic financial savings to CMS of just over 1%.[7] This analysis excludes the enormous costs providers have incurred to implement these value-based payment initiatives.

A recent HBR article, “How US Hospitals and Health Systems Can Reverse their Sliding Financial Performance,”[8] drew attention to the devastating financial losses incurred by American hospitals and health systems attempting to operate under a variety of top-down strategies for improving care quality and reducing costs.

In 2015, a Republican-dominated Congress enacted The Medicare Access and CHIP Reauthorization Act (MACRA) to reconfigure CMS programs for doctors. MACRA’s goal is laudable. It strives for better care management by rewarding physicians who deliver better health outcomes with more efficient resource utilization.

Like CMMI’s value-based payment programs, MACRA is centrally-administered, very complex, introduces a heavy regulatory burden and is likely to under-perform. CMS has delayed implementing key program components as providers scramble to adopt its complex provisions. The Medicare Payment Advisory Commission (“MedPAC”) has already begun to recommend policies to replace pieces of the payment regime.

Advantage Medicare Advantage

CMMI payment programs and MACRA are vinegar. They inhibit innovation and emphasize compliance. In contrast, Medicare Advantage (MA) programs are honey. MA offers holistic high-quality healthcare services that seniors want. MA membership is expanding as it rewards innovative business models that manage their members’ healthcare efficiently and effectively.

The modern Medicare Advantage program emerged in 2003 when President George W. Bush signed the Medicare Prescription Drug, Improvement and Modernization Act. The legislation directed subsidies to insurance companies and HMO’s encouraging private plans to offer market-based health plans that could compete with traditional Medicare.

MA plans receive risk-adjusted monthly payments to cover their members’ healthcare costs. Consequently, MA plan revenues are largely fixed. MA plans succeed when they generate high-quality care outcomes in a cost-effective manner. Lower-quality, less-efficient plans generally lose money.

Value follows payment. MA incentivizes participating health plans to innovate, produce better outcomes and offer value-laden services. Comprehensive, coordinated care keeps beneficiaries healthier. Most MA plans also offer vision, dental and prescription drug benefits not included in traditional Medicare.

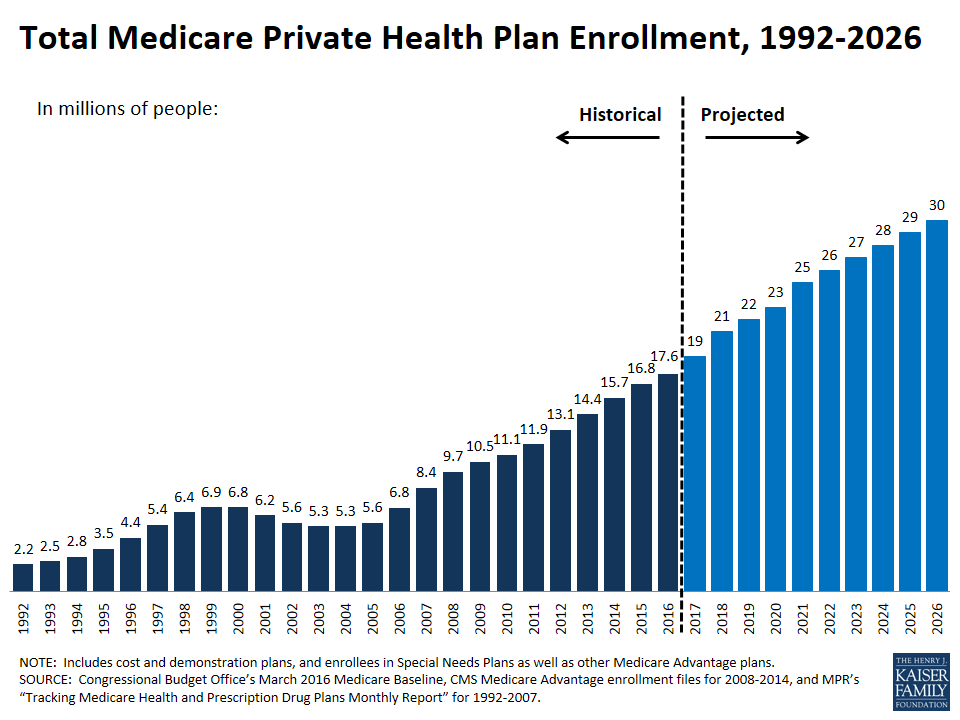

MA enrollment has outpaced traditional Medicare. The number of MA beneficiaries more than tripled from 5.3 million in 2004 to 17.6 million in 2016. In 2004, only 13% of Medicare beneficiaries enrolled in MA plans. Today 33% of current Medicare beneficiaries participate in MA plans and 88% are highly satisfied.[9]

MA plans have stimulated business model innovation. Chicago-based Oak Street Health[10] operates adult primary care centers in low-income urban neighborhoods. Oak Street’s customers are entirely MA plan members and most are “dual eligible,” meaning they qualify for both Medicare and Medicaid coverage. Essentially, Oak Street provides care to the elderly urban poor, a group that American healthcare has under-served for decades.

Oak Street is fully-accountable for the quality and cost of its members’ care, so they spend extra time with their patients to get to know them as people and earn their trust. The company opened its first center in Chicago’s Edgewater neighborhood in 2013 and is growing fast. They now provide vital high-touch primary care services to tens of thousands of individuals in Chicago, Detroit and Indiana with plans to expand to Philadelphia.

Medicare Advantage entices investors and entrepreneurs because it allows for business models that foster growth and innovation. Another new entrant, Devoted Health, will offer MA plans starting in 2019. Aiming to treat every MA member “like Mom or Dad,” Devoted Health will combine personal health guides, world-class technology and a network of high-quality providers.[11]

Devoted Health’s leadership is experienced and stellar. The company is run by Ed Park, the former Chief Operating Officer of Athena Health, and his brother Todd Park, the co-founder of athenahealth and Castlight who also served as President Obama’s Chief Technology Officer. Its Board includes savvy Venrock investors Bryan Roberts and Bob Kocher, former Senate Majority Leader Bill Frist and former Secretary of HHS Kathleen Sebelius. This sophisticated group chose Medicare Advantage as the best vehicle to deliver high-value care to seniors.

MA plans work. Member-level risk adjustment programs give plans important information for allocating resources efficiently. The transparent star rating system measures plan performance and helps consumers compare and select plans. Most importantly, beneficiaries are happy. Seniors, it turns out, have a taste for honey.

In a recent Wall Street Journal editorial, CMS Administrator Selma Verma announced her intention to “re-engineer” CMMI’s value-based programs:

“We are analyzing all Innovation Center models to determine what is working and should continue, and what isn’t and shouldn’t. The complexity of many of the current models might have encouraged consolidation within the health-care system, leading to fewer choices for patients. Strengthening Medicare and Medicaid will require health-care providers to compete for patients in a free and dynamic market, creating incentives to increase quality and reduce costs.”[12]

Consistent with this “honey-oriented” perspective, CMS has just issued a broad-based request for proposals soliciting suggestions for improving CMMI’s value-based payment initiatives.

Bringing More Honey to Healthcare

Since 1999, the cost of a family health insurance policy has increased 550% more than median household incomes.[13] The culprit is excessively-high healthcare treatment costs. Public and private payers are pursuing top-down or bottom-up strategies to normalize healthcare service prices, especially for routine commodity care.

The use of vinegar can be effective, but has limits. Strong-arming providers is likely to create friction and frustration while doing little to encourage collaboration and innovation. Hospitals and health systems pay a steep financial price for market inefficiency. Preventing consumers from making value-based choices slows health system transformation.

American healthcare will not fully repair itself until consumers exercise more purchasing discretion and benefit directly from lower prices. Value-providing companies, like Carrum Health and Oak Street Health, are gaining market-share by attacking the system’s inherent inefficiencies with relentless energy and focus.

Vinegar triggers resistance. Honey invites innovation. That’s why it captures more customers. Winning health companies are discovering creative ways to deliver high-value care at lower prices.

Outcomes matter. Customers count. Value rules.

[1] http://home.uchicago.edu/~vlima/courses/econ200/spring01/hayek.pdf

[2] http://www.modernhealthcare.com/article/20170826/NEWS/170829906

[3] http://www.modernhealthcare.com/article/20170826/NEWS/170829906

[4] https://smartchoicemri.com

[5] http://time.com/money/2995166/why-does-mri-cost-so-much/

[6] https://khn.org/news/why-one-california-county-went-surgery-shopping/

[7] http://healthaffairs.org/blog/2017/06/19/savings-reported-by-cms-do-not-measure-true-aco-savings/

[8] https://hbr.org/2017/10/how-u-s-hospitals-and-health-systems-can-reverse-their-sliding-financial-performance

[9] http://www.modernhealthcare.com/article/20170720/NEWS/170729995

[10] http://www.oakstreethealth.com

[11] http://www.xconomy.com/boston/2017/10/23/devoted-health-led-by-athenahealth-alums-bags-62m-for-senior-care/

[12] https://www.wsj.com/amp/articles/medicare-and-medicaid-need-innovation-1505862017

[13] https://jamanetwork.com/journals/jama/fullarticle/2661699

CO-AUTHOR

Nathan Bays

Nathan Bays is a senior banker in the Firm’s Health Systems M&A Group. Mr. Bays joined Cain Brothers in 2017 with over 10 years of extensive experience in serving as a strategic advisor on policy, governance and healthcare innovation as well as legal counsel to hospitals and health systems. He is a frequent speaker to hospitals, health systems and the healthcare investment community on topics such as the impact of federal health policy on new delivery models.

Nathan Bays is a senior banker in the Firm’s Health Systems M&A Group. Mr. Bays joined Cain Brothers in 2017 with over 10 years of extensive experience in serving as a strategic advisor on policy, governance and healthcare innovation as well as legal counsel to hospitals and health systems. He is a frequent speaker to hospitals, health systems and the healthcare investment community on topics such as the impact of federal health policy on new delivery models.

Prior to joining Cain Brothers, Mr. Bays was General Counsel and Executive Director of The Health Management Academy. Before joining The Health Management Academy, he served as legal counsel to hospitals, health systems and corporate clients on regulatory and transactional matters. He also worked with health systems and other healthcare providers on issues ranging from Stark and Anti-Kickback compliance to capital markets financing and mergers & acquisitions.

Mr. Bays earned his Juris Doctor degree from Wake Forest University School of Law and graduated from East Tennessee State University, with a degree in Finance.

Disclaimer:

The information contained in this report was obtained from various sources that we believe to be reliable, but we do not guarantee its accuracy or completeness. Additional information is available upon request. The information and opinions contained in this report speak only as of the date of this report and are subject to change without notice. This report has been prepared and circulated for general information only and presents the authors’ views of general market and economic conditions and specific industries and/or sectors. This report is not intended to and does not provide a recommendation with respect to any security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. This report does not take into account the financial position or particular needs or investment objectives of any individual or entity. The investment strategies, if any, discussed in this report may not be suitable for all investors. This report does not constitute an offer, or a solicitation of an offer to buy or sell any securities or other financial instruments, including any securities mentioned in this report. Nothing in this report constitutes or should be construed to be accounting, tax, investment or legal advice. Neither this report, nor any portions thereof, may be reproduced or redistributed by any person for any purpose without the written consent of Cain Brothers.

Cain Brothers is a member of SIPC. © 2016 Cain Brothers and Company, LLC