May 26, 2022

That Giant Sucking Sound: Lost Patient Volume

As health systems report their earnings for the first quarter of 2022, the red ink is flowing in torrents. This is mostly due to financial losses on investment portfolios. More concerning, however, are hospitals’ substantial operating losses.

During a Fitch Ratings webinar on the mounting pressures confronting not-for-profit providers, Senior Director Kevin Halloran described health systems’ current financial performance as follows,

No matter how you look at it, the first quarter of 2022 will be one of the worst on record for most providers.

The last time health systems experienced this level of financial distress was in the late 1990s. The Balanced Budget Act of 1997 imposed severe budget cuts on healthcare providers which led to sizable operating losses.

At that time, the credit rating agency Moody’s created a “century club” whose members reported annual operating losses greater than $100 million. Those losses seem quaint by today’s standards. Quarterly operating losses within some large health systems are staggering. Here are a few notable examples:

- Ascension: $671 million

- Common Spirit: $591 million

- Providence: $510 million

- Mass General Brigham: $193 million

Expect more red ink as more health systems report their first quarter 2022 earnings. As financial pressures mount, operating losses at hospitals are likely to worsen before they improve. Declining hospital patient volume and increasing expenses are the primary factors driving the negative operating margins.

Volume Matters

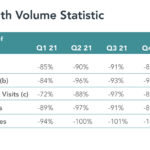

It’s well documented that patient volume in hospitals remains below pre-pandemic levels. For example, the chart from Tenet Health depicts quarterly inpatient and outpatient volume relative to pre-pandemic levels.

Like most health systems, Tenet experienced increasing patient volume in all categories through the first half of 2021 and declines thereafter. Absolute hospital patient volumes by category were 12% to 19% lower than pre-pandemic levels during the first quarter of 2022. Unlike its hospital-specific activities, Tenet’s outpatient surgeries through its USPI subsidiary now operate at or above pre-pandemic volume levels.

Unlike the health systems listed above, Tenet remains profitable from operations. The company reported higher first-quarter operating income in 2022 than it did in 2021 ($213 million versus $140 million). Tenet’s positive financial performance reflects, in part, the company’s expanding ambulatory service network as well its shrinking hospital footprint.

Lies, Damn Lies & Statistics

Mark Twain attributed the quote, “There are three kinds of lies: lies, damned lies and statistics” to Great Britain’s influential Prime Minister Benjamin Disraeli in the 1870s and 1880s. Disraeli was instrumental in shaping the modern Conservative Party and creating a unifying “one nation” political agenda. According to Twain, Disraeli bemoaned the use of statistics to bolster weak arguments.

I recalled Twain’s observation while reviewing the American Hospital Association’s just-released “Costs of Caring” report. In the report, the AHA pleads for more federal hospital funding to support hospitals as they prepare for new COVID surges while absorbing “unsustainable” increases in labor, supply and drug costs. This excerpt from the report captures the guts of the AHA’s argument.

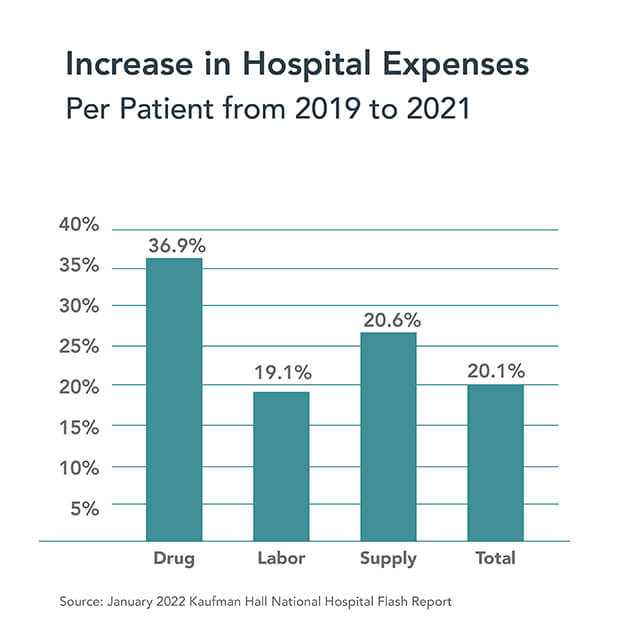

…the pandemic has taken a significant toll on hospitals and health systems and placed enormous strain on the nation’s health care workforce. During this unprecedented public health crisis, hospitals and health systems have confronted many challenges, including historic volume and revenue losses, as well as skyrocketing expenses (See Figure #1) … additional support is needed now to keep hospitals strong so they can continue to provide care to patients and communities.

I’ve reproduced “Figure #1” from the AHA report which uses Kaufman Hall’s January 2022 “Flash Report” to document a 20.1% increase in per-patient (italics added) hospital expenses between 2019 and 2021.

It’s important to note that the Kaufman Hall data measures cost increases on a per-patient basis, not on a more static per-bed or per-hospital basis. This analytic methodology amplifies percentage increases in hospital expenses when patient volumes decline. The math is simple. Even when revenue and expenses grow at the same rate, per-patient costs will increase when patient volume decreases.

While the Kaufman Hall analysis overstates the absolute increases in labor, supply and drug costs, there is no question that rising expenses pose a profound challenge to hospital operators. Achieving near-term operating stability will require adroit leadership. Even the best expense management, however, cannot overcome the strategic need for health systems to reconfigure their facility footprints, as Tenet is doing, in response to changing market dynamics.

Tides, Waves and Tidal Waves

The tide has been going out on hospital utilization for decades. This Modern Healthcare article from 2014, for example, chronicles the reasons underlying the long-term decline hospital admissions. Until COVID, patient volume continued to flow out of hospitals into lower-cost and more convenient ambulatory facilities. The COVID wave altered utilization patterns.

As described above, COVID disrupted hospital operations in monumental fashion. Elective surgeries disintegrated as hospitals shifted capacity to accommodate COVID patients. The CARES Act provided emergency funding to keep hospital operating even as commercial health insurance companies booked record profits.

Government regulatory changes during the pandemic incentivized virtual and at-home care delivery. They also enabled caregivers to cross state lines and practice at top-of-license. These advances make reverting to pre-pandemic operating models, as many providers desire, more difficult to achieve. The genie won’t go back in the bottle.

As disruptive as the COVID wave has been to hospital operations, it hasn’t changed the direction of the outgoing tide. Consumerism, new payment models, digital technologies and savvy competitors are creating a market-driven tidal wave that is crashing down upon incumbent business practices. Rationalizing an overbuilt acute care delivery system to promote health as well as treat disease will consume the healthcare ecosystem for the next decade.

There are many potential explanations for the post-COVID decline in hospital patient volumes. They include delayed or forgone necessary care, eliminated unnecessary care and/or care lost to alternative treatment venues. It is also possible that the million-plus COVID deaths that disproportionately afflicted individuals with severe chronic conditions have eliminated a significant source of patient volume for hospitals. That’s a sobering possibility.

Whatever the reasons, it’s not preordained that volume levels will return to pre-pandemic levels. In fact, it’s likely that post-COVID supply-demand dynamics for hospital services have fundamentally changed. This is healthcare’s new normal. If true, hospitals that fail to adapt to this shift in patient volume will lose patient volume and market relevance over time.

That Giant Sucking Sound

During the second 1992 U.S. Presidential Debate in St. Louis, third-party candidate Ross Perot memorably predicted that passage of the North American Free Trade Agreement (NAFTA) would create “a giant sucking sound” as good American jobs went south to Mexico. In making this statement, Perot emphasized that healthcare was the “single most expensive element in manufacturing a car” [in America].

Thirty years later, American hospitals are hearing another “giant sucking sound.” Its source is the increasing numbers of American consumers choosing to forgo hospital care in favor of more convenient and lower cost treatment alternatives. More than increasing expenses, hospitals’ operational losses are a by-product of this change in consumer behaviors.

Rather than simply dedicate more resources to a shrinking hospital sector, as the AHA would have American society do, it’s time for health systems to reassess their business models and reposition them to offer more value to customers. Pursuit of that just cause will not be easy, but it does align with the righteous mission of putting patients first.