August 19, 2020

The Future of Hospitals in Post-COVID America (Part 1): The Market Response

Editor’s Note: This is the first of two articles on the Future of Hospitals in Post-COVID America. This article examines how market forces are consolidating, rationalizing and redistributing acute care assets within the broader industry movement to value-based care delivery. The second commentary examines gaps in care delivery and the related public policy challenges of providing appropriate, accessible and affordable healthcare services in medically underserved communities.

Part 1: The Market Response

Part 2: The Policy Response

In her insightful 2016 book, The Gray Rhino: How to Recognize and Act on the Obvious Dangers We Ignore, Michelle Wucker coins the term “Gray Rhinos” and contrasts them with “Black Swans.” That distinction is highly relevant to the future of American hospitals.

Black Swans are high impact events that are highly improbable and difficult to predict. By contrast, Gray Rhinos are foreseeable, high-impact events that we choose to ignore because they’re complex, inconvenient and/or fortified by perverse incentives that encourage the status quo. Climate change is a powerful example of a charging Gray Rhino.

In U.S. healthcare, we are now seeing what happens when a Gray Rhino and a Black Swan collide.

Listen to co-authors talk about the thinking behind this article on the House Calls Podcast available on iTunes & Stitcher.

Arguably, the nation’s public health defenses should anticipate global pandemics and apply resources systematically to limit disease spread. This process did not happen with the 2020 coronavirus pandemic.

Instead, COVID-19 hit the public healthcare infrastructure suddenly and hard. This forced hospitals and health systems to dramatically reduce elective surgeries, lay off thousands and significantly change care delivery with the adoption of new practices and services like telemedicine.

In comparison, many see the current American hospital business model as a Gray Rhino that has been charging toward unsustainability for years with ever-building momentum.

Even with massive and increasing revenue flows, hospitals have long struggled with razor-thin margins, stagnant payment rates and costly technology adoptions. Changing utilization patterns, new and disruptive competitors, pro-market regulatory rules and consumerism make their traditional business models increasingly vulnerable and, perhaps, unsustainable.

Despite this intensifying pressure, many hospitals and health systems maintain business-as-usual practices because transformation is so difficult and costly. COVID-19 has made the imperative of change harder to ignore or delay addressing.

For a decade, the transition to value-based care has dominated debate within U.S. healthcare and absorbed massive strategic, operational and financial resources with little progress toward improved care outcomes, lower costs and better customer service. The hospital-based delivery system remains largely oriented around Fee-for-Service reimbursement.

Hospitals’ collective response to COVID-19, driven by practical necessity and financial survival, may accelerate the shift to value-based care delivery. Time will tell.

This series explores the potential repositioning of hospitals during the next five years as the industry rationalizes an excess supply of acute-care capacity and adapts to greater societal demands for more appropriate, accessible and affordable healthcare services. It starts by exploring the role of the marketplace in driving hospital consolidation and the compelling need to transition to value-based care delivery and payment models.

COVID’s Dual Shock to Patient Volume

Many American hospitals faced severe financial and operational challenges before COVID-19. The sector has struggled to manage ballooning costs, declining margins and waves of policy changes.[1] A record 18 rural hospitals closed in 2019.[2] Overall, hospitals saw a 21% decline in operating margins in 2018-2019.[3]

COVID intensified those challenges by administering two shocks to the system that decreased the volume of hospital-based activities and decimated operating margins.

The first shock was immediate. To prepare for potential surges in COVID care, hospitals emptied beds and cancelled most clinic visits, outpatient treatments and elective surgeries. Simultaneously, they incurred heavy costs for COVID-related equipment (e.g. ventilators, PPE) and staffing. Overall, the sector experienced over $200 billion in financial losses between March and June 2020.[4]

The first shock was immediate. To prepare for potential surges in COVID care, hospitals emptied beds and cancelled most clinic visits, outpatient treatments and elective surgeries. Simultaneously, they incurred heavy costs for COVID-related equipment (e.g. ventilators, PPE) and staffing. Overall, the sector experienced over $200 billion in financial losses between March and June 2020.[4]

The second, extended shock has been a decrease in needed but not necessary care. Initially, many patients delayed seeking necessary care because of perceived infection risk.[5] For example, Emergency Department visits declined 42% during the early phase of the pandemic.[6]

Increasingly, patients are also delaying care because of affordability concerns and/or the loss of health insurance.[7] Already, 5.4 million people have lost their employer-sponsored health insurance.[8] This will reduce incremental revenues associated with higher-paying commercial insurance claims across the industry. Additionally, avoided care reduces patient volumes and hospital revenues today even as it increases the risk and cost of future acute illness.

The infusion of emergency funding through the CARES Act helped offset some operating losses[9] but it’s unclear when and even whether utilization patterns and revenues will return to normal pre-COVID levels. Shifts in consumer behavior, reductions in insurance coverage, and the emergence of new competitors ranging from Walmart to enhanced primary care providers will likely challenge the sector for years to come.

The disruption of COVID-19 will serve as a forcing function, driving meaningful changes to traditional hospital business models and the competitive landscape. Frankly, this is long past due. Since 1965, Fee-for-Service (FFS) payment has dominated U.S. healthcare and created pervasive economic incentives that can serve to discourage provider responsiveness in transitioning to value-based care delivery, even when aligned to market demand.

Telemedicine typifies this phenomenon. Before COVID, CMS and most health insurers paid very low rates for virtual care visits or did not cover them at all. This discouraged adoption of an efficient, high-value care modality until COVID-19.

Unable to conduct in-person clinical visits, providers embraced virtual care visits and accelerated its mass adoption. CMS and commercial health insurers did their part by paying for virtual care visits at rates equivalent to in-person clinic visits. Accelerated innovation in care delivery resulted.

The Complicated Transition to Value

Broadly speaking, health systems and physician groups that rely almost exclusively on activity-based payment revenues have struggled the most during this pandemic. Vertically integrated providers that offer health insurance and those receiving capitated payments in risk-based contracts have better withstood volume losses.

Modern Healthcare notes that while provider data is not yet available, organizations such as Virginia Care Partners (an integrated network and commercial ACO), Optum Health (with two-thirds of its revenue risk-based), and MediSys Health Network (a New York-based NFP system with 148,000 capitated and 15,000 shared risk patients), are among those navigating the turbulence successfully.

As the article observes,

…providers paid for value have had an easier time weathering the storm…. helped by a steady source of income amid the chaos. Investments they made previously in care management, technology and social determinants programs equipped them to pivot to new ways of providing care.[10]

They were able to flip the switch on telehealth, use data and analytics to pinpoint patients at risk for COVID-19 infection, and deploy care managers to meet the medical and nonclinical needs of patients even when access to an office visit was limited.

Supporting this post-COVID push for value-based care delivery, six former leaders from CMS wrote to Congress in June 2020 calling for providers, commercial insurers and states to expand their use of value-based payment models to encourage stability and flexibility in care delivery.[11]

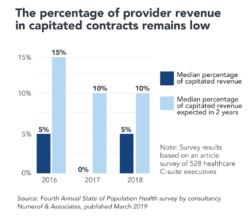

If value-based payment models are the answer, however, adoption to date has been slow, limited and difficult. Ten years after the Affordable Care Act, Fee-for-Service payment still dominates the payer landscape. The percentage of overall provider revenue in risk-based capitated contracts has not exceeded 20%.

Despite improvements in care quality and reductions in utilization rates, cost savings have been modest or negligible.[12] Accountable Care Organizations have only managed to save at best, a “few percent of Medicare spending, [but] the amount varies by program design.”[13]

While most health systems accept some forms of risk-based payments, only 5% of providers expect to have a majority (over 80%) of their patients in risk-based arrangements within 5 years.[14]

The shift to value is challenging for numerous reasons. Commercial payers often have limited appetite or capacity for risk-based contracting with providers. Concurrently, providers often have difficulty accessing the claims data they need from payers to manage the care for targeted populations.

The current allocation of cost-savings between buyers (including government, employers and consumers), payers (health insurance companies) and providers discourages the shift to value-based care delivery. Providers would advance value-based models if they could capture a larger percentage of the savings generated from more effective care management and delivery.Those financial benefits today flow disproportionately to buyers and payers.

This disconnection of payment from value creation slows industry transformation. Ultimately, U.S. healthcare will not change the way it delivers care until it changes the way it pays for care. Fortunately, payment models are evolving to incentivize value-based care delivery.

As payment reform unfolds, however, operational challenges pose significant challenges to hospitals and health systems. They must adopt value-oriented new business models even as they continue to receive FFS payments. New and old models of care delivery clash.

COVID makes this transition even more formidable as many health systems now lack the operating stamina and balance-sheet strength to make the financial, operational and cultural investments necessary to deliver better outcomes, lower costs and enhanced customer service.

Market-Driven Consolidation and Transformation

Full-risk payment models, such as bundled payments for episodic care and capitation for population health, are the catalyst to value-based care delivery. Transition to value-based care occurs more easily in competitive markets with many attributable lives, numerous provider options and the right mix of willing payers.

As increasing numbers of hospitals struggle financially, the larger and more profitable health systems are expanding their networks, capabilities and service lines through acquisitions. This will increase their leverage with commercial payers and give them more time to adapt to risk-based contracting and value-based care delivery.

COVID also will accelerate acquisition of physician practices. According to an April 2020 MGMA report, 97% of physician practices have experienced a 55% decrease in revenue, forcing furloughs and layoffs.[15] It’s estimated the sector could collectively lose as much as $15.1 billion in income by the end of September 2020.[16]

Struggling health systems and physician groups that read the writing on the wall will proactively seek capital or strategic partners that offer greater scale and operating stability. Aggregators can be selective in their acquisitions, seeking providers that fuel growth, expand contiguous market positions and don’t dilute balance sheets.

Adding to the sector’s operating pressure, private equity, venture investors and payers are pouring record levels of funding into asset-light and virtual delivery companies that are eager to take on risk, lower prices by routing procedures and capture volume from traditional providers. With the right incentives, market-driven reforms will reallocate resources to efficient companies that generate compelling value.

As this disruption continues to unfold, rural and marginal urban communities that lack robust market forces will experience more facility and practice closures. Without government support to mitigate this trend, access and care gaps that already riddle American healthcare will unfortunately increase.

Winning at Value

The average hospital generates around $11,000 per patient discharge. Ancillary services can add up to more than $15,000 per average discharge. Success in a value-based system is predicated on reducing those discharges and associated costs by managing acute-care utilization more effectively for distinct populations (i.e. attributed lives).

This changes the orientation of healthcare delivery toward appropriate and lower cost settings. It also places greater emphasis on preventive, chronic and outpatient care as well as better patient engagement and care coordination.

Such a realignment of care delivery requires the following:

- A tight primary care network (either owned or affiliated) to feed referrals and reduce overall costs through better preventive care.

- A gatekeeper or navigator function (increasingly technology-based) to manage / direct patients to the most appropriate care settings and improve coordination, adherence and engagement.

- A carefully designed post-acute care network (including nursing homes, rehab centers, home care services and behavioral health services, either owned or sufficiently controlled) to manage the 70% of total episode-of-care costs that can occur outside the hospital setting.

- An IT infrastructure that can facilitate care coordination across all providers and settings.

- Quality data and digital tools that enhance care, performance, payment and engagement.

- Experience with managing risk-based contracts.

- A flexible approach to care delivery that includes digital and telemedicine platforms as well as non-traditional sites of care.

- Aligned or incentivized physicians.

- Payer partners willing to share data and offload risk through upside and downside risk contracts.

- Engaged consumers who act on their preferences and best interests.

While none of these strategies is new or controversial, assembling them into cohesive and scalable business models is something few health systems have accomplished. It requires appropriate market conditions, deep financial resources, sophisticated business acumen, operational agility, broad stakeholder alignment, compelling vision, and robust branding.

Providers that fail to embrace value-based care for their “attributed lives” risk losing market relevance. In their relentless pursuit of increasing treatment volumes and associated revenues, they will lose market share to organizations that deliver consistent and high-value care outcomes.

Conclusion: The Charging Gray Rhino

America needs its hospitals to operate optimally in normal times, flex to manage surge capacity, sustain themselves when demand falls, create adequate access, and enhance overall quality while lowering total costs. That is a tall order requiring realignment, evolution, and a balance between market and policy reform measures.

The status quo likely wasn’t sustainable before COVID. The nation has invested heavily for many decades in acute and specialty care services while underinvesting, on a relative basis, in primary and chronic care services. It has excess capacity in some markets, and insufficient access in others.

COVID has exposed deep flaws in the activity-based payment as well as the nation’s underinvestment in public health. Disadvantaged communities have suffered disproportionately. Meanwhile, the costs for delivering healthcare services consume an ever-larger share of national GDP.

Transformational change is hard for incumbent organizations. Every industry, from computer and auto manufacturing to retailing and airline transportation, confronts gray rhino challenges. Many companies fail to adapt despite clear signals that long-term viability is under threat. Often, new, nimble competitors emerge and thrive because they avoid the inherent contradictions and service gaps embedded within legacy business models.

The healthcare industry has been actively engaged in value-driven care transformation for over ten years with little to show for the reform effort. It is becoming clear that many hospitals and health systems lack the capacity to operate profitably in competitive, risk-based market environments.

This dismal reality is driving hospital market valuations and closures. In contrast, customers and capital are flowing to new, alternative care providers, such as OneMedical, Oak Street Health and Village MD. Each of these upstart companies now have valuations in the $ billions. The market rewards innovation that delivers value.

Unfortunately, pure market-driven reforms often neglect a significant and growing portion of America’s people. This gap has been more apparent as COVID exacts a disproportionate toll on communities challenged by higher population density, higher unemployment, and fewer medical care options (including inferior primary and preventive care infrastructure).

Absent fundamental change in our hospitals and health systems, and investment in more efficient care delivery and payment models, the nation’s post-COVID healthcare infrastructure is likely to deteriorate in many American communities, making them more vulnerable to chronic disease, pandemics and the vicissitudes of life.

Article 2 in our “Future of Hospitals” series will explore the public policy challenges of providing appropriate, affordable and accessible healthcare to all American communities.

Sources:

- https://www.modernhealthcare.com/article/20190117/NEWS/190119923/ballooning-costs-government-mandates-were-hospitals-biggest-challenges-in-2018

- https://www.beckershospitalreview.com/finance/rural-hospital-closures-hit-record-high-in-2019-here-s-why.html

- https://www.cnn.com/2020/04/22/perspectives/hospitals-funding-coronavirus/index.html

- https://www.aha.org/guidesreports/2020-05-05-hospitals-and-health-systems-face-unprecedented-financial-pressures-due

- https://khn.org/news/nearly-half-of-americans-delayed-medical-care-due-to-pandemic/

- https://www.cdc.gov/mmwr/volumes/69/wr/mm6923e1.htm

- https://www.nytimes.com/2020/06/16/health/coronavirus-insurance-healthcare.html

- https://www.familiesusa.org/resources/the-COVID-19-pandemic-and-resulting-economic-crash-have-caused-the-greatest-health-insurance-losses-in-american-history/

- https://www.cnn.com/2020/04/22/perspectives/hospitals-funding-coronavirus/index.html

- https://bit.ly/3aEYeyd

- https://bit.ly/2Yi3LG9

- https://www.healthaffairs.org/do/10.1377/hblog20180918.957502/full/

- https://www.nytimes.com/2019/09/23/upshot/medicare-health-value-costs.html

- https://www.fiercehealthcare.com/hospitals-health-systems/survey-hospital-health-system-leaders-slow-to-adopt-risk-based-payment

- https://www.medicaleconomics.com/view/how-covid-19-affecting-practices-financially

- https://www.medpagetoday.com/columns/focusonpolicy/87399

Co-Authors:

Carsten Beith, Managing Director of Cain Brothers, a division of KeyBanc Capital Markets, joined the firm in 1993 to open the firm’s Chicago office. Mr. Beith is the Co-Head of Cain Brothers’ Health Systems M&A Group and a member of the firm’s management committee. Over 28 years, he has led a broad range of transactions covering hospitals and health systems, academic medical centers, physician groups, managed care organizations, and other health care service providers. His engagements have included sales, acquisitions, mergers, equity recapitalizations, joint ventures, joint operating agreements, restructurings, and other unique arrangements tailored to meet the objectives of each specific situation. Mr. Beith is a frequent speaker and author of articles on healthcare industry mergers and acquisitions. Prior to joining Cain Brothers, Mr. Beith was with Unibank A/S, a predecessor bank to Nordea Bank, where he was responsible for healthcare lending. He started his career with Arthur Andersen & Co., where his healthcare work included hospital audits, feasibility studies, and merger and acquisition advisory services. Mr. Beith earned an MBA in finance from New York University’s Stern School of Business and is an Honors College graduate of Michigan State University. Mr. Beith also holds a CPA license.

Carsten Beith, Managing Director of Cain Brothers, a division of KeyBanc Capital Markets, joined the firm in 1993 to open the firm’s Chicago office. Mr. Beith is the Co-Head of Cain Brothers’ Health Systems M&A Group and a member of the firm’s management committee. Over 28 years, he has led a broad range of transactions covering hospitals and health systems, academic medical centers, physician groups, managed care organizations, and other health care service providers. His engagements have included sales, acquisitions, mergers, equity recapitalizations, joint ventures, joint operating agreements, restructurings, and other unique arrangements tailored to meet the objectives of each specific situation. Mr. Beith is a frequent speaker and author of articles on healthcare industry mergers and acquisitions. Prior to joining Cain Brothers, Mr. Beith was with Unibank A/S, a predecessor bank to Nordea Bank, where he was responsible for healthcare lending. He started his career with Arthur Andersen & Co., where his healthcare work included hospital audits, feasibility studies, and merger and acquisition advisory services. Mr. Beith earned an MBA in finance from New York University’s Stern School of Business and is an Honors College graduate of Michigan State University. Mr. Beith also holds a CPA license.

James Moloney is Managing Director, Co-Head of Health Systems M&A Group and a member of the firm’s Executive Committee. Mr. Moloney joined Cain Brothers in 1995 and has 29 years of experience in health care mergers, acquisitions, financings, and real estate transactions. His clients include a broad range of academic medical centers, not-for-profit health systems, publicly traded and privately-owned healthcare providers, medical groups, real estate development companies, and real estate investors. Mr. Moloney’s recent notable engagements include the sale of Verity Health’s hospitals, a joint-venture between UNM Health System and Lovelace Health for the UNM Lovelace Rehabilitation Hospital, Group Health Physicians’ affiliation with Kaiser Permanente, MultiCare Health System’s acquisition of Rockwood Health System from Community Health Systems, Tenet’s sale of five Atlanta area hospitals to WellStar and Meriter Health Services’ affiliation with UnityPoint.

James Moloney is Managing Director, Co-Head of Health Systems M&A Group and a member of the firm’s Executive Committee. Mr. Moloney joined Cain Brothers in 1995 and has 29 years of experience in health care mergers, acquisitions, financings, and real estate transactions. His clients include a broad range of academic medical centers, not-for-profit health systems, publicly traded and privately-owned healthcare providers, medical groups, real estate development companies, and real estate investors. Mr. Moloney’s recent notable engagements include the sale of Verity Health’s hospitals, a joint-venture between UNM Health System and Lovelace Health for the UNM Lovelace Rehabilitation Hospital, Group Health Physicians’ affiliation with Kaiser Permanente, MultiCare Health System’s acquisition of Rockwood Health System from Community Health Systems, Tenet’s sale of five Atlanta area hospitals to WellStar and Meriter Health Services’ affiliation with UnityPoint.

Prior to his current role, Mr. Moloney founded and was the head of the Cain Brothers’ Real Estate Group. He has advised clients on real estate transactions valued in excess of $2 billion and involving more than 200 healthcare properties. Before joining Cain Brothers, Mr. Moloney was a member of Citicorp Securities Health Care Group for five years. He earned a BA in Business from University of Washington and an MBA from the University of Rochester’s William E. Simon School of Business.