February 21, 2018

Platforming Healthcare (TM): Owning Hospitals Is So 2015

The news that Amazon, Berkshire Hathaway and JP Morgan Chase joined forces to create their own healthcare company rocked the industry. The ten largest health insurers and pharmacy businesses lost $30B in market value in two hours.[1]

In industry after industry, once-thriving giants struggle when nimble companies innovate, grab marketshare and reconfigure the competitive landscape. This relentless, evolutionary cycle reveals a core truth: customers care about outputs (products, services and customer experience), not the production process.

“Platform” companies like Amazon, Uber, Airbnb and Netflix disrupt and reconfigure incumbent business practices. They connect suppliers (where costs are) with customers (where the money is) by delivering superior products and services at competitive prices with great customer experience. They prioritize outcomes, not ownership and control.

Traditional businesses build moats around market share by investing in facility ownership and maintaining production control. Platform companies are agnostic about ownership and control. They beat incumbents by building more efficient, cost-effective and ever-improving platforms of connected capabilities, suppliers and data, assembled to identify and fulfill customer needs.

As the Amazon news illustrates, American healthcare is ripe for platform disruption. The recently-announced CVS-Aetna, Humana-Kindred, Advocate-Aurora, Dignity-CHI and Optum-DaVita mega-transactions provide more proof. Incumbent health organizations are asset-heavy, prefer to “own and control” all aspects of care delivery and operate business models that prioritize revenue generation over value-based care delivery and customer experience.

Healthcare “customers” want personalized support and optimal results. They crave better experiences from clinical and administrative encounters. They expect the enhanced access, convenience and connection that retailers like Walmart and CVS offer in stores and Amazon delivers online.

This is good for doctors. Care providers want to practice medicine, not data entry and transaction management. They desire more meaningful engagement with patients and easier connections, informed by timely access to patient information and clinical data that deliver quality outcomes. Platform companies remove barriers, facilitate integration and engage customers by making their service experience quick, easy and reliable.

Health organizations, increasingly at risk for delivering better outcomes, must understand, engage with and care for patients individually, bolstered by personalized data and mobile technologies. Their objective must be to deliver more care outside the hospital when and where it is needed.

Hospitals once symbolized healthcare. Increasingly, they will become niche components within robust health and wellness networks. By “platforming” healthcare, innovative health companies will transform care delivery and experience to give customers what they crave – better, more convenient and affordable healthcare services.

It’s the Customer, Stupid

It’s the Customer, Stupid

In his 1960 HBR paper, “Marketing Myopia”, Harvard Professor Theodore Levitt asked corporations to answer the question, “What business are you in?”[2] Professor Levitt emphasized that companies must prioritize and solve customer needs. He illustrated his logic by quipping, “People don’t want a quarter-inch drill. They want a quarter-inch hole!”[3]

The cardinal rule in Lean process improvement is that “value is always defined by customer need.”[4] Platform companies are the ultimate Lean machines – relentlessly driving out waste, cost and intermediaries to curate, arrange and personalize service provision.

Amazon embodies this approach. Relentless customer focus fuels Amazon’s business practices. The company’s goal is to own customer relationships through low prices, limitless choice, ridiculous convenience and the constant expansion and enhancement of value.

In the same way that Amazon has become the total integrator of retail consumer needs, health companies must become total integrators of customers’ health needs. Like Amazon, health companies must focus on outcomes and customer experience to design the best operating platforms. They must see their customers as individuals and excel at meeting their needs, wants and expectations. All other considerations are secondary.

Innovation guru Clayton Christensen framed Levitt’s axiom as “jobs-to-be-done.” Healthcare customers have two essential jobs-to-be-done:

- Fix Me When I’m Broken: where providers deliver episodic care to treat illness and injury.

- Keep Me as Healthy as Possible: where providers deliver ongoing care to manage chronic conditions, treat mental illness, prevent disease and promote wellness.

In healthcare’s fragmented fee-for-service (FFS) operating environment, “Fix Me When I’m Broken” treatments are healthcare’s highest-margin services and receive disproportionate resource allocation. Delivered within intensive settings, acute procedures and follow-up care are not well-coordinated, but generate the lion’s share of health systems’ margins.

“Keep Me as Healthy as Possible” services are low-margin, but they are extremely high-value activities for healthcare consumers. Until recently, disappointed customers have not had the market power to punish health companies that fail to get this job done.

This disconnection between customer need and service provision explains the nation’s gross under-investment and under-performance in chronic disease management, behavioral health, health promotion and wellness. As the healthcare marketplace self-corrects, health systems must re-orient to serve customers’ needs if they want to remain relevant.

Rethinking Healthcare Business Models

The movement to “value-based care” flips the current fee-for-service (FFS) orientation by paying for health outcomes. In its purest form, value-based payments convert hospitals to cost centers. Acute care interventions are high-cost, last-resort treatments. Services that “Keep Me as Healthy as Possible” are critical because they minimize the need for acute procedures.

The two most successful new value-based payment models align directly with healthcare’s two jobs-to-be-done: bundled payment for episodic care and capitated payments for ongoing care services.

In episodic care, delivering the right care at the right time in the right place at the right price constitutes a successful outcome. “Focused factories[5],” from Cleveland Clinic to DaVita, have emerged to service this market need.

Ongoing care management is more nuanced. Its success depends on avoiding or reducing acute, episodic interventions. Health organizations that establish deep, long-term, trusting customer relationships experience the best results.

Platform companies are evolving to succeed under healthcare’s bundled and capitated payment models. They often operate outside legacy systems and generate greater value (better outcomes, lower costs, better customer experience) than incumbent business models.

One example is ChenMed, an exceptionally focused “patient-centered” company that takes full risk for Medicare Advantage members in high-need neighborhoods. ChenMed specializes in delivering and coordinating personalized, chronic condition management for each member—including van rides to appointments—to make sure no one slips through the cracks. The services built into this business model keep patients, providers and payers happy.

Incumbent health organizations are vulnerable to emerging platform companies precisely because they do not solve customers’ two healthcare jobs-to-be-done. Clinging to existing business practices as consumerism transforms healthcare is equivalent to fighting gravity. It’s possible for a time, but ultimately doomed to fail.

Amazoning Healthcare

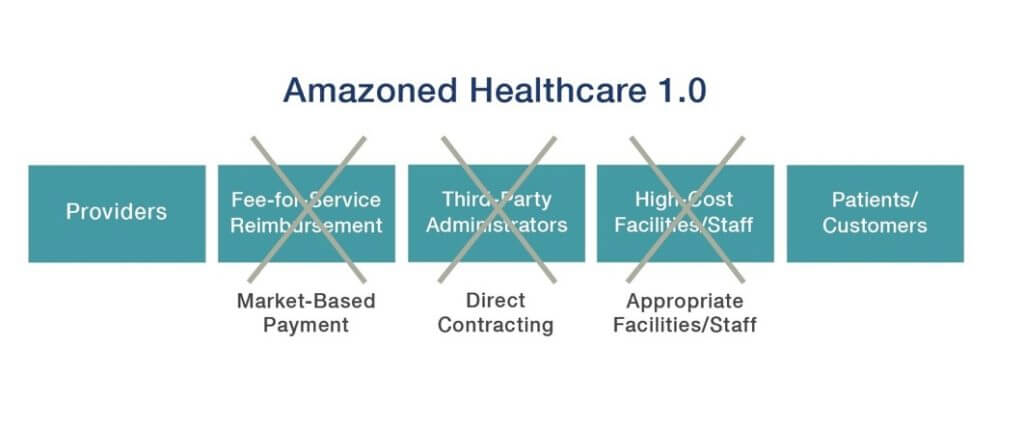

Amazon’s platform business model first disrupted the publishing industry. Amazon determined that only authors and readers were irreplaceable. They methodically disintermediated supply-chain intermediaries (publishers, distributers, book stores) by developing direct-to-consumer delivery and self-publishing capabilities. Book prices fell. Selection increased. Authors exercised production control and earned more money.

As in publishing, healthcare disruption will emerge largely through service innovation. It will occur as payment programs (risk-based, outcome-focused, bundled, transparent) reformulate incentives and retail-oriented competitors deliver superior customer-specific services.

Healthcare’s essential participants are providers and patients. An Amazon-like focus on meeting customers’ jobs-to-be-done will differentiate winning companies. Innovators will reorganize episodic and ongoing care delivery into discrete service offerings and compete on price and customer experience (see chart below).

This platforming strategy is already occurring in select markets:

- Direct primary care (DPC) practices offer comprehensive services through activated care teams under capitated payment models, freeing them up to meet individual customer needs.

- Laser eye surgery clinics, colonoscopy centers and free-standing MRI facilities offer transparently-priced, low-cost, highly reliable procedures in convenient centers open nights and weekends.

- High-volume, high-quality, low-cost specialty surgery centers (i.e. focused factories) like the Hoag Orthopedic Institute, are well-positioned for profitability under bundled joint replacement payment programs.

- Vitals, a technology-based provider selection and price-comparison service, aims to be the “Priceline” of healthcare. It matches patients with high-quality providers and offers cash incentives to encourage patients to seek lower-cost treatments.

- Improvements in home infusion services enable patients to receive care delivery at home. Outcomes are better, costs are lower. and patients are happier.

The list goes on. While the types of companies and services described above do not constitute total care integration, they can be effective component parts within healthcare platforms.

Platform health companies will partner with the best component providers and deliver services through well-branded, service-focused networks to do the following:

- Offer a trusted coach and advisor (think Primary Care Physician) to guide the customer/patient over time and events to improve health and manage care;

- Manage and analyze comprehensive patient, provider and payer data;

- Create a seamless match between a patient’s care needs and the best possible suppliers, then deliver that service;

- Optimize all other functions, including supply chain management, real estate, finance, energy use and data analytics by leveraging internal and external (strategically outsourced) expertise.

Total Care Integration

Total Care Integration

Health organizations can become “total integrators of health” by operating high-functioning holistic business platforms. Buyers of healthcare services will flock to health companies that assure high-quality services, transparent prices and great customer service.

Despite skewed markets, health organizations are not immune from natural laws governing economics, human behavior and innovation. To thrive in a customer-oriented market, incumbent health companies must rethink their fundamental business models and design operating platforms that deliver better healthcare at lower prices.

For example, Steward Health Care has transitioned from a traditional hospital-operating company into an accountable-care company. Steward’s employed and affiliated physicians manage 5 million patient encounters annually through capitated payment contracts. To fund growth and promote holistic patient-centric care, Steward deliberately relinquished ownership of its nine Massachusetts hospitals last year in a $1.25 billion sale-leaseback transaction.[6]

With its acquisition of eight Community Health Systems hospitals in May and its acquisition of 19 Iasis Healthcare hospitals in September 2017, Steward become a 36-hospital system operating in 10 states with approximately $8 billion in annual revenues.[7] More importantly, Steward operates as a transformational, risk-bearing health company well-positioned for continued growth and profitability. This is platform healthcare in action.

Steward demonstrates that traditional health systems can break-free from FFS business practices by delivering high-value, coordinated and cost-effective care to its customers.

Increasingly, all health providers, payers and suppliers will be subsumed within platforming networks such as Steward. Platforms that establish powerful brands, deliver valued services and generate exceptional customer loyalty will dominate.

Like Steward, Providence St. Joseph Health (PSJH), is leading the way. To better understand customer experience, PSJH is mapping each sequential customer interaction and providing new tools to enhance their experience. Additionally, PSJH is expanding access to wellness programs and enhancing non-hospital community-based services. The goal is to provide customers with the health and wellness services they need, when and where they want them.

Other innovative health companies include Kaiser, Iora and Optum. Platform strategies are powerful but nascent in healthcare. They will continue to grow. Paraphrasing science fiction writer William Gibson: “Healthcare’s platforming future is already here. It’s just not widely distributed yet.”

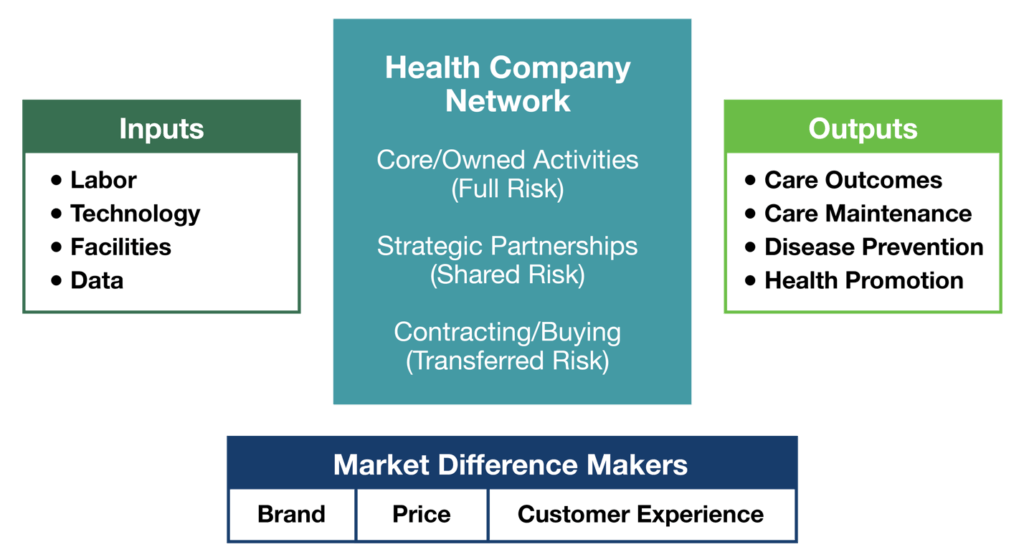

Rethinking Inputs and Outputs

All companies have inputs and desired outputs. Platform companies are agnostic with regard to whether they own, partner or outsource capabilities. Focusing on desired outcomes (jobs-to-be-done) liberates them to construct their service and production networks with the right mix of owned, partnered and purchased services.

The chart above outlines the flow of healthcare inputs to outputs and the resource-allocation alternatives (own, partner, outsource) within health systems. It also depicts the key channels (brand, price, consumerism) that differentiate superior product offerings.

In vigorous markets, companies differentiate based on price, brand and customer experience. These are not core competencies of most health systems. This provides a market opportunity for value-based competitors, such as high-performing surgical hospitals, to win market share.

In response, health systems must undertake an honest assessment of organizational strengths and weaknesses. This takes courage. It requires defying conventional wisdom, challenging powerful and entrenched business practices and raising the following provocative questions:

- Should health companies own acute facilities, particularly in saturated markets?

- Does partnering or outsourcing to deliver needed functions generate superior outcomes?

- Do current operations compromise quality?

Leading health companies understand their strengths (why customers “hire” them) and the risks they should own. They relinquish control to partners and/or vendors that add value and generate better outcomes. A relentless push to achieve competitive advantage forces effective resource-allocation decisions. They grind “sacred cows” into hamburger.

Conclusion: The Platform Mindshift

Conclusion: The Platform Mindshift

Today’s health organization business models prioritize ownership and production control to maximize revenues. The complexity and costs embedded in this “conglomerate” approach create friction, erode margins and diminish operating performance. Health companies must “let go” of their desire to control all production functions and focus on value-creation that enhances customer experience.

Enlightened health companies, including Steward Health Care and Providence St. Joseph Health, are creating Amazon-like “platforms” that employ data and systems to create a seamless match between patients’ care needs and their fulfillment. Their platforms combine owned and aligned providers, services, suppliers, infrastructure and analytics. Their sole goal is meeting customers’ health needs efficiently and cost-effectively.

As consumerism advances in healthcare, the movement toward platform service models will accelerate. Health organizations will reorganize to deliver better, more convenient healthcare services at lower costs. Fulfilling customers’ “jobs-to-be-done” will fuel continuous innovation and value creation. As this evolutionary process unfolds, U.S. healthcare will repair itself.

Einstein once noted that when a game changes, players must learn the new rules. Then they must play better than everyone else. Platform healthcare is the new game. It will be fascinating to see how new and existing health organizations curate their services differently in pursuit of customer value.

When the dust settles, the winners will demonstrate that outcomes matter, customers count, and value rules.

SOURCES

[1] https://qz.com/1192731/amazons-push-into-healthcare-just-cost-the-industry-30-billion-in-market-cap/

[2] https://hbr.org/2004/07/marketing-myopia

[3] https://hbr.org/2016/08/a-refresher-on-marketing-myopia

[4] https://www.asme.org/engineering-topics/articles/manufacturing-design/5-lean-principles-every-should-know

[5] https://www.managedcaremag.com/archives/1998/5/conversation-regina-e-herzlinger-focused-factories-will-provide-care

[6] https://www.steward.org/1/article/steward-receives-125-billion-investment-medical-properties-trust-setting-stage-national

[7] https://www.bizjournals.com/boston/news/2017/05/19/steward-to-acquire-18-hospitals-through-merger.html

CO-AUTHOR

Amy Compton-Phillips, M.D

Amy Compton-Phillips, M.D., is executive vice president and chief clinical officer for Providence St. Joseph Health. She oversees Clinical Care for the system, focused on creating high-value health outcomes for every individual seen. Key interest areas include developing cutting edge care through research, advanced access to care through innovation, highly reliable care processes through physician partnerships and systems design, and building the healthcare workforce of the future.

Amy Compton-Phillips, M.D., is executive vice president and chief clinical officer for Providence St. Joseph Health. She oversees Clinical Care for the system, focused on creating high-value health outcomes for every individual seen. Key interest areas include developing cutting edge care through research, advanced access to care through innovation, highly reliable care processes through physician partnerships and systems design, and building the healthcare workforce of the future.

Prior to joining Providence in August, 2015, Dr. Compton-Phillips served as the chief quality officer at the Permanente Federation where she focused on improving the value of care delivery. During her tenure, Dr. Compton-Phillips was a key organizational leader in developing capacity in patient-driven design, enhancing clinical outcomes and the care experience, and addressing the affordability of care.

Dr. Compton-Phillips is a board certified internist, author, and Theme Leader for NEJM Catalyst. She holds a bachelor’s degree from Johns Hopkins University and earned her medical degree from the University of Maryland School of Medicine.

OTHER CONTENT FROM AMY COMPTON-PHILLIPS & DAVID JOHNSON

Video: August 23, 2018, Amy Compton-Phillips came to MATTER, Chicago’s healthcare incubator. She presented her perspective on platforming in the industry and at Providence St. Joseph Health, then David Johnson interviewed her, building from her presentation and audience questions. Watch the livestream here.

Podcast: Amy Compton-Phillips, M.D., joined David Johnson in Episode 5 of Market Corner Conversations. Listen here or subscribe via iTunes or Stitcher.