March 4, 2025

Undue Duplicity: The False Promises of Phantom Debt Relief

Amid much fanfare, Gov. J.B. Pritzker announced on Feb. 26, 2025, that the state of Illinois would cancel $220 million in outstanding medical debt owned by low-income residents. This was the second round of Pritzker’s $1 billion medical debt relief program. Since the program’s launch in early 2024, Illinois has erased more than $345 million in medical debt for 270,000 residents across 100 counties. The debt abolished per person averages $1,300.

Unfortunately, appearances are deceptive. Pritzker’s medical debt relief program cancels debt that hospitals, health systems and other medical providers have already written off. No debt collector was coming to wrench money out of the hands of poor Illinoisans. While the letters that recipients receive detailing their medical debt relief may provide some comfort, they offer no incremental financial benefit.

A high-profile nonprofit organization named Undue Medical Debt orchestrates these sleight-of-hand debt relief programs. Undue’s business model, operations and marketing are hypocritical and cruel. The company offers false hope to beleaguered American consumers riddled with unpaid medical bills. Undue is anything but “a source of justice” as their website claims.

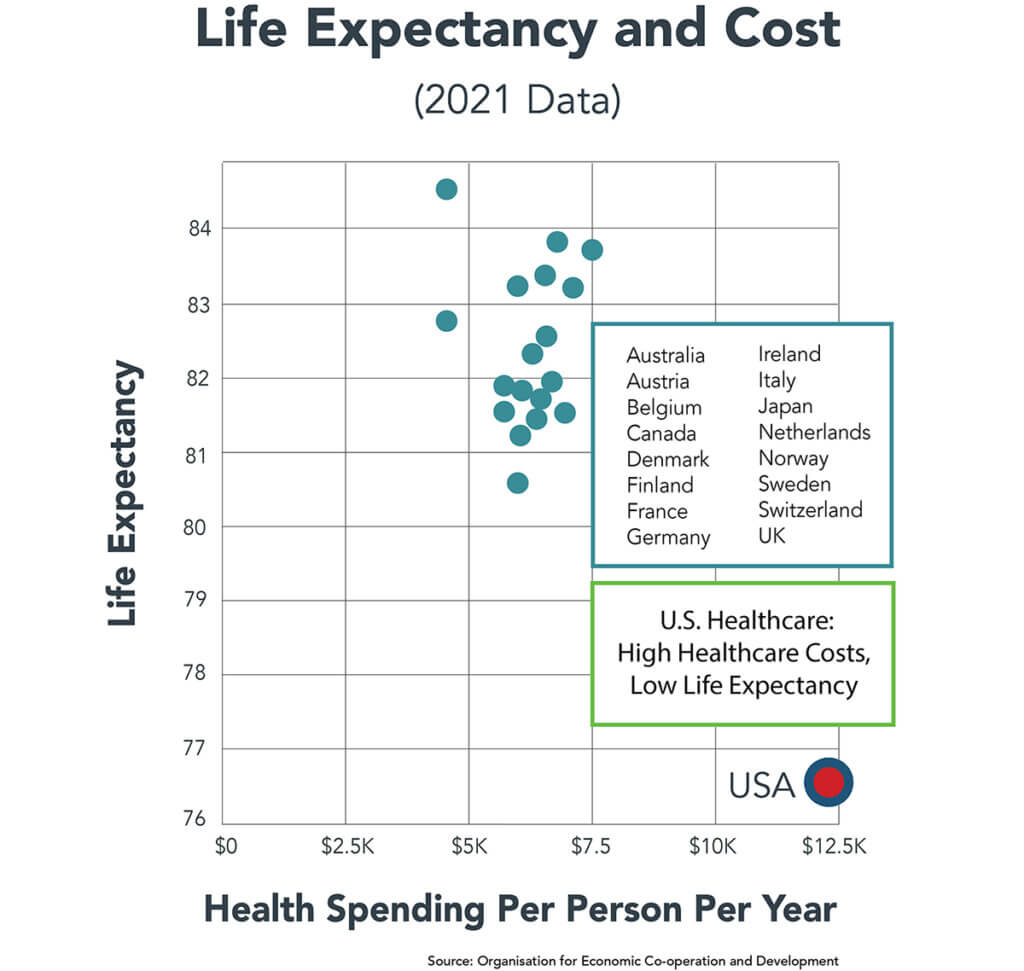

Before exposing Undue’s duplicity, it is essential to establish the catastrophic psychological toll and financial harm that the U.S. healthcare system inflicts on the American people. As depicted in the chart below, the ineffectiveness of the U.S. healthcare system is unique among wealthy nations. Its hallmarks are high costs and early death.

Indeed, it is the U.S. system’s fundamental failures that create the fertile soil into which Undue can plant and grow its false claims. U.S. healthcare requires transformation, not window dressing to meet the American people’s expansive health and healthcare needs.

Numbers Tell the Real Story

Almost every American family has healthcare horror stories. These stories range from medical errors to overcharging to neglect to overtreatment to lack of access to illogical billing. Americans’ fear and anger with the healthcare system is boiling over. It manifests as fear, distrust and self-destructive medical behaviors:

- A recent Gallop study found that trust in the U.S. medical system had dropped to just 34%.

- A NORC survey found that more Americans fear paying a medical bill than contracting a serious illness.

- A JAMA study found that over 20% of adults 65 and older did not fill prescriptions due to cost.

- A Kaiser Family Foundation survey found that 73% of adults worry about their ability to access care and that 40% have some form of medical debt.

- A Commonwealth study found that nearly a quarter of working adults have insurance that leaves them underinsured.

The picture that emerges from these studies is a burdensome patchwork of health insurance coverage through which consumers struggle to gain access and information and pay their medical bills. Wrapped in the saintly garb of do-gooding philanthropists, Undue exploits healthcare’s complex billing practices and Americans’ frustrations with their healthcare system to ride to their apparent rescue. Don’t believe it.

Digging into the Illinois program’s numbers reveals how Undue creates the illusion of delivering substantial medical debt relief. This passage from news coverage of Gov. Pritzker’s announcement describes how Illinois’ medical debt relief program operates,

To cancel debt, the Illinois Department of Healthcare & Family Services, or HFS, has partnered with national nonprofit Undue Medical Debt, which negotiates down patient debt with hospitals and health systems and buys it at a steep discount.

“Steep discount” is a gigantic understatement. Undue targets unpaid balances up to seven years after providers have stopped collection efforts. This is why Undue can purchase medical debt for less than one cent per dollar owed. Moreover, the long lead times between the debt cancellation and medical services provided make Undue’s medical debt “relief” out-of-date as well as irrelevant.

With Undue’s assistance, Illinois has spent $2 million to date to “buy back” $345 million in outstanding medical debt owed by the state’s residents. That rounds up to six-tenths of a penny for every dollar of cancelled debt. In essence, it costs the state $7.54 to “repay” the average $1,300 claim.

No provider would ever accept such miniscule payment for collectible medical bills. Healthcare providers have inflated “chargemasters” that list their medical treatment prices. Chargemaster prices bear little relationship to providers’ underlying costs. They are a tool providers use to maximize payment from third-party payers (governments, health insurance companies and self-insured employers) and document higher levels of community benefit.

Although increasing, patients’ out-of-pocket costs (e.g., copays and deductibles) represent a small fraction of medical payment. At the same time, they often create a severe financial hardship for low-income individuals. This is why providers establish charity care policies to minimize patients’ financial burden.

Given the relatively small dollar amounts and collection difficulty, most providers expend little effort to collect outstanding medical debts from low-income patients. Ultimately, they write them off as charity care on their income statements. These are the “medical debts” that Undue is “purchasing” from providers.

Rather than sell these written-off claims to Undue, enlightened providers are sending their own letters to patients informing them of the retirement of their outstanding medical debt. Why not? It’s always cheaper to eliminate the intermediary.

Shakedown Accounting

Undue Medical Debt was founded in 2014 as RIP Medical Debt by experienced debt collection executives Jerry Ashton and Craig Antico along with “healthcare industry expert” Robert Goff. The company’s stated mission is “to strengthen communities by erasing financially burdensome medical debt.”

Undue targets its programs to benefit low-income Americans. Recipients’ incomes cannot exceed 400% of federal poverty guidelines unless their medical debt exceeds 5% of their annual income. Funds disproportionately support debt relief for people of color who disproportionately struggle with medical and dental debt according to an analysis by the Kaiser Family Foundation and the Peterson Center on Health.

Undue’s founders knew how to play the medical payment game and went after easy-to-write-off medical claims with a vengeance. In June 2016 as RIP Medical Debt, the company orchestrated a masterful publicity coup. It collaborated with John Oliver, the host of HBO’s “Last Week Tonight,” to create a debt acquisition company for $50 through an Alabama internet site.

Oliver named the company Central Asset Recovery Professionals or CARP after the bottom-feeding fish. CARP subsequently purchased the medical debt of 9,000 people totaling $15 million at a discounted price of $60,000 (four-tenths of a penny per dollar of debt purchased). With much hullaballoo, Oliver then forgave the debt on air. So began a juggernaut.

In fairness to Undue, purchasing and forgiving steeply discounted medical debt was a logical first step to establish the company’s credibility and pursue fundraising. Here’s the rub. Undue has never expanded its model to deliver real debt relief. In the process, it has become a large, high-profile company basking in the glow of its perceived good deeds.

Undue now has a staff of 40 professionals and a slick, sleek website with client testimonials, progressive policy positions, gushing news reports and a continuous counting board tabulating the amount of debt retired. To date, Undue claims that it has erased almost $15 billion in medical debt on behalf of nearly 10 million people living it the U.S.

Undue’s fundraising has been prodigious. The company has hoodwinked billionaire McKenzie Scott into contributing $130 million in three separate donations. Charity Watch assigned Undue a “C+ rating” in 2023, noting the company spent 19% of its expenses on overhead and maintained excessive cash reserves. According to the company’s IRS tax Form 990 for 2023, Undue had nine executives with annual total incomes exceeding $135,000, including compensation for CEO Allison Sesso exceeding $325,000.

In February 2023, the Biden administration committed a monumental policy blunder. It approved the use of American Rescue Plan (ARP) monies by state and local governments to fund medical debt purchasing programs like those offered by Undue. Illinois, for example, is using ARP monies to fund its medical debt relief program.

On its website, Undue identifies 16 governmental “partners,” including the state of Illinois. It’s acceptable for Scott to fund a toothless debt relief program if she so chooses. It is unacceptable to use hard-earned taxpayer dollars for the same purpose.

The English language has multiple idioms to describe enterprises that appear promising on the surface but lack substance upon closer examination. They include “all sizzle and no steak,” “all hat and no cattle,” “all bark and no bite,” and “all talk and no action.” These phrases capture the skeptical mindset required to engage con artists. Undue Medical Debt no more relieves real medical debt than snake oil relieves rheumatism.

In describing its mission on its website, Undue Medical Debt makes this stirring proclamation:

We work tirelessly to end medical debt and ensure a future where everyone can access healthcare without fear.

My favorite aphorism is, “Hypocrisy is the tribute vice pays to virtue.” In essence, there would be no need to be hypocritical unless a person or organization wanted to appear virtuous. My take is that Undue works tirelessly to erase long-delayed, already written-off medical debt without improving care access nor reducing fear. Its financial chicanery and self-righteous promotion harm the very people the company claims to serve.

Band-Aids cannot heal the gaping structural inequities embedded within U.S. healthcare. The nation requires a revolutionary overhaul of its healthcare system to promote value, consumerism and equitable access for all. Claiming to meet a fundamental need without delivering tangible benefits, as Undue Medical Debt does, decreases public trust and complicates true reform efforts. Don’t be fooled.