February 6, 2017

Moving at the Speed of Medicine: Turbo-Charging Performance with Strategic Partnerships

Insourcing is a time-honored practice employed by market-dominant companies. Rather than contract with external experts, companies dedicate internal resources for specialized functions. While generally less efficient, insourcing enables companies to maintain full production control.

However, insourcing’s benefits crumble as industries become more competitive because reduced efficiency and limited strategic flexibility translate into lower profit margins. The antidote is strategic partnerships that align companies’ capabilities and interests to deliver superior products and services.

Health systems practice insourcing broadly – from facilities management to pharmacy operations to logistics and transportation services. The benefits of maintaining production control are less compelling as market demands for value-based care have intensified. Strategic partnerships offer higher-octane performance and higher-quality outcomes at lower costs.

In today’s complex and dynamic healthcare marketplace, agility, efficiency and quality are the new drivers of success. Using strategic partnerships to turbo-charge performance differentiates winning health systems.

Have You Driven a Ford Lately?

In its early decades, Ford Motor Company was a tightly-integrated, highly-controlled enterprise that owned its entire supply chain. The company raised its own sheep, hogs and cattle. It grew soy beans, flax and sugarcane. It operated rubber plantations, timberlands, coal mines, freighters, saw mills, blast furnaces, a railroad and a glasswork.

Controlling all production factors was more efficient, embodied less risk and improved car quality. A more competitive marketplace requires a different approach. As the automobile industry evolved, car manufacturers embraced strategic partnerships for the same reasons they did in the early 1900s: to enhance efficiency, reduce risk and improve quality.

Toyota, the world’s largest car maker, engages in a sophisticated web of partnerships with vendors, suppliers and even other auto manufacturers. It carefully screens potential partners, then engages with them in a highly collaborative way to ensure that operations are as efficient and value-laden as possible.[1]

Like Toyota, today’s Ford manages multiple strategic relationships to better position its products and its brand. Ford recently announced a strategic partnership with Motivate to sponsor a massive sharable bike program in metropolitan San Francisco. Ford did so because they want to become the “single place where users can find available transportation or mobility options nearby whenever they need them.”[2]

This strategic partnership with Motivate reflects Ford’s sophisticated understanding of changing consumer preferences and buying habits. Succeeding long-term requires more than building and selling great cars. Ford believes it must offer a transportation eco-system that gets customers where they want to go on their own terms.

If Ford has a Better Idea…

Like the Ford Motor Company of yore, most health systems value control. They prefer to own assets and favor insourcing. This operating orientation reflects a “reimbursement-first” managerial mindset where financial benefits accrue to those providing the most, not necessarily the best, healthcare services.

Optimizing reimbursement does not create value for customers. As healthcare becomes more consumer-oriented, meeting customer demands requires rigorous examination of organizational capabilities along with strategic partnering and outsourcing to strengthen product offerings and make them more cost-effective.

Strategic partnerships work best when prospective partners bring expertise, capabilities and/or capital that enhance performance and improve outcomes. The best strategic partnerships align customer and service-provider interests.

The US healthcare marketplace is changing rapidly. As societal expectations for improved care delivery accelerate, health systems must develop better care coordination and practice greater transparency while reducing costs, medical errors and performance variation. Providers must also engage patients more meaningfully, communicate with them more effectively, and truly serve their interests as customers.

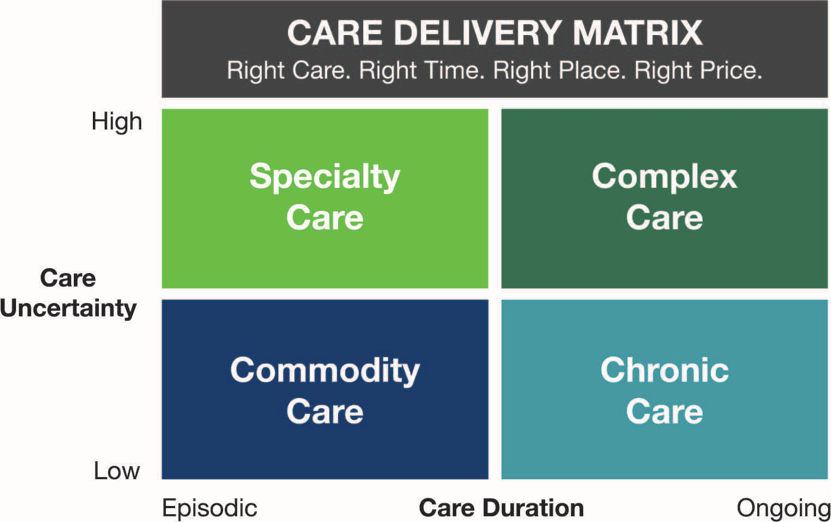

To meet these new imperatives, care delivery is segmenting into four distinct areas (commodity care; specialty care; complex care and chronic care) based on care duration and care uncertainty. Each segment requires a different business model to compete effectively. (See chart below.)

Too many health systems try to be all things to all patients under one organizational umbrella. This is a recipe for mediocrity. No company excels at all products and services. Health systems need to provide the right care in the right place at the right time and at the right price.

Most medical treatments are routine and subject to commoditization. With outcome certainty, consumers judge quality based on speed, convenience and service. Commodity care is a high volume, low-margin business. Specialty care requires focused “factories.” Complex care is a “solutions shop” business. Chronic care requires intense, non-acute customer engagement.

The marketplace self-organizes within segments. For example, SmartChoice MRI offers $600-or-less MRIs throughout metropolitan Chicago in convenient centers that operate six days a week. The Cleveland Clinic reviews each SmartChoice MRI for diagnostic accuracy. This is “commodity care.” SmartChoice advertises that “MRIs shouldn’t cost an arm and a leg” and hails their platform as “the cure for the $2600 MRI.”

To remain viable, health systems must reconfigure imaging services to meet market-based price and service levels. Some health systems, like ThedaCare, are forming strategic partnerships with SmartChoice.

Price-based competition for commodity services is new terrain for health systems. Historically, their managerial orientation has focused solely on reimbursement optimization. Today, the same competitive intensity is occurring in specialty care, complex care and chronic care as health systems and other healthcare organizations reposition for success in post-reform healthcare.

Adapting to New Market Realities

Healthcare delivery is complex and involves coordinated execution across hundreds of business functions. At the same time, market forces demand constant performance improvement and optimization of resources and assets. In response, healthcare systems must become highly integrated, efficient, transparent, consistent and customer-centric.

To win, health systems must overcome their preferences for “owning” sub-optimal business functions. Their alternative is to align with strategic partners to deliver superior products and services. Great strategic partnerships are built on a clear understanding of organizational strengths and weaknesses combined with a compelling strategic vision. They create superior value for customers and partners alike.

Consider Target’s 2015 decision to sell its 1600 pharmacies and 80 medical clinics to CVS Health for $1.9B. This was no ordinary transaction since the pharmacies and clinics remain within Target department stores while operated and branded by CVS.

Target realized that it would never develop the scale and expertise necessary to compete effectively in retail pharmacy. Shedding its health business freed Target to focus on its core grocery and merchandising businesses. Target stores benefit from the increased “foot traffic” provided by new CVS customers. Target customers benefit from improved efficiency, lower costs and more expansive pharmacy services.[3] [4]

Choosing Dance Partners

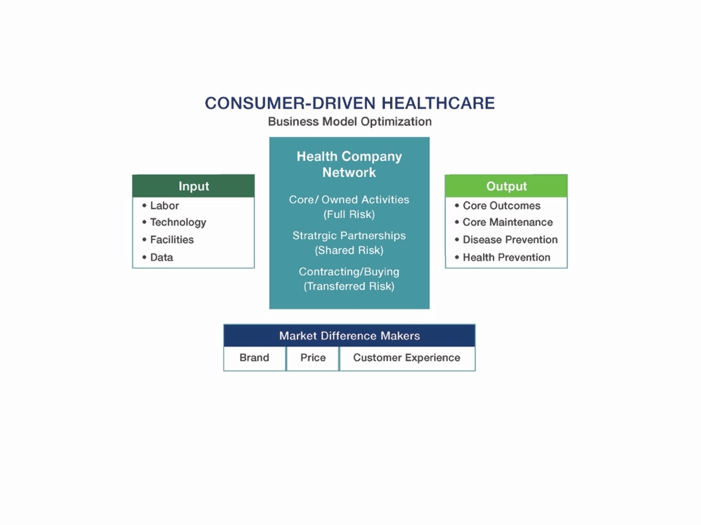

Selecting the right strategic partners is vital for health systems. The evaluation starts with a coherent and outcomes-focused vision. The organization must ask itself, “What businesses are we in, and how do we provide the greatest value to our patients/customers?”

Such analyses require dispassionate assessments of organizational strengths and weaknesses and a willingness to work with strategic partners. The chart below illustrates the process.

All companies apply available inputs to generate targeted outputs. They operate business models that strive to optimize production through “owned” activities, strategic partnerships and purchased services. Getting the formula right is essential to succeeding in competitive markets.

Commodity-based service arrangements are shorter-term, transaction-oriented contracts. They incorporate “zero-sum” economics. Price determines benefit. The lower the price the higher the benefit. These types of contracts pit companies against their contractors (think Walmart suppliers).

By contrast, strategic partnerships develop when companies acknowledge an expert partner is better positioned to provide a vital function in joint pursuit of a desired outcome.

Aligned and Vested Interests

Kate Vitasek, professor at the University of Tennessee and author of the book, Vested Outsourcing, has led long-term research into the dynamics of successful collaborative business partnerships. The Vested methodology centers on achieving desired outcomes, clear measures of success, aligned incentives, and mutual trust.

In a very real sense, the parties are on the same side of the table, pursuing agreed-upon objectives and winning or losing together. This requires the following four elements:

- A mutual focus on client objectives, not transactions or processes;

- Incentive-based compensation tied to clearly-defined outcomes (e.g. reduced costs, higher sales, fewer errors);

- A shared commitment to mutual learning and adaptive program evolution; and

- Honest and regular program assessment (what’s working, what’s not, how to be better, new win-win opportunities, and whether the engagement should continue).

Companies generally only have a handful of strategic partnerships. The best relationships are aligned, mutually beneficial and focused on outcomes.

Moving at the Speed of Medicine

In his insightful book, Nonzero: The Logic of Human Destiny, Robert Wright chronicles human progress as a series of increasingly complex win-win arrangements. The integration of competitive and cooperative forces defines success and failure in all human endeavors. Healthcare is no exception.

Albert Einstein once said, “We cannot solve our problems with the same thinking we used when we created them.” To that point, health systems cannot solve their challenges in adapting to a value-oriented, consumer-driven market environment by employing regulatory mindsets that prioritize full control of comprehensive services.

Companies with market mindsets focus on outcomes, customers and efficient resource allocation. They understand their internal limitations and clarify their strategic priorities. They objectively assess their strengths and the risks they should own. When necessary, they partner with like-minded companies that add value and generate better outcomes.

The right strategic partnerships advance care delivery by generating better care outcomes and more efficient operations. This leads to more engaged employees who are focused on doing what the organization does well and achieving superior outcomes.

SOURCES

[1] http://www.economist.com/node/13173671

[2] https://techcrunch.com/2016/09/09/ford-backs-massive-bike-share-expansion-in-the-san-francisco-bay-area/

[3] http://www.forbes.com/sites/greatspeculations/2015/06/30/cvs-to-buy-all-of-targets-pharmacy-stores-a-win-win-for-both/#12194bc769d1

[4] http://www.usatoday.com/story/money/2015/06/15/target-cvs-pharmacy-sale/71248932/