March 14, 2019

Why Proponents Are Finding Innovative Health Plan Designs a Hard Sell

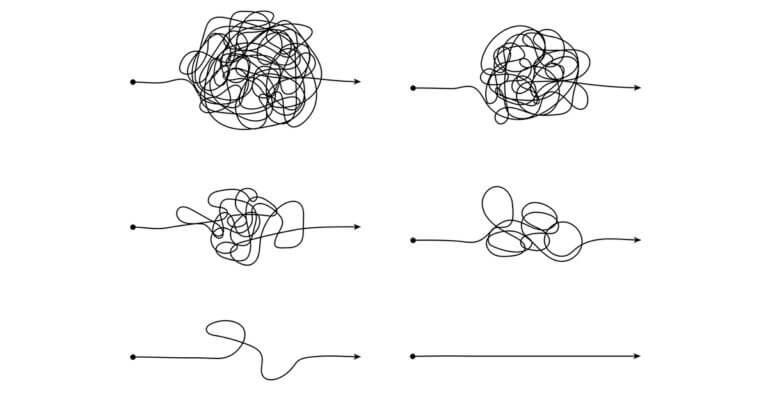

When your phone company or your cable provider offers you a new and innovative service plan, your immediate thought is that you’re going to end up paying more for less. That same lack of trust is stalling the adoption of new and innovative health plan designs that promise to lower healthcare costs without jeopardizing the quality of patient care.

That’s the takeaway from two new studies on why buyers of healthcare services—both enrollees and employers—are shying away from new types of benefits designs.

The first study, by researchers from California State University and the University of California, appeared in the journal Health Affairs. They wanted to know what people thought of three types of value-based health insurance benefits designs.

The three types are:

- Value-based benefit design under which enrollees pay less for high-value medical services and more for low-value medical services

- Reference pricing under which enrollees pay the difference between the price set by their health plan for a medical service and the price charged by a provider if that price was higher

- Narrow networks under which enrollees are required to get their medical care from a limited and fixed network of hospitals and doctors

To find out, the researchers interviewed and surveyed 125 people in three communities in Northern California. The respondents had health insurance through their employer or a health plan purchased over the state’s ACA-mandated health insurance exchange.

None of the three nontraditional health plans drew a favorable response from more than half of the enrollees:

- 41 percent had a favorable view of value-based benefit design with 8 percent having a negative view (the rest had no opinion or didn’t know what it meant)

- 28 percent had a favorable view of reference pricing with 12 percent having a negative view (the rest had no opinion or didn’t know what it meant)

- 21 percent had a favorable view of narrow networks with 23 percent having a negative view (the rest had no opinion or didn’t know what it meant)

The researchers said that the enrollees equated quality with the patient-provider relationship, not with any objective quality measures, which they didn’t trust. The researchers also said that the enrollees had trouble separating price from quality, not realizing that they could get the same quality medical care for less from another provider.

“We found skepticism and mistrust of value-based insurance design approaches, even when issues related to quality and pricing were explained,” the researchers said.

The California researchers’ peers from Harvard University didn’t fare any better in their study, which appeared in the American Journal of Managed Care.

They interviewed 13 people from 12 organizations about reference pricing. Seven of the 13 were from benefits consulting firms or business coalitions; six were human resources executives from large self-insured employers. Nine of the 13 considered reference pricing but didn’t implement it. Four did.

Though all agreed that reference pricing could save money without a drop in the quality of care, they said most employers shy away from reference pricing for three reasons:

- It’s a complex benefit that difficult to administer

- It puts employees at risk for catastrophic out-of-pocket costs

- It requires significant employee education and communication to work

“Despite strong evidence that RBP (reference-based pricing) can decrease healthcare spending, our findings suggest that it is unlikely that there will be wide adoption of RBP in its current form in the U.S. commercial health insurance market,” the researchers conceded.

The results from the two studies reveal a few things.

First, virtually everyone has been burned by their health insurer like they’ve been burned by their phone company or their cable provider. Everyone has paid more and gotten less. The mistrust runs deeps.

Second, health insurance is complicated. It’s too complicated. Not just for patients but for employers that provide health benefits to their workers. The time to simply health insurance is now.

Third, the best chance that innovative health plan designs have to take root and grow is health literacy. Nothing will happen without enrollees understanding how things work. Communication is critical.

Market-based healthcare reforms run on educated customers.

Author

David Burda is a columnist for 4sight Health and news editor of 4sight Friday, our weekly newsletter. Follow Burda on Twitter @DavidRBurda and on LinkedIn. Read his bio here.