November 12, 2019

Transforming the Built Environment: Unlocking Value Across the Health Care Continuum

Health care providers suffer from a unique form of institutional irony: delivering institutionalized care in centralized, high-cost facilities impedes their ability to meet their communities’ expansive health and wellness needs.

According to an influential 2007 study in the New England Journal of Medicine, medical care accounts for only 10% of health status.[1] By contrast, lifestyle choices, genetics and social circumstances account for 85%. The vast majority of factors that determine individual health and wellness (social determinants of health) originate outside health care delivery.

To improve health status and promote more efficient delivery of care, payment models are shifting away from fee-for-service (FFS) formularies to risk-based models. In response, more convenient, lower-cost facilities and delivery channels are emerging to deliver routine care services.

Burdened by expensive legacy facilities, antiquated technology systems and suboptimal service lines, many health systems and other health care providers continue to operate in “built environments” designed for a fee-for-service payment models.

Owning and operating these high-cost acute facilities is becoming a significant, even existential, threat to traditional health care providers.

For most health care providers, however, facility ownership and full operational control are sacrosanct. Over 65% of the trillion dollars invested in hospital and ambulatory care facilities is locked up in health system and other provider balance sheets. This remains true even as providers struggle to fund, invest and develop the capabilities related to data analytics, smart technologies, telehealth and retail strategies that underlie value-based care delivery.

As individual consumers exercise more discretion in their health care purchasing, they are demanding easier, more convenient and lower-cost treatment alternatives. Under this type of market pressure, health systems and other providers require greater strategic flexibilty to align their operating models and facilities to changing market demands. It is clearly time to “think different” about where providers meet and treat healthy consumers as well as sick patients.

In other industries, operators routinely transfer real estate ownership and associated risk to third parties through sale and/or leaseback transactions. This type of facility ownership transfer is beginning to happen in health care. Like companies in other capital-intensive industries, health systems and other providers are monetizing real estate assets to increase vital investment capital, mitigate financial risk and free providers to concentrate on service delivery. As pressures to improve operational performance mount, the rate of capital repositioning among health systems and other providers also will increase.

With liberated capital, health systems and other providers may also co-invest with strategic partners on new facilities, services, technology systems and delivery channels that advance health status in targeted communities. Redesigning services and repurposing facilities as part of a strategically designed built environment can dramatically enhance performance while supporting ongoing organizational sustainability.

Breaking Free of the Ownership Burden

A half century of artificial economics has calcified strategic thinking regarding hospital ownership and operations.

Under FFS medicine, owning and controlling all acute care facilities and service lines enabled health care providers to maximize revenues and profits. This managerial mindset emphasizes getting paid, not value creation. Accordingly, the following “truths” have governed provider business models for decades:

- Hospitals and on-campus ambulatory centers are the ideal (only) settings to deliver care.

- Services offered in alternative settings or through alternative channels (homecare, telemedicine, retail clinics, etc.) are marginal, costly and potentially harmful to patients.

- Health care activities are too complex and specialized to become commodity services subject to competitive pricing.

- Primary or preventive care is less “valuable” than acute or emergency care.

- Clinical expertise and quality outcomes matter more to patients than customer service, convenience and experience.

- Owning and/or controlling all production factors optimizes performance.

The consequences of this managerial mindset exacerbate the inefficiencies of the American health care system and contribute to its soaring costs. U.S. health care spending has doubled in the last 15 years.[2] During the same period, U.S. life expectancy has declined.[3]

These FFS “truths” are largely myths. While some complex procedures and patient monitoring must occur in high-tech facilities, the health care ecosystem needs many fewer acute facilities than it currently operates.

An overbuilt and profligate acute care infrastructure burdens the U.S. economy and fragments care delivery. The American people shoulder this burden through skyrocketing health insurance costs, over-treatment, personal bankruptcies and compromised service access.

To succeed in a value-based market, providers must focus on value creation, not preserving facility ownership and maintaining tight operational control. Even with a full commitment to value-based care, no health system has the financial capacity and operational expertise to deliver the range of services consumers increasingly expect and demand.

Fortunately, health systems and other providers do not have to accomplish these goals alone. They can develop strategic partnerships that share risk, expand expertise, lower costs and streamline operations. They win by assembling all necessary services, facilities, technologies and data on integrated platforms

tailored to consumer needs and value-based service provision.

Win-Win Real Estate Partnerships

In his 1999 book, Nonzero: The Logic of Human Destiny, author Robert Wright makes a compelling case that the arc of human history mirrors the evolution of increasingly complex win-win arrangements. Such partnerships enable collaborating parties to enjoy mutual (nonzero) gains while limiting zero-sum losses.

The hospitality, transportation and retail industries have modified their built environments by engaging in win-win real estate partnerships that enhance operational performance. Companies operating in these “asset-heavy” sectors separate facility ownership, facility management and business operations by distributing production and ownership responsibilities. This enables businesses to reduce costs, maintain strategic flexibility and focus on creating value for customers.

Hotel chains burnish their brand identities through their facilities, yet few own the buildings in which they operate. Instead, they lease properties from third parties, most notably Real Estate Investment Trusts (REITs). Acute care providers can do the same.

Not all money is the same shade of green. The best real estate investment partners bring not only funding, but capabilities, perspective and relationships to their strategic partnerships with health systems.

For example, Jefferson Health is fundamentally rethinking its approach to facility ownership, delivery channels and service lines. As Jefferson’s CEO Stephen Klasko notes,

“We’re moving towards a future where hospitals are a commodity and no longer the center of the health care ecosystem. As providers, our main job will be to deliver health assurance services and sick care only when needed.

Other services will get plugged in, and the line between digital and bricks-and-mortar will disappear. No one talks about “tele-banking” anymore, it’s just banking which has moved from the bank to the home. The same thing will happen in health care.”

Klasko describes the new approach as “health care with no address,” where Jefferson starts with consumer needs to design its strategic operational priorities. In line with Klasko’s vision, the following two case studies also illustrate how repositioning health care real estate can accelerate growth, create scale and amplify market impact.

A Toledo Tale: Promedica and Welltower Restructure HRC Manorcare

Since the late 1960s, Toledo-based HCR ManorCare has operated skilled nursing and assisted living facilities, rehab clinics, hospice and home health care services across the nation. Confronting serious financial challenges and an unfavorable regulatory environment in 2018, the company entered into negotiations with two other Toledo-based companies (ProMedica and Welltower) to restructure its assets.

![]()

ManorCare’s then-CEO Steve Cavanaugh, who now serves as ProMedica’s CFO, describes ManorCare today as a company that can deliver care more effectively within an integrated and seamless continuum,

“By fully integrating with a leading health system (in ProMedica) and a health care real estate company specializing in senior living communities and ambulatory, outpatient and post-acute care facilities (in Welltower), we were able to incorporate programs focused on social determinants into our advanced care models on a national scale.”

This win-win-win partnership leverages ManorCare’s expertise to expand ProMedica’s post-acute network in multiple new markets with the financial backing of an experienced and aligned strategic capital partner in Welltower.

Caring More: Integrating Senior Living Facilities Into Holistic Medicare Advantage Coverage

Welltower’s platform of over 1,100 independent living, assisted living and memory care communities provide built environments of care and wellness for a large population of at-risk seniors. These controlled settings enable innovative health care/wellness service models and technologies to be tested and delivered at scale.

Welltower’s recently-announced collaboration with CareMore/Anthem illustrates the power of strategic partnerships. Their collaboration combines CareMore’s holistic approach to health and wellness within Welltower’s network of community-based independent and assisted living centers.

The partnership offers Welltower’s residents the opportunity to enroll in Medicare Advantage institutional special needs plans (I-SNPs) offered by health plans affiliated with CareMore. Through these I-SNPs, CareMore clinicians will deliver and manage care for these patients residing in Welltower facilities.

These safe, purpose-built living environments will enable Caremore to attend to important elements of wellness, including nutrition, hydration and medication adherence, in controlled lower cost, home-like settings. As CareMore President Sachin Jain notes,

“Leveraging CareMore’s high-touch integrated model in Welltower communities brings world-class care to residents on-site. Our interdisciplinary care teams (physicians, nurse practitioners, and pharmacists) make high-quality, compassionate health care easy to access.”

Conclusion: Health Care’s New Frontier

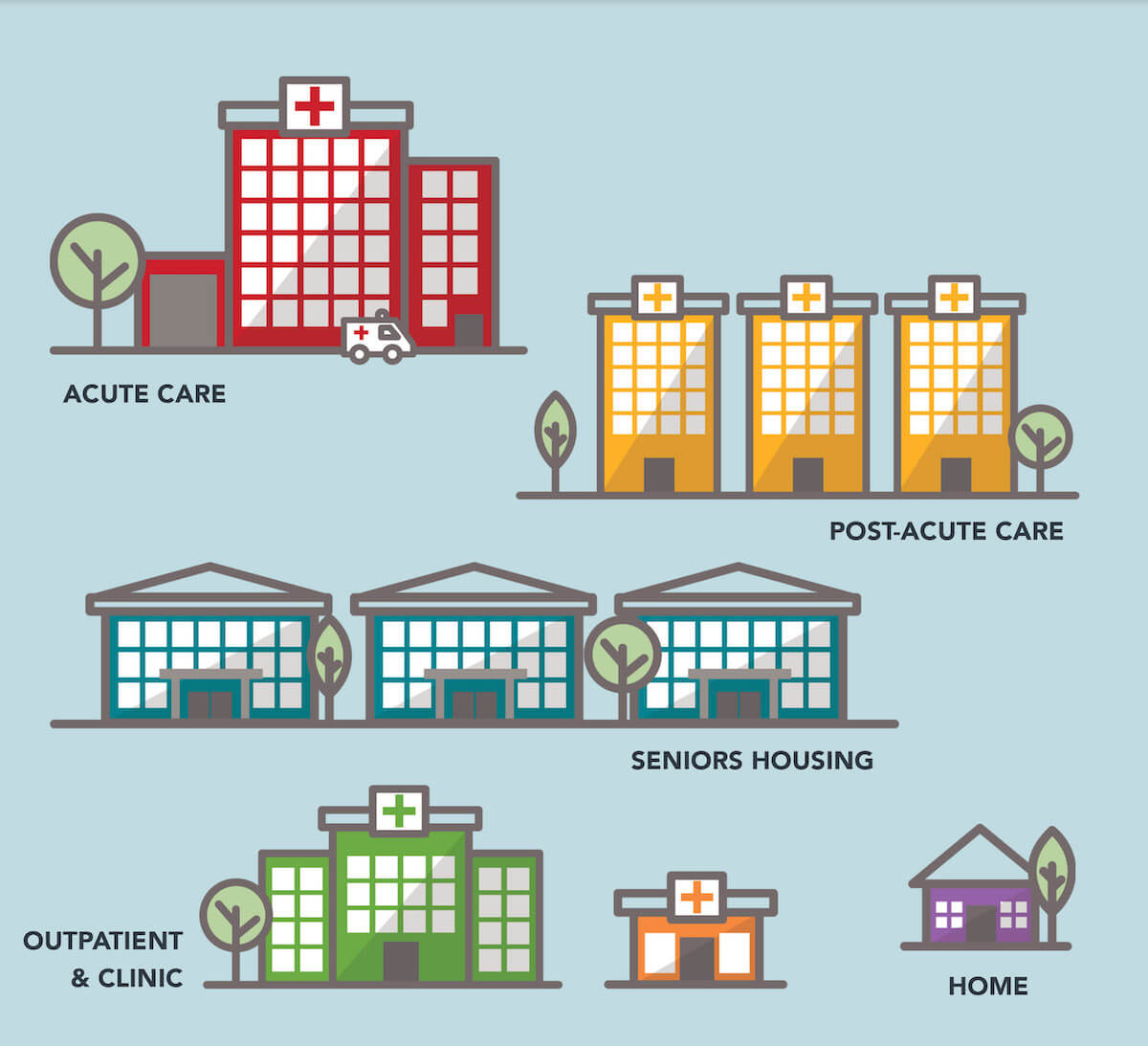

U.S. health care is transitioning to new payment and operating models predicated on value. While the transition will be uneven, the long-term trend is toward decentralized care delivery on integrated platforms that provide the right care at the right time in the right place at the right price.

To position themselves for success, enlightened health systems and other providers are disrupting their own business models with the help of aligned strategic partners. They are developing population health business models, decentralizing service delivery, embracing lower-cost technologies that increase access (e.g. telemedicine) and undertaking more risk-based contracting.

Partnered solutions for real estate turbocharge capital formation for health systems and other providers. They enable integrated care delivery platforms that deliver exceptional outcomes, service and customer experience at competitive prices.

Jefferson Health CEO Steve Klasko likes to recount an anecdote about Steve Jobs. Asked by Apple CEO John Sculley to come up with a three-year business plan, Jobs produced the following:

Year 1: We change

Year 2: We change the industry

Year 3: We change the world

With new thinking on facility ownership, service provision and value creation, visionary health care companies and their partners are changing the health care industry for the better. They may even change the world.

Outcomes Matter. Customers Count. Value Rules.

Sources

- Source: Revista; Fall 2018 Industry Outlook, data as of 12/31/2017

- https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html

- https://www.cnbc.com/2019/07/09/us-life-expectancy-has-been-declining-heres-why.html

- Welltower and ProMedica created a strategic joint venture to acquire the ManorCare assets with Welltower taking an 80% ownership stake. ProMedica took the remaining 20% ownership interest and signed a long-term lease agreement with Welltower. At closing, ProMedica converted ManorCare’s operations to not-for-profit status while retaining its name and branding.

Co-Author

Thomas J. DeRosa has been the Chairman of the Board of Welltower Inc. (NYSE: WELL), an S&P 500 company since May 2019 and Welltower’s Chief Executive Officer since April 2014. Under his leadership, WelltowerTM has grown into the global leader in health care real estate with a broad, diversified portfolio across the United States, United Kingdom and Canada. Since Mr. DeRosa assumed his current position in April 2014, Welltower’s enterprise value has grown to over $50 billion. He has served as a Director of the company since 2004.

Thomas J. DeRosa has been the Chairman of the Board of Welltower Inc. (NYSE: WELL), an S&P 500 company since May 2019 and Welltower’s Chief Executive Officer since April 2014. Under his leadership, WelltowerTM has grown into the global leader in health care real estate with a broad, diversified portfolio across the United States, United Kingdom and Canada. Since Mr. DeRosa assumed his current position in April 2014, Welltower’s enterprise value has grown to over $50 billion. He has served as a Director of the company since 2004.

Mr. DeRosa is former Vice Chairman and Chief Financial Officer of The Rouse Company, a position he held from September 2002 until November 2004, when The Rouse Company merged with General Growth Properties, Inc. From 1992 to September 2002, Mr. DeRosa held various positions at Deutsche Bank AG, DB Alex Brown, and Alex. Brown & Sons including Global Co-Head of the Health Care Investment Banking Group. Mr. DeRosa’s extensive background in health care, real estate and capital markets has allowed him to uniquely position Welltower as a leading proponent for collaboration across the continuum of health care — including seniors housing, independent living, memory care, post-acute and outpatient medical facilities — to drive cost efficiencies and better outcomes.

Throughout his career, Mr. DeRosa has championed diversity and inclusiveness, believing that innovation and business success stem from a creative mix of personalities, skills and backgrounds. Mr. DeRosa has extensive corporate governance experience and has sat on the Board of four NYSE companies including Dover Corporation and Empire State Realty Trust, Inc. He has previously served on the Board of Directors of Georgetown University and as a member of the Health Advisory Board of the Michael Bloomberg School of Public Health at Johns Hopkins University. Mr. DeRosa currently is Governor of the World Economic Forum, a member of the Advisory Board of the Health Care and Pharmaceutical Management Program at Columbia Business School, a member of the Park Avenue Armory Board and a Director of CECP – The CEO Force for Good which was founded by the actor and philanthropist, Paul Newman. In 2018, Mr. DeRosa was named to the Board of Overseers of the Columbia University School of Business. He is a frequent speaker on the growth of aging populations, their unique challenges and opportunities to drive better outcomes in health care delivery. Mr. DeRosa was the 2016 National Honoree of The Alzheimer’s Association.

Mr. DeRosa is a graduate of Georgetown University and earned an MBA from the Columbia University Graduate School of Business.