October 23, 2018

Study Refocuses ER Coverage Debate on Patients

A new study reminds us that the squabble between providers and payers over coverage of unnecessary emergency room visits should be more about patients and less about who pays who for what.

Call any doctor’s office or visit any hospital website and they’ll tell you to call 911 or go to the ER if you think you‘re having a medical emergency. The back of your health insurance card will tell you the same thing, and most go even further by telling you that you don’t need prior authorization to seek care for what you think is a life-threatening condition.

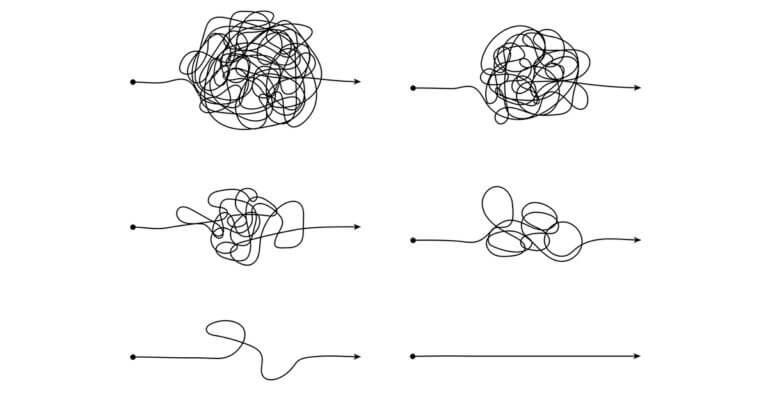

But the messages and reminders can be traps for patients as providers and payers spar over coverage of ER visits that could have been more appropriately handled in less acute settings or not at all.

On one side are health plans that have adopted policies under which they’ll deny most claims submitted by hospitals and doctors for patient ER visits for non-emergent diagnoses. Health plans say they’re doing this only to reduce unnecessary medical spending and to pass those savings to employers and enrollees in the form of lower health insurance premiums. (Or, it could be that health plans want to boost their margins by saving money from not paying providers.)

On the other side are providers that argue that such policies put patients at risk. By creating a financial disincentive to go to the ER, patients may decide not to get treated for legitimate medical emergencies and end up getting sicker or worse. (Or, it could be that providers want to avoid trying to collect ER fees directly from patients whose claims were denied by their health plans for lack of medical necessity.)

A new study published in JAMA Network adds some much-needed empirical evidence and the patients’ voice to the altruistic yet ultimately self-serving rhetoric from health plans and providers.

Medical school researchers from Harvard and Yale looked at the impact that restrictive health plan reimbursement policies can have on patients and their claims for payment for their ER visits.

The researchers analyzed more than 28,000 ER visits by commercially insured patients over a five-year period, Jan. 1, 2011, through Dec. 31, 2015. All of the patients were 15 to 64 years of age. All went to the ER suffering from common symptoms like chest pain, abdominal pain, sore throats and headaches.

The researchers split the visits into two categories: “denial diagnosis visits” and “denial symptom visits.” Denial diagnosis visits were ER visits for which health plans would have denied payment because at least one diagnosis was for a non-emergent condition like bronchitis or gastritis. Denial symptom visits were visits in which patients had the same symptoms or reasons for going to the ER as did the other patients.

Of all the ER visits in the study sample, health plans would have denied payment for 15.7 percent of the visits even though they went to the ER suffering from 87.9 percent of the same symptoms as the other patients in the study group.

“A retrospective diagnosis-based policy is not associated with accurate identification of unnecessary ED visits and could put many commercially insured patients at risk of coverage denial,” the study said.

Or simply, you can’t expect patients to know whether their chest pains, abdominal pains or headaches are emergencies until they go to the ER and get checked out. If they get checked out and they’re fine, i.e., they don’t have an urgent or emergent condition, their health plans may deny their claims and stick them with the entire bill.

And that bill can be quite high. For example, of the patients who were fine health-wise:

- 39.7 percent received ER-level care

- 26.0 percent received two or more diagnostic tests

- 24.5 percent were first triaged as needing urgent or emergent care

Another study that we wrote about in a previous blog post found that the average cost per ER visit for low-acuity medical conditions jumped 79 percent from 2008 to 2015.

Healthcare is a business like any other business. Health plans don’t want to pay for services that patients really don’t need. Providers want to be paid for the services they give to patients to determine how sick they are. We get it.

But, putting patients at financial risk for not knowing whether their chest pains are gas or a heart attack doesn’t seem to be the right way to go about it. Instead, payers and providers should work together to find a creative, patient-centered solution to the problem. This is a patient issue. It’s not an underwriting issue or a revenue-cycle management issue.

Author

David Burda is a columnist for 4sight Health and news editor of 4sight Friday, our weekly newsletter. Follow Burda on Twitter @DavidRBurda and on LinkedIn. Read his bio here.