December 3, 2020

The Market Response to the Building COVID-19 Mental Health Crisis – Burda on Healthcare

So far, my immediate family and I have dodged the coronavirus. With a wife who is a nurse, a daughter who works in public health, a son with a bachelors in statistics, a high school-age son who loves science and my reverence for facts as a journalist, it would be impossible not to take COVID-19 seriously.

We follow all the science-based guidance on how we can protect ourselves and others from contracting COVID-19. We do so knowing that there are no guarantees during this period of uncontrolled spread of the deadly virus because others aren’t taking it very seriously at all.

Mentally, we’ve done well, too. But now, our mental health will be put to the test as COVID-19 vaccines start entering the market.

It probably will be three months or more before it will be our turn to get the vaccine. We’re passengers on a sinking ship waiting to board a lifeboat. We’re vacationers on a burning plane waiting to slide down the inflatable chute. We’re standing on the roof of our house surrounded by rising flood waters, waiting for our turn to climb into the helicopter basket that will whisk us to safety.

The waiting is the hardest part, according to Tom Petty and the Heartbreakers.

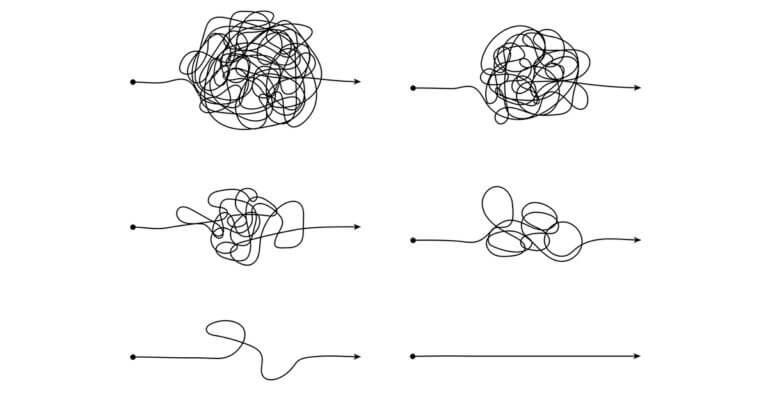

With that mental health challenge ahead of us, I wanted to learn more about how others are doing and how the market is responding to their behavioral health needs if we need help coping with the wait. So, I’m going to share what I learned in the format of a typical case study: challenges, solutions and results.

Challenges

Lots of research is coming out now that documents the negative impact that the pandemic is having on everyone’s mental health. Below is a representative sample of that research.

More anxiety, substance abuse and suicidal thoughts

In August, the Centers for Disease Control and Prevention published a study in Morbidity and Mortality Week Report (yes, that’s the same MMWR that Trump flunkies tried to politicize) that showed a COVID-related rise in mental health disorders, substance abuse and suicidal thoughts. You can download the CDC’s study here.

The study is based on a CDC survey of 5,412 adults age 18 or older conducted by the agency during the last week of June. Of those respondents, about one-third completed a similar CDC survey in April and/or May. The surveys asked the respondents about symptoms of an anxiety disorder, a depressive disorder or a trauma- and stressor-related disorder, or TSRD. They asked if they started or increased their use of alcohol, legal or illegal drugs or misuse of prescription drugs to cope with the outbreak. And they asked if they had seriously considered suicide in the 30 days before taking the survey.

Overall, 40.9 percent of the respondents reported an adverse mental or behavioral health condition. By condition, here are the numbers:

- 3 reported COVID-related TSRD

- 5 percent reported anxiety

- 3 percent reported depression

- 3 percent said they started or increased their substance use

- 7 percent said they seriously considered suicide within the previous 30 days

“Markedly elevated prevalences of reported adverse mental and behavioral health conditions associated with the COVID-19 pandemic highlight the broad impact of the pandemic and the need to prevent and treat these conditions,” the CDC said.

More mild, moderate and severe depression

In September, six researchers affiliated with Boston, Brown and Columbia universities published a study in JAMA Network Open that said the pandemic is exacerbating the level of depression in adults. You can download the study here.

The researchers compared the level of depression symptoms reported by two groups of adults age 18 or older. The pre-COVID group consisted of 5,065 adults surveyed in 2017 and 2018. The concurrent-COVID group included 1,441 adults surveyed in March and April of this year. The researchers ranked symptoms reported by the groups into five levels: none; mild; moderate; moderately severe; and severe.

The researchers found that the percentage of respondents at each level (other than none) was higher in the concurrent-COVID group compared with the pre-COVID group:

- 6 percent versus 16.2 percent for mild

- 8 percent versus 5.7 percent for moderate

- 9 percent versus 2.1 percent for moderately severe

- 1 percent versus 0.7 percent for severe

“There is a high-burden of depression symptoms in the U.S. associated with the COVID-19 pandemic, and this burden falls disproportionately on individuals who are already at increased risk,” the researchers said.

More demand for mental health care

In November, the American Psychological Association released the results of a survey of psychologists that said the demand for anxiety and depression treatments is growing because of the pandemic. You can read the survey results here.

The APA surveyed the 1,787 U.S. psychologists from Aug. 28 through Oct. 5, asking them to compare the demand for specific mental and behavioral health services before and after the pandemic. The top four disorders for which the psychologists said they were experiencing more demand for after the pandemic are:

- Anxiety disorders (74 percent of the respondents reported more demand)

- Depressive disorders (60 percent of the respondents reported more demand)

- TSRDs (51 percent of the respondents reported more demand)

- Sleep-Wake disorders (48 percent of the respondents reported more demand)

“These data underscore what we already feared: The coronavirus pandemic is taking a heavy emotional toll on many Americans,” the APA said in a press release announcing the survey results.

Interestingly, only 29 percent of the surveyed psychologists said they are seeing more patients despite the increase in demand. Seventy-one percent said they are seeing the same or fewer patients.

Solutions

Anxiety. Depression. Sleep disorders. Substance abuse. Suicide. TSRD. All are on the rise because of the pandemic, as these and other credible reports and research reveal. But, the healthcare system as it runs today can’t meet that growing demand for mental and behavioral health services.

What can the market do to reverse the situation? Well, as it turns out, a lot. Here are a few examples of how the market is responding to the COVID-driven demand for mental and behavioral health services.

Digital health tools

Start-up technology companies are flooding the market with digital health tools and apps in response to the demand for behavioral health services. In its second quarter 2020 report on venture capital funding of digital health companies, Rock Health said digital behavioral health companies attracted $588 million in venture capital through the first six months of 2020. That half-year figure exceeds the full-year figure of $539 million in funding for 2019. You can download the Rock Health report, released in July, here.

According to the report, the tools and apps attracting most of the big bucks fall into one of two buckets:

- Technologies that enable existing providers to offer remote treatment like telemedicine for acute and chronic behavioral health conditions

- Digital therapeutics that enable consumers to manage or treat their behavioral health conditions themselves

“Funding has gone to companies with a range of product features, from fully automated chatbots to video chat platforms with additional tools that augment patient-clinician interactions,” Rock Health said.

In the APA survey, for example, of the 96 percent of the psychologists who said they are seeing patients despite the outbreak, 64 percent said they are doing it all remotely, and 32 percent said they are doing it via a combination of in-person and remote visits.

Behavioral health integration

In October, the American Medical Association created the Behavioral Health Integration Collaborative, which you can learn more about here.

The goal of the BHI Collaborative is teaching primary-care physicians how to integrate behavioral health services into their practices. That means the PCPs aren’t just treating a physical injury or illness during a patient visit. They’re also treating the patient’s behavioral health during the same visit as physical health and mental health are inextricably linked.

The AMA said most successful behavioral health integration models follow one of two types:

- A co-located model in which behavioral health clinicians are physically onsite at the primary-care practice

- A physically separate model in which offsite behavioral health clinicians supervise onsite care managers who help the PCPs provide behavioral health services to their patients

“Identification and management of behavioral health conditions should be a core competency of primary care practice, not an exception,” the AMA said, acknowledging that the pandemic has only accelerated that recognition.

Expanded mental health benefits

Employers also are feeling the effects of the pandemic not only from the shift to work from home for most of their employees but from their employees’ COVID-related medical claims and benefits needs.

For example, Willis Towers Watson, the benefits consulting firm, surveyed 397 U.S. employers from Aug. 11 through Sept. 9 and asked them what they’re worried about. The surveyed employers’ top concerns for next year are:

- Affordability of specialty drugs (cited by 85 percent of the respondents)

- Access to mental health services (cited by 84 percent of the respondents)

- Affordability of mental health services (cited by 78 percent of the respondents)

- Access to substance abuse treatment (cited by 77 percent of the respondents)

- Affordability of specialty care medical services (cited by 77 percent of the respondents)

What are they going to do about it? Fifty-one percent of the employers said they intend to offer “third-party digital, virtual or coaching solutions” to their employee with mental and behavioral health needs. That’s on top of the 66 percent that already offer tele-behavioral health services to their workers. You can download the survey results, released in October, here.

Further, 20 percent of the 1,113 employers surveyed by Mercer, the benefits consulting firm, said they intend to or are seriously considering increasing their support for workers’ behavioral health benefits in 2021. You can download the results of the Mercer survey, also released in October, here.

Results

It’s clear that the market is responding to the off-the-charts demand for mental and behavioral health services created by the pandemic, whether that’s new digital health tools, new models of care or new benefits designs.

What will the results be of all these market-driven innovations in how the current system delivers and pays for mental and behavioral healthcare? I have no idea. That’s a question for public health experts and health services researchers to answer a year or two from now.

For me, I just hope I’m still not waiting in line for a vaccine.

Thanks for reading.

Stay home. Stay safe. Stay alive.