December 17, 2019

Overcoming Collateral Damage: Healthcare Price Transparency Now and Forever

Key Takeaways:

- Providers and payers fight the implementation of transparent prices with all their considerable resources and influence.

- Monopolies and monopsonies resist transparent pricing for their services because it threatens their market leverage. To expect them to do otherwise is naive.

- Far too often, healthcare’s payers and providers simply have become too big to care.

- The best method for combatting healthcare’s perverse behaviors and the collateral damage they cause is through full-risk contracting, full-risk bundles for episodic care and capitation for population health.

- Value-based care delivers the best outcome at the lowest cost with the highest consumer satisfaction.

- Transparent pricing is an important and essential first step in addressing the Healthcare Industrial Complex’s ® stranglehold on American consumers.

It’s not a surprise that the American Hospital Association and aligned groups are suing the Centers for Medicare and Medicaid Services (CMS) regarding its new price transparency rules. If enacted, these rules would enable consumers to know the cost of procedures and out-of-pocket costs before they receive treatments.

On account of their self-evident benefit to consumers, CMS’s pricing transparency rules are a white-hot dagger aimed directly at the healthcare industry’s beating heart. Transparent prices eviscerate the strategies that the Healthcare Industrial Complex™ uses to inflate revenues, boost profits and drive healthcare costs ever higher.

The evidence that transparent prices make healthcare services more appropriate and affordable to consumers is incontrovertible. Commentaries by CMS Administrator Seema Verma in a Chicago Tribune Op Ed and Health Evolution’s Chairman David Brailer in his inaugural Leadership Matters column present the economic logic in compelling fashion.

![]()

Like used cars used to be, healthcare is a buyer-beware marketplace that overwhelms consumers. The emergence of independent valuations, car-specific data (e.g. through Carfax) and seller warranties have created sufficient market trust and confidence among consumers that the new and used car marketplaces operate today with equivalent effectiveness. If transparency can empower consumers in the used car market, it can in healthcare too.

As Verma and Brailer make evident, competitive markets require transparent prices to function efficiently and effectively. There is no reason that healthcare cannot employ well-established market mechanisms to build consumers’ trust and reduce transaction friction, particularly for the vast majority of healthcare services that are routine.

In an alternative universe, healthcare companies could embrace price transparency and help consumers navigate through the complex healthcare ecosystem to receive the right care at the right time in the right place at the right price. Instead, they will fight the implementation of transparent prices with all their considerable resources and influence.

Given this dismal reality, the question that most interests me is why providers and payers resist efforts to implement transparent pricing for healthcare services so ferociously.

Monopoly-Monopsony Love

There are hundreds, if not thousands, of healthcare microeconomies where healthcare providers, manufacturers and suppliers enjoy monopoly selling power and/or healthcare insurers enjoy monopsony buying power. This concentrated ability to influence healthcare prices is the root cause of

healthcare’s economic dysfunction — the reason why Americans pay more for healthcare services than citizens in any other advanced economy.

Most understand monopoly selling power. For example, hospitals with concentrated market power can demand higher prices for the services they provide. Even high-volume commodity services, such as MRI scans, vary dramatically within and across markets.[1]

Monopsony buying power is less understood but equally virulent. It occurs when a purchaser has sufficient market concentration to set the prices it is willing to pay for products or services. For

example, monopsonist health insurers establish payment rates for treatments independent of market forces and then impose them on providers.

Monopsony and monopoly go together like love and marriage. They accommodate one another to maintain their anticompetitive market positions.

Monopoly providers and monopsony payers each win when they divvy up commercial health insurance payments through secret pricing negotiations.

This is why both provider and payer groups are forcefully lobbying against CMS’s new transparency rules.In a cruel twist of fate, monopolist and monopsonist companies often coexist within the same markets. They grow and consolidate to increase their negotiating leverage between one another, not to create greater value for customers.

Explaining monopsony and monopoly mechanics is not a theoretical exercise. It is the principal means through which the Healthcare Industrial Complex™ extracts increasing levels of societal resources without offering commensurate value in return.

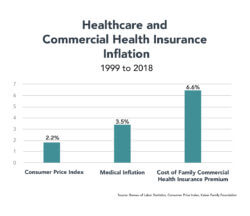

An examination of medical and commercial health insurance inflation between 1999 and 2018 illustrates the phenomenon.

As the chart below illustrates, commercial health insurance premiums rose three times the rate of inflation (as measured by the Consumer Price Index) and almost double the rate of medical inflation. This is not a natural market phenomenon. Monopolistic and monopsonist healthcare companies have used their market leverage to drive healthcare prices into the stratosphere.

Unfortunately, healthcare inflation is not subsiding. CMS recently announced that healthcare expenditures grew 4.6% in 2018 to $3.6 trillion[2] versus CPI growth of only 1.9%.[3] Earlier this year, the Kaiser Family Foundation documented that the average cost of a commercial family health insurance plan now exceeds $20,000.[4] Overall, commercial health insurance spending increased 5.8% and enrollee expenditures jumped even more — by 6.7%.[5]

While growth in hospital and physician spending actually decreased, prices for both increased. CMS Administrator Verma attributed the price increases to anti-competitive industry consolidation and the creation of monopolies.[6]

Monopolies and monopsonies resist transparent pricing for their services because it threatens their market leverage. To expect them to do otherwise is naive. It’s in their institutional nature to resist.

Collateral Damage

In a devastating commentary, Elizabeth Rosenthal, the editor of Kaiser Health News, details the billing shenanigans that accompanied her husband’s treatment for injuries sustained in a bicycle accident. She divided them into five categories.

- Medical Swag: all manner of medical products and equipment, many unnecessary, given to patients during treatment;

- The Cover Charge: “activation” fees for emergency care;

- Imposter Billing: payment to medical professionals who don’t actively engage in a patient’s care;

- The Drive By: brief and/or unwanted encounters with medical professionals who provide little or no actual care; and

- The Enforced Upgrade: routine care guided to and delivered in emergency rooms at absurdly high costs

While technically legal, Rosenthal believes these types of practices are immoral and fraudulent. Adding insult to injury, auto-filling of medical claims institutionalizes this profiteering to optimize revenue collection. Rosenthal’s list doesn’t even include “surprise billing” and other out-of-network practices that providers employ to inflate revenues.

Providers engage in these practices because they can. Commercial health insurers pay for these fraudulent behaviors because these practices are difficult to monitor, and they almost always can shift their costs to self-insured employers. Far too often, healthcare’s payers and providers simply have become too big to care.

The best method for combatting healthcare’s perverse behaviors and the collateral damage they cause is through full-risk contracting, full-risk bundles for episodic care and capitation for population health. Full-risk contracts incorporate transparent pricing by design and align incentives between consumers and healthcare companies.

When healthcare companies bear the financial risk of over/undertreatment, over-pricing and medical errors, they avoid the fraudulent practices that Rosenthal describes. They strive to keep people healthy by treating them efficiently and holistically. Where full-risk payment models exist, they consistently drive better health outcomes at lower costs with greater consumer satisfaction.

Unfortunately, as chronicled by my 4sight Health colleague Dave Burda in a recent Burda on Healthcare commentary, the industry’s movement to value-based payment has stalled. Burda referenced studies by Definitive Healthcare, Premier, the Health Care Payment Learning and Action Network, Leavitt Partners and Black Book in reaching his conclusion.

A report released by Catalyst for Payment Reform (CPR) on December 4th confirms the anemic progress. CPR found that only 6% of value-based payments in 2017 incorporated financial risk to providers. This was roughly the same percentage as in 2012. Without skin in the game, providers have little incentive to deliver value-based care.

The industry offers up multiple explanations for the lack of progress. They include a lack of resources, gaps in interoperability, reimbursement inadequacy, revenue uncertainty and delivery complexity. These excuses have some validity; however, they miss the proverbial forest for the trees.

Simply stated, value-based care delivers the best outcome at the lowest cost with the highest consumer satisfaction. Value-based care delivery and the payment that incentivize it are not taking hold for the following two core reasons:

- It is not in the financial interests of healthcare companies to pursue value-based care delivery and payment; and

- The buyers of healthcare services haven’t had the market clout to demand higher value for their healthcare purchases.

In playground vernacular this translates as “I don’t want to do it, and you can’t make me!” Enough is enough. It’s time for CMS to implement pro-market reforms that level the competitive playing field and protect consumers from profiteering. CMS Administrator Verma is determined to make this happen. She doesn’t mince words in her Chicago Tribune commentary:

For too long, the health care system has catered to the demands of powerful vested interests led by hospitals and insurers. The decades-long norm of price obscurity is just fine for those who get to set the prices with little accountability and reap the profits, but that stale and broken status quo is bleeding patients dry.

Transparency and Value

Transparent pricing is an important and essential first step in addressing the Healthcare Industrial Complex’s™ stranglehold on American consumers. Pro-market regulation and more demanding purchasing behavior by buyers of healthcare services have the power to force transparent pricing on the industry.

On January 26, 1830, Senator Daniel Webster of Massachusetts rose from his seat to respond to an argument from South Carolina Senator Robert Hayne who believed that individual states should have the right to “nullify” federal laws that contradict their interests. Many historians believe Webster’s short speech to be the greatest in Senate history (listen to Orson Welles doing a powerful rendition here).

Webster closed his remarks with this ringing endorsement to the union of American states, “Liberty and Union, now and forever, one and inseparable.” We can substitute “Transparency and Value” and make the same claim. They also are one and inseparable.

Ultimately, the United States fought a cataclysmic Civil War to preserve the Union and grant liberty to all Americans. An urgent question for our time is whether we are willing to confront and overcome the tyranny imposed on the American people by the Healthcare Industrial Complex™ so that all Americans can receive the kinder, smarter and affordable healthcare they richly deserve.

Sources:

- https://www.americanhealthimaging.com/how-cost-mri-varies-across-states/

- https://www.healthaffairs.org/doi/abs/10.1377/hlthaff.2019.01451?journalCode=hlthaff

- https://www.bls.gov/news.release/archives/cpi_01112019.pdf

- https://www.kff.org/report-section/ehbs-2019-section-1-cost-of-health-insurance/

- https://www.healthcaredive.com/news/us-healthcare-spending-growth-rebounded-last-year-influenced-by-insurance/568571/?utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%202019-12-06%20Healthcare%20Dive%20%5Bissue:24496%5D&utm_term=Healthcare%20Dive

- Ibid.