August 14, 2019

Win-Win Partnerships: Strategics and Sponsors Increasingly Team Up

As US healthcare consolidation continues, innovative corporate buyers (strategics) and private equity investors (sponsors) are partnering to accomplish increasingly complex transactions. Such deals can create win-win arrangements that serve market needs for value-based care services. Yet they can be challenging to design and execute. This commentary looks at the structures of a variety of pioneering deals that have proven effective in select situations.

When Kindred put its company up for sale in 2017, Humana wanted to acquire Kindred’s home health, hospice and community care businesses (Kindred at Home) to expand its non-acute care platform. Humana was not interested, however, in acquiring Kindred’s long-term acute care hospitals, inpatient rehabilitation facilities or contract rehab services business (Kindred Healthcare).

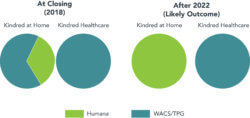

Rather than pass on the opportunity or buy assets it didn’t want, Humana partnered with two private equity firms, Welsh Carson (WCAS) and TPG, in 2018 to get the deal done. As part of the transaction, WCAS and TPG created a new standalone business comprised of Humana’s long-term care and specialty hospital assets. At closing, TPG and WCAS separated Kindred at Home from Kindred Healthcare. The two PE firms simultaneously formed a joint venture with Humana to own Kindred at Home.

Initially, Humana acquired a 40% ownership stake in Kindred at Home for $800 million with a unique put/call structure that offers a predefined path for the company to acquire full ownership of the Kindred at Home assets.

After July 2022, TPG and WCAS can sell their 60% stake in Kindred at Home to Humana at a predetermined cash-flow multiple.

After July 2023, Humana can buy out its PE partners under the same valuation methodology.

This structure benefits both Humana (path to 100% ownership) and WCAS/TPG (predefined exit strategy).

Importantly, this transaction structure enabled Humana to acquire only the assets that its leadership believes will generate the greatest strategic value for shareholders. Post-transaction, Humana became the nation’s largest provider of health and hospice services, creating synergies with its existing Medicare and Medicare Advantage service lines.

By forming a consortium to purchase the Kindred assets, Humana, WCAS and TPG were able to make a compelling purchase offer that benefits all parties. Kindred received a favorable price for its assets; Humana expanded its service platform at a reasonable cost without having to acquire unwanted businesses; and WCAS and TPG acquired Kindred Healthcare and a majority stake in Kindred at Home. Both businesses have significant upside potential under new management with renewed focus on synergies/operations.

With significant competition driving premium valuations, buyers continue to seek ways to differentiate themselves, despite increased transaction complexity. The Kindred transaction illustrates how creative strategic-sponsor partnerships are generating value within the healthcare ecosystem.

While the transaction structures can be complex, strategic-sponsor partnerships sharpen competitive advantages that create favorable outcomes for all stakeholders. Strategic buyers, like Humana, are able to realize synergies post-closing and have access to lower-cost capital. Financial sponsors, like WCAS and TPG, provide deal execution and functional expertise as well as potential funding for subsequent acquisitions. Sponsors also help guide acquired businesses on a day-to-day basis while strategic buyers run their core businesses.

The Best of Both Investing Worlds

In a constantly evolving healthcare ecosystem, strategic acquisitions can help established companies consolidate fragmented service lines and create new “platform” offerings that meet market demands for better, more cost-effective healthcare products and services.

Strategic buyers have the ability (not available to private equity buyers) to generate synergies post-closing. This supports the payment of premium acquisition prices. Examples of corporate synergies include the following:

- Reducing overhead costs;

- Entering complementary markets;

- Enabling cross-selling and/or business line expansion in new markets;

- Blending synergistic products and services; and

- Achieving economies of scale across larger operating platforms.

In addition, strategic buyers with strong credit ratings can provide access to lower cost debt financing at more favorable terms than private equity buyers.

These inherent advantages provide compelling reasons for private equity firms to partner with strategic buyers to pursue acquisitions. Partnering with a corporate/strategic buyer that can generate synergies at the target company enables private equity buyers to bid at the high end of the valuation spectrum. Access to lower-cost capital through the strategic partner provides further value enhancement. Bidding alongside a corporate partner allows some private equity firms to participate in large transactions they would not be able to execute on their own.

Additionally, the strategic partner (as illustrated by Humana in the Kindred transaction) is often a natural long-term acquirer. Structural mechanisms (e.g., put/call options) can create predefined exit strategies that reduce investment risk for sponsors.

While the benefits to the financial sponsor are readily apparent, partnership transactions also create value for corporate/strategic partners. Historically, sponsors generated their returns largely from financial engineering and cost cutting at target companies. Today, financial sponsors increasingly act as value-added partners for target companies as illustrated by their increasing involvement in guiding acquired-company operations during the past decade.

A majority of private equity firms provide toolboxes for acquired companies to grow revenues and cash flows during their investment hold period. Toolboxes can include the following capabilities: recruiting and incentivizing top-tier managers; funding for geographic expansion, new product development or new market entry; restructuring expertise; enhanced back-office efficiencies; and strategic M&A assistance. Properly executed, these toolbox strategies create near-term financial value that offsets any earnings dilution that can occur as strategic partners execute performance improvement plans to drive long-term synergies.

Often, strategic acquirers prefer to purchase partial interest in targeted companies with the option for a full purchase at a later date. This approach spreads the purchase price over an extended time period. It also gives them time to reposition the acquired company by stabilizing, aggressively growing its revenues and optimizing its performance prior to assuming full ownership. This mitigates the strategic partner’s upfront and interim financial risks.

Sponsors can move rapidly to inject capital into the strategic transaction partner directly or to finance the joint venture ownership vehicle through a PIPE financing (private investment in public equity securities). The sponsor, in turn, will leverage its investment within the holding company or at the fund level to create higher investment returns. Sponsors can then underwrite based upon a prescribed exit formula.

From a transaction execution perspective, strategic buyers typically pursue acquisitions in a deliberate fashion in an effort to validate synergies while juggling other priorities (competing acquisition opportunities, quarterly earnings, internal growth and efficiency projects, board politics, etc.). In contrast, sponsors mobilize and execute transactions on accelerated timelines. As such, many strategic acquirers benefit from the execution expertise of established private equity firms.

These benefits illustrate the potential attractiveness of strategic-sponsor partnerships. However, there are several questions that strategic and sponsor buyers must address before deciding to partner on an acquisition.

Do the Benefits Outweigh the Headaches?

While financial and strategic benefits may be compelling, designing effective partnerships can be challenging due to governance considerations, the design of exit mechanisms, majority/minority interest considerations, and transaction design, execution and negotiation complexities.

From a governance perspective, the partners must determine the appropriate go-forward management team and board composition. While board representation will typically reflect ownership percentages, establishing board roles and titles for the targeted company can become more difficult with multiple owners. Negotiating rights for minority-interest holders can also be challenging, particularly with investors holding a large-minority ownership position.

Successful negotiation of exit mechanisms for non-controlling parties often becomes a substantial obstacle. Common arrangements include put/call options with three- to five-year timeframes and predetermined methods for determining fair market value. These arrangements may explicitly define future earnings multiples or ranges, reference agreed-upon valuation methodologies (e.g., discounted cash flow and precedent transactions) and/or set caps for future multiples.

Some transactions sanction staged purchases over a number of years while others require full purchase of the minority-interest position at agreed-upon dates. While these mechanisms provide clarity for strategic buyers and reduce investment risk for sponsors, there is potential for one of the parties to miss some upside due to pre-negotiated exit mechanics. Corporate/strategic buyers require a controlling-interest position to fully consolidate financial results. A controlling interest can originate through majority ownership or through other mechanisms (such as the sole ability to appoint / remove CEO or sole budget approval). As such, corporate buyers must determine whether or not fully consolidated financial results are a desired outcome for the initial transaction. By necessity, corporate buyers must have sufficient capital to purchase the sponsor’s partnership shares in subsequent transactions.

Given these inherent challenges, strategic-sponsor transactions require creative structuring to meet the myriad of goals of the parties involved. Consequently, incremental value derived from strategic-sponsor partnerships must be sufficient to offset added transaction complexities.

The Variety and Scope of Deals

Deal structures can take many forms depending on acquirer and target business characteristics and circumstances. In addition to the Kindred transaction described above, the following transactions illustrate the broad range and character of recent strategic-sponsor partnership deals in the healthcare industry.

1. naviHealth (Cardinal Health and CD&R)

In August 2018, Cardinal Health sold a controlling 55% interest in naviHealth, a provider of post-acute benefits management for health plans and value-based care support to providers, to Clayton, Dubilier & Rice (CD&R) managed funds at a transaction value exceeding $1.2 billion. Cardinal Health retained a 45% minority interest in naviHealth.

The investment structure provided naviHealth funding to accelerate growth and expand its value-based service offerings. naviHealth can also benefit from CD&R’s relationships with current and potential customers. Cardinal Health received a sizable cash infusion from the transaction along with a tightly defined option to reacquire CD&R’s shares to regain 100% ownership of the business at a certain point in the future.

Roughly 60% of the investments made by CD&R over the past decade have included a partnership component, either with the seller or a strategic partner. The fund welcomes more complex situations and takes an active hand in making operating improvements. According to CD&R, approximately 80% of the value created in its investments as measured by EBITDA growth is attributable to operational enhancements.

2. Netsmart (Allscripts and GI Partners)

![]()

In March 2016, Allscripts announced a definitive agreement to combine resources with GI Partners in a joint venture to acquire Netsmart Technologies for a purchase price of $950 million. Netsmart Technologies is a technology company focused on behavioral health and post-acute care. The transaction created the largest technology company exclusively dedicated to human services and post-acute care.

Allscripts contributed 100% of its Homecare business, plus $70 million cash, to the JV in exchange for a 51% equity interest. GI Partners combined its cash contribution (~$340 million) and third-party debt financing to consummate the transaction and acquire a 49% equity stake. The transaction structure provided GI Partners with an 11% preferred security as well as a put option to compel the JV to redeem its equity on the earlier of the transaction’s fifth anniversary or a change-in-control away from Allscripts.

In December 2018, Allscripts sold its position in Netsmart to GI Partners and TA Associates for a total of $525 million. Post transaction, GI Partners owns approximately two-thirds and TA Associates owns approximately one-third of Netsmart. Allscripts indicated it would use the proceeds to repay long-term debt, invest in existing businesses and repurchase outstanding common stock.

Corporate partnering has become a core part of GI Partners’ strategy. As GI Managing Director Dave Kreter describes it: “Building strong strategic relationships is a critical part of our sourcing and investment strategy, especially in today’s environment when it is hard to compete without a unique angle. We proactively seek out transactions that are transformative, which partnering facilitates in a variety of ways.”

3. Concentra (Select Medical and WCAS)

In March 2015, Select Medical Holdings and WCAS partnered to acquire Concentra from Humana for $1.055 billion in cash. At the time of the transaction, Concentra was already a leading national provider of occupational medicine services with 488 service locations in 40 states. Concentra’s markets significantly overlapped with Select’s outpatient rehabilitation business. This market overlap creates opportunities for facility alignment, increased profitability and enhanced value. WCAS had previously sold Concentra to Humana in December 2010.

Select and WCAS formed a JV in which Select owns 50.1% and WCAS owns 49.9%, with each party making cash equity contributions commensurate with their pro-rata ownership in the JV. From year 3, WCAS owns a put option based on the fair market value of Concentra at the time of exercise. Select additionally holds a call provision after year 5 based on fair market value. Fair market value per the terms of the put/call provisions is to be determined based on a valuation of Concentra performed by a mutually agreed-upon investment bank.

4. United Surgical Partners International (Tenet Health and WCAS)

In March 2015, Tenet Health acquired a majority stake in United Surgical Partners International (USPI) from WCAS through a Contribution and Purchase Agreement. The transaction accelerated Tenet and USPI’s shared strategy to expand their ambulatory service offerings to meet growing consumer demand for services provided in convenient, lower-cost facilities.

In exchange for 50.1% equity ownership in the JV, Tenet contributed its ambulatory surgery center and imaging center businesses, along with a cash payment of ~$425 million to WCAS to align the respective valuations of the contributed assets. USPI contributed its operations to the JV in exchange for a 49.9% equity ownership in the JV for its shareholders (primarily WCAS).

The transaction included a put/call arrangement granting Tenet the right to purchase all of WCAS’ ownership stake over a five-year period. In the years following the transaction, Tenet purchased WCAS’ share in full, with the final transaction closing in April 2018. Baylor University Medical Center maintains a 5% ownership interest in USPI.

As illustrated by the wide range of transaction structures described above, designing and negotiating the entrance and exit mechanics for strategic-sponsor partnership transactions is challenging. To succeed, parties must establish relative valuations for the existing businesses, create effective governance and negotiate exit terms in advance.

As Scott Mackesy, Managing Partner at WCAS notes, “There has to be some kind of win-win logic at the core of these transactions to do them in the first place. But a large corporation wouldn’t partner in a creative and complicated deal with someone who didn’t have a lot of credibility built up over time. Having pioneered these corporate partnership transactions, I can tell you that trust built on long-term relationships is a critical factor in the equation.”

Conclusion: A Brave New Marketplace

Partnered solutions have emerged as an option to compete effectively for transactions in a changing and dynamic healthcare marketplace characterized by the following characteristics:

- Larger, more complex transactions;

- Shifting payment and delivery dynamics;

- Greater need for strategic flexibility and growth capital; and

- The need by investors to reduce individual transaction risk.

US healthcare is undergoing widespread consolidation as fragmented service lines combine into larger platforms for delivering value-based care services. 2017 and 2018 saw more than 70 acquisitions with valuations in excess of $1 billion. That trend toward mega deals and buyouts will likely continue.

Partnerships between private equity and corporations can be advantageous. These large transactions require strategic flexibility, ample capital, shared risk and deep understanding of market needs. In return, they can accelerate corporate growth and enhance value-creation in an industry in need of new and better ways to deliver, administer and operationalize care.

Strategic-sponsor partnerships will continue to make sense in select situations as healthcare consolidates. Creative transactions that combine the unique strengths of financial sponsors and strategic acquirers have the potential to accelerate the transformation of U.S. healthcare.

Outcomes Matter. Customers Count. Value Rules.

John and Dave discuss this topic in an episode of the Cain Brothers House Calls podcast. Find all episodes of House Calls here.

CO-AUTHORS:

John V. Soden is a Managing Director at Cain Brothers, where he co-leads the Medical Technologies Advisory practice, building on almost 20 years of experience on medical devices, diagnostics and life science tools/reagents. Previously, he specialized in M&A across multiple industries. Prior to joining Cain Brothers in 2016, Mr. Soden focused on private and public company M&A at Houlihan Lokey and Thomas Weisel Partners. Mr. Soden received a B.A. in Economics (with Honors) from Northwestern University.

Kris M. Beth is a Vice President in Cain Brothers’ Corporate M&A Advisory practice. He brings over 10 years of experience advising companies on a variety of M&A, capital raising, and strategic advisory transactions. Before joining Cain Brothers in 2017, Mr. Beth worked across industries in the corporate finance group at Chartwell, a boutique middle market advisory firm. Mr. Beth earned a B.S. in Finance from University of Minnesota Carlson School of Management, and is also a CFA charterholder.