January 5, 2023

The End of Traditional Nonprofit Healthcare Business Models?

What is going on with nonprofit health systems? I recently gave a keynote address to an investor forum that included CEOs from roughly a dozen nonprofit health systems. We dug into the structural and environmental challenges confronting their organizations.

When queried, over half the CEOs admitted that their asset-heavy business models were not sustainable. Most agreed that their operations required a major overhaul to remain competitive. Houston, we have a problem!

All hospitals are under pressure. Many will close. Consolidation will continue. Here’s the scary part. The old solutions of jacking up treatment volumes and commercial payment rates aren’t working. Evidence of business model failure abounds. A fiscal storm is raging.

Red-Ink Storm on the Horizon

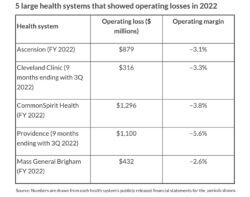

Nonprofit health systems are bleeding red ink. The exhibit below documents operating losses and margins for five prominent health systems. These figures capture the most recently reported financial data. Two are for the full 2022 fiscal year. The other three capture 2022 performance through the third fiscal reporting period. Any way you cut it, the losses are staggering.

Kaufman Hall’s November National Hospital Flash Report characterizes 2022 as “one of the worst financial years on record for hospitals.” Even in the best of times, the nonprofit hospital business model has never been robust. Hospitals are capital-intensive, labor-intensive, highly regulated, low-margin businesses that require high-cost facilities and highly expert personnel to operate.

Competing mission and business priorities make running nonprofit hospitals even more difficult. Indeed, a recent Kaiser Family Foundation report found that the three largest for-profit hospital chains (HCA, Tenet and CHS) were profitable during COVID-19 and remain so.

The existential question is whether current operating losses at nonprofit health systems are aberrant or indicate a broader collapse of their models. I believe it’s the latter. Structural weaknesses, combined with pernicious macro forces, make this a period of unprecedented challenge for nonprofit providers.

Structural Weaknesses

My six-part “Cracks in the Foundation” series identified and explored five deeply embedded defects in current nonprofit business models. These defects became more apparent and destructive during 2022.

- Artificial economics. The Kaiser Family Foundation’s annual employer survey documents that the total 2022 price (employer plus employee contribution) of a commercial family health insurance policy increased only 1.13%, well below U.S. Bureau of Labor Statistic’s reported 12-month inflation rate of 7.7%. Historically low premium increases suggest that commercial health insurers are unlikely to provide much financial relief to struggling providers.

- Needs-services mismatch. Despite massive financial support for hospitals and ample vaccine supply during COVID, the United States’ rate of all-cause mortality was more

than double that of all 17 peer countries except Finland. When Americans do not receive vital care services, they die in disproportionately

high numbers. - Brittle business models. Despite significant movement to virtual and home-based care delivery modalities during COVID, most health systems are backsliding and doubling down on high-cost, high-pay, hospital-based care. Moreover, construction of costly facilities continues at near-record levels. Health systems’ hospital-centric focus makes them even more vulnerable to novel and value-based competitors.

- Regulatory headwinds. Disclosing negotiated procedure prices by hospitals is now the law of the land, but their compliance has been weak. Hospitals haven’t been much better at implementing mandated data interoperability rules. It’s impossible to be customer-centric without transparent pricing and understandable data sharing.

- Inadequate leadership. Despite high CEO turnover, most nonprofit health systems do not have adequate succession plans. Beyond turnover, the stay-the-course governance orientation that predominates in nonprofit healthcare is incapable of providing the incisive strategic leadership required to maintain competitiveness.

Under pressure, health systems are struggling to right the ship, but they are defaulting to old habits. They’re chasing volume and rates under fee-for-service (FFS) medicine. While this has worked in the past, it is not a viable long-term strategy. Powerful macro forces are aligning against healthcare business practices. Ignoring them won’t make them go away.

Macro Forces

In the wake of the hospital-unfriendly Balanced Budget Act of 1997, Moody’s Investor Service created a “century club” for health systems. Membership required losing $100 million from operations in a single year. Today, some nonprofit health systems are losing more than that amount each month. Even with fortress balance sheets, they cannot sustain these levels of financial losses without jeopardizing their futures.

Here’s the rub. Maintaining long-term viability requires health systems to address the structural defects described above while adapting to the following countervailing market dynamics that further weaken traditional business practices.

Softening patient volume. While pre-COVID ambulatory patient volumes have recovered at most hospitals, inpatient volumes remain below 2019 levels. This is particularly true for hospital-based surgeries and emergency department visits, both of which are critical to hospitals’ financial performance. Concurrently, the patient mix (increased nonsurgical admissions) and acuity (sicker patients) for hospitals are shifting in ways that drive up costs without equivalent increases in revenues.

Deteriorating case mix. Accompanying softening volume is a deteriorating case mix as patients turn 65 and replace higher-paying commercial health insurance with Medicare. Differential payment for the equivalent treatments is a hallmark of FFS medicine. That equation works against providers when their patients migrate into government-funded insurance plans.

New competitors. Beyond treatment patterns, new competitors are emerging and siphoning away traditional hospital volume into lower-cost, customer-friendly service providers for routine services. They’ve created focus factories and retail centers for high-volume surgeries and diagnostics. These nontraditional competitors improve outcomes, lower prices and enhance customer service at incumbents’ expense. They’re not going away. Consumers love the increased choice, convenience and value.

Skyrocketing cost increases for labor, supplies and drugs. This is the macro force receiving the most attention. Payers aren’t coming to hospitals’ rescue. The American Hospital Association’s “Costs of Caring” initiative to raise more emergency funding for hospitals has hit a brick wall. In response, the AHA has shifted its advocacy to securing more funding for metropolitan anchor hospitals.

Negative investigative reports. The proliferation of such reports is perhaps most concerning. Major media outlets are skewering nonprofit healthcare about their skimpy levels of charity care, the societal cost of tax exemption, 340B program abuses, poor customer service, medical errors and lack of care access. Healthcare is losing the battle for the hearts and minds of the American people. Health systems will have to change the narrative to win them back.

Bottom Line

Whether they realize it or not, nonprofit hospitals and health systems are playing a new game. And when this happens, to paraphrase an often-cited quote, they must learn the rules of the game and then play it better than anyone else. Healthcare’s new game centers on consumerism and value. Surviving health systems will solve consumers’ healthcare problems at fair prices.

At 20% of GDP, the United States spends enough to provide affordable healthcare to all Americans that doesn’t bankrupt them or the country. Business as usual won’t achieve this result. The customer revolution in healthcare is upon us. It will deliver exponential, not incremental, change. Nonprofit health systems can either lead the change or have the change imposed upon them. The choice is theirs.

—This column was originally published on December 21, 2022, on HFMA.org in the Cost Effectiveness of Health series.