July 8, 2019

Should Hospitals Pay Taxes?

Many health systems and hospitals operate as Not-for-Profit (NFP), mission-oriented organizations that do not pay sales, excise, property or other taxes. In exchange, NFPs must publicly report the level of annual “community benefit” they provide, like investments into local economic development, workforce empowerment and community health.

But NFPs still generate a profit. In fact, 7 of the 10 most profitable health systems operate as not-for-profit organizations – like Mayo Clinic and Mass General Hospital.

Under the Affordable Care Act (ACA), NFPs must publish their community benefit activities. However, there are no measurable indicators stated by the ACA. If NFPs paid taxes, their payments would contribute to the community by funding public services and increase transparency with the public.

Prior to World War I, religious organizations and charities operated most hospital, funded through research and education grants. In 1913, charitable care became exempt from tax law.

“Charity” hospitals began to disappear when hospital care improved, health insurance emerged, payment for healthcare services institutionalized and hospitals merged into health systems.

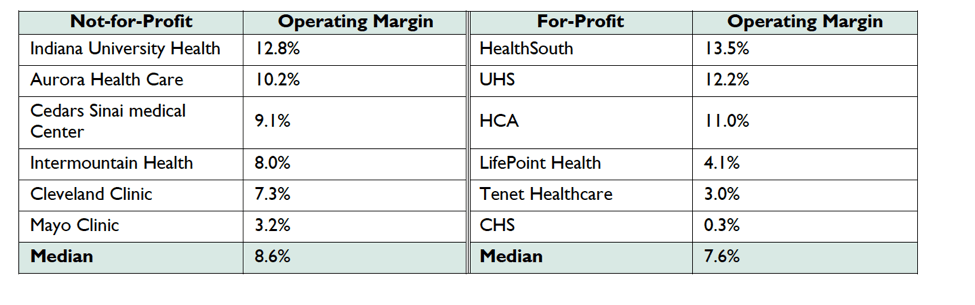

Now, most of the public cannot distinguish NFPs from for-profit hospitals. Both for-profit and NFP hospitals provide the same services, comply with the same regulations and both need to turn a profit to stay in business. According to Harvard professor Clayton Christensen, even their profit margins are similar.

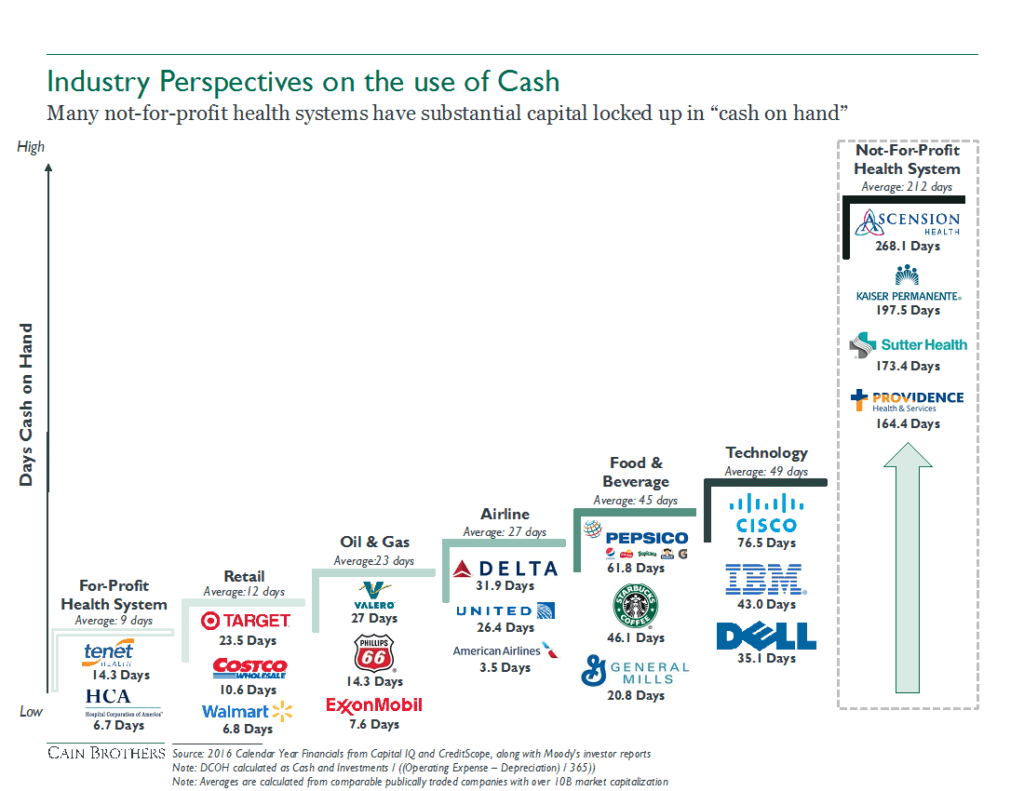

NFP operations are limited and cannot tap into their full financial potential. Given their not-for-profit status, they are unable to issue stocks and incur higher interest rates on debt. Their limited capital formation alternatives require them to keep high levels of cash on the balance sheet, instead of using this cash to invest into operations and development. Conversely, for-profit health systems can apply taxable debt and private equity investment to create more efficient capital structures. Take a look at the untapped potential NFPs store in their cash reserves.

It’s time to for NFP systems to consider giving up their non-profit status.. This will enable them to use their resources effectively and become competitive and profitable. Or, if they transition into for-profits, they can develop not-for-profit foundations to provide the following services:

- Tackling social determinants of health

- Improving local food quality

- Investing in local pharmacies

- Eliminating lead in drinking water

- Improving local infrastructure

- Investing in education and engagement programs

Transitioning NFPs into for-profits can dramatically improve healthcare. In 2010, Caritas Christi operated six hospitals in Massachusetts and struggled to maintain a quality services and facilities to serve its patients. Their operating loss resulted in a sale to Cerberus, a private equity company, which restructured its debt, acquired new health systems and rebranded as Steward Health Care.

Now, Steward is a 36-hospital system operating in 10 states with approximately $8 billion in annual revenue.[1] NFPs which pay their taxes or convert into for-profits will relieve burdensome reporting and artificially-imposed profitability constraints. The newfound strategic flexibility will enable quality healthcare delivery at the right time in the right place at the right price—the greatest contribution to the public and key to long-term success. For more information on this topic, please read the full Market Corner Commentary here.

Source

[1] https://www.prnewswire.com/news-releases/steward-health-completes-acquisition-of-iasis-healthcare-300528426.html