September 24, 2019

Upselling in Healthcare? It’s Just Business

As wary consumers, we’ve come to expect upselling. Need an oil change? Looks like you need a new air filter and radiator flush, too. That sports coat looks fantastic on you. This shirt and tie absolutely would go great with it. But, we don’t expect to be upsold when we see our doctor. Yet, a new study suggests that’s exactly what’s happening when patients go to a hospital-owned physician practice.

The new study appeared in the Journal of General Internal Medicine. Researchers from Rice University compared the cost and quality outcomes of patients treated by hospital-owned physician practices and those treated by physician-owned practices.

The study pool consisted of more than 600,000 adult patients enrolled in a commercial PPO offered by Blue Cross and Blue Shield of Texas. The researchers analyzed the claims submitted by patients for care provided by primary-care practices from 2014 through 2016. Of the 1,907 practices in the study, 1,869, or 98 percent, were physician-owned. Hospitals or hospital systems owned the other 38 practices.

The researchers compared annual healthcare spending by patients treated by physician-owned practices with those treated by hospital-owned practices. They also compared the outcomes of patients treated by physician-owned practices with those treated by hospital-owned practices. The outcomes were 30-day readmission rates, adherence to diabetes treatment protocols and breast cancer screening rates.

After adjusting for patients’ medical conditions and the local cost of living, patients treated by hospital-owned practices spent more on care than patients treated by physician-owned practices with virtually no difference in the three outcome measures.

The average annual spending on healthcare services by patients treated by hospital-owned practices was $4,824.93, or more than 8 percent higher than the $4,451.80 by the patients treated by physician-owned practices, the study found.

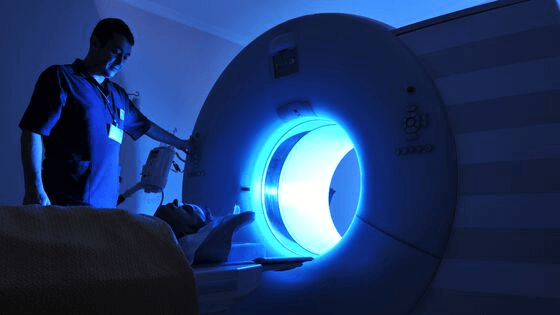

More interesting was what drove higher spending by patients who saw doctors whose practices were owned by hospitals. It wasn’t the prices. It was greater utilization. Specifically, it was more spending on imaging procedures, durable medical equipment and other “unclassified services.”

All things being equal, patients spent more at hospital-owned practice compared with physician-owned practices because they bought more whether they needed it or not as the outcomes were the same.

“Our findings, combined with previous research, suggest that increased integration leads to higher spending, with no consistent evidence of better quality,” the researcher said.

This, in a word, is upselling.

Large hospital-owned practices have more things to sell and an incentive to sell more things so they do. Small physician-owned practices have fewer things to sell despite the same incentive so they don’t.

The study results lay bare the motivation behind the vertical integration craze in healthcare. Not only can you control and set the prices for another segment of the healthcare delivery system, you can sell more things. It’s upselling.

Healthcare is a business just like any other business. Vertical integration is a business strategy to lower operating costs, raise prices and sell more products and services. That’s as true in healthcare as it is in any other industry.

That’s why the researchers from Rice recommended several market-driven policies to counter what’s happening in healthcare. They suggested:

- Accelerating the shift to value-based reimbursement models to lessen the incentive to do more in order to get more

- Reducing administrative and regulatory burdens on physician practices to lessen their incentive to sell out to hospitals or hospital systems

- Ratcheting up state and federal oversight of contracts between insurers and hospital systems to ensure that contracts reward lower prices and higher quality rather than market power

Hospitals behave like businesses because they are businesses. If you want them to behave in a way that produces better outcomes for less money, then you have to give them a business reason to do so.

Thank you for reading.