July 29, 2015

Reimbursement Roulette: Health Companies “Double Down” on Revenue

Market Corner Commentary: July 28, 2015-Reimbursement Roulette: Health Companies “Double Down” on Revenue

A version of this commentary appeared in “Academy 360” on July 23, 2015

Let the good times roll!- Revenue

A July 4th New York Times article reports that health insurance plans are seeking “rate increases of 20 to 40 percent or more” for 2016.

On July 2nd, the U.S. Bureau of Labor Statistics reported that healthcare added 40,000 jobs in June and 400,000 jobs during the last year. Hospitals added 11,000 jobs in June and 108,000 jobs in the last year.

Health systems are building again. A July 21st Modern Healthcare article highlights a surge in new facility construction. Increased bond issuance for new projects provides conclusive proof.

Thunder follows lightening. As providers add new labor and facility costs, they raise prices. As provider costs increase, so do health insurance premiums.

Rising Rates Lift Payor and Provider “Boats”

While commentators often characterize payor-provider negotiations as “zero sum” (i.e. one wins at the other’s expense), both payors and providers prosper when health insurance premiums increase.

Significant payor income originates from self-insured employers as a percentage of administered claims. More claims translate into more income. The Affordable Care Act’s 15% limitation on profits further incentivizes health insurance companies to increase top-line revenues. 15% of a bigger number translates into higher profits.

Providers exhibit reciprocal behavior. Activity-based payments shape treatment patterns. More is better. Higher payment is better. Providers distribute facilities and services to maximize reimbursement payments. Health system revenues and income increase with higher treatment volume and greater commercial insurance payment.

The result is more money flowing into the healthcare sector without meaningful improvement in health status or treatment outcomes. Healthcare wins. America loses.

“Regulatory Mindsets” and Health Company Operations

All companies seek profits. Business models reflect market dynamics and economic incentives. Most industries generate profits by delivering competitively-priced products and services to customers. Companies earn profits by optimizing price, demand and consumer surplus (i.e. value).

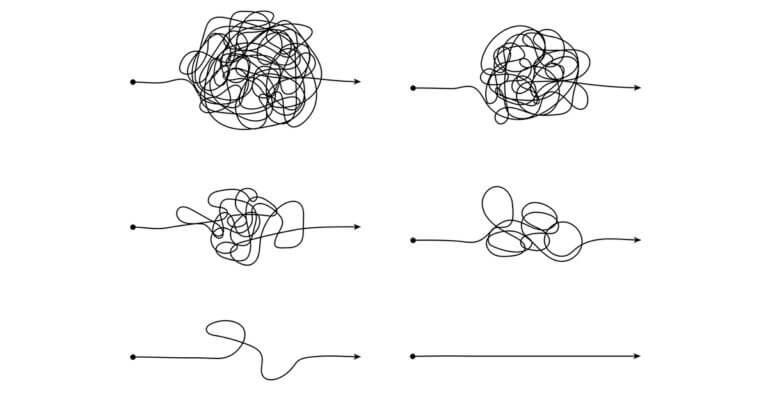

In normal markets, supply adjusts to intrinsic customer demand. Managers employ a “market mindset” to create value for customers and profits for their companies. Customer needs and perceptions are their principal considerations.

Apple has become the world’s most valuable company by making desirable products that are affordable and accessible to consumers.

In healthcare, supply creates its own demand and disrupts normal market function. Physicians prescribe procedures and diagnostic tests with few external limitations. Since third-party payors cover almost all costs, providers can consummate “transactions” without regard for treatment affordability and convenience.

Payors compensate providers for all “reasonable” care (a wide standard). This “supply-driven” market spawns a regulatory mindset among health company executives. They optimize revenues, not outcomes, by manipulating complex payment algorithms administered within a highly-regulated operating environment.

Health systems generate revenues (and profits) by optimizing patient volume, payor mix and treatment coding. Customer needs and perceptions are secondary considerations. Healthcare wins. Patients lose.

Time for a New Playbook

Upward pressure on rates, costs and premiums by payors and providers is “old thinking”. Too many incumbents are “doubling down” on activity-based payment while giving lip service to value-based delivery.

“Pushing rates” is a well-honed maneuver. It’s in every health company “playbook”. Even though reform calls for bold action, managers are reluctant to pursue new strategies.

Healthcare’s ability to “steal” resources from other sectors has been remarkable. Since Medicare’s 1965 arrival, health expenditure as a percentage of the national economy has more than tripled, from 5.6% to 17.4%.[1]

More of the same will not deliver better outcomes nor create healthier communities.

The old playbook still has force, but its magic is evaporating. Following the old playbook also carries embedded danger. The wider the gap between artificial “supply-driven” prices and competitive prices, the greater the opportunity for competitors to steal away customers with higher-value services.

Health companies should replicate Apple’s playbook and reconfigure operations to deliver tangible value to customers. Almost everybody wins when health companies deliver better care at lower prices in customer-friendly venues.

Some grizzled incumbents will fade away – addition by subtraction. Winning health companies employ “market mindsets” to create “value” for customers. Outcomes improve. Prices decrease. Service and convenience matter.

It’s time to “win one for both customers and America”!